According to the filing, K Bank plans to offer 60 million shares out of its 405.7 million total. The Korea Exchange’s review normally takes two to three months, putting an early-2026 listing within reach if approval is granted. NH Investment & Securities and Samsung Securities are joint lead managers.

The clock is ticking. Under agreements with its financial investors (FIs), K Bank must go public by July 2026. Failure to do so would allow investors to exercise tag-along or put options by October next year, making this effectively its last window to complete the deal.

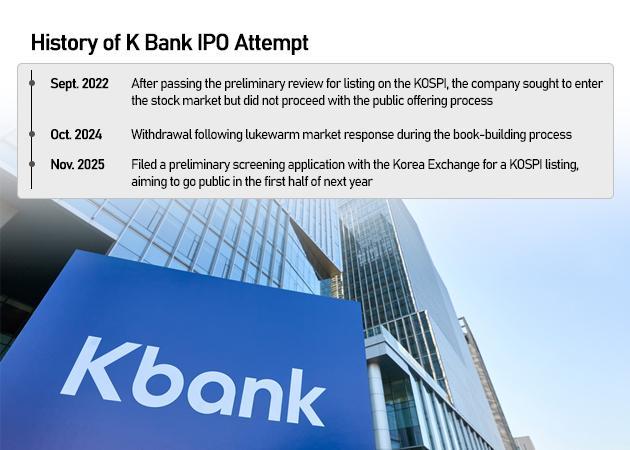

K Bank previously cleared the preliminary review in 2022 but canceled its offering in the face of rapidly rising interest rates and a frozen IPO market. A second attempt in late 2023 was also withdrawn after weak demand during roadshows. The bank has since trimmed its target valuation to 5.3 trillion won ($3.6 billion) from roughly 7 trillion won.

Whether the current year-end rally will be enough to support a newcomer remains uncertain. The bank’s repeated last-minute withdrawals have already dented its credibility among investors.

The Upbit-linked deposits have been a major growth driver, as K Bank supplies verified accounts to crypto traders. But renewal uncertainty hangs over the bank each time the contract comes due. Meanwhile, the bank’s early-mover advantage has largely faded as traditional lenders now operate fully competitive mobile platforms.

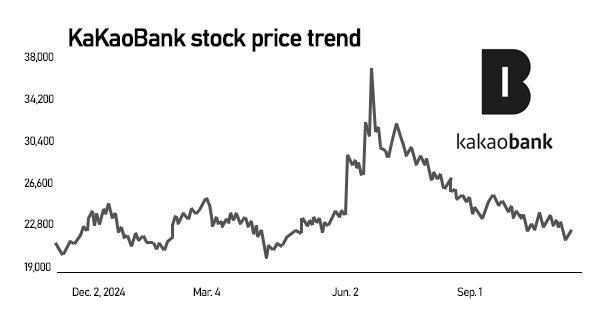

Market sentiment toward digital-only banks has also cooled. KakaoBank shares have dropped 44.5 percent from their June 24 peak of 38,750 won to 21,500 won ($14.7) as of Tuesday. Last week, Hana Securities cut its price target for KakaoBank to 32,000 won from 36,000 won, pointing to weaker-than-expected third-quarter earnings and slowing fee income. KakaoBank’s net profit fell 10.3 percent on-year to 111.4 billion won.

As it weighs its KOSPI push, K Bank has also been expanding its offline footprint. Starting in December, Seoul Metro’s Euljiro 4-ga Station — near the bank’s headquarters — will adopt “K Bank Station” as a secondary name under a paid naming-rights deal effective through December 2028.

Copyright ⓒ Aju Press All rights reserved.