SEOUL, November 14 (AJP) - South Korea’s import prices rose in October to their highest level in nine months, pushed up by a sharp depreciation of the won.

Export prices climbed even more steeply, reflecting both currency effects and strengthening demand for semiconductors and metals.

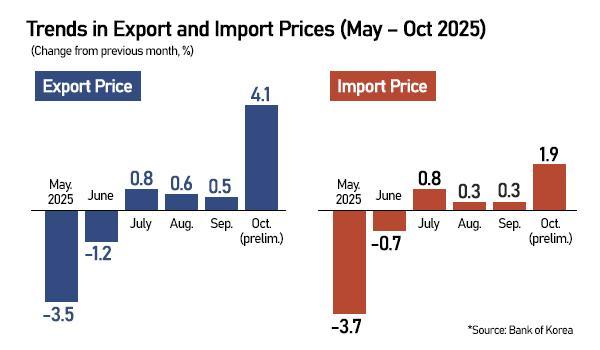

Data released Friday by the Bank of Korea showed that import prices increased 1.9 percent in October from the previous month, the fastest pace since January, after modest 0.3 percent gains in August and September. The central bank said the slide in the Korean currency effectively erased the benefit of cheaper crude oil. Dubai crude fell from an average of $70.10 a barrel in September to $65 in October, but the won weakened from 1,391.83 to 1,423.36 per dollar over the same period, lifting overall import costs.

Raw material imports fell 0.9 percent on the month because of lower oil prices, but intermediate goods — including computers, optical equipment and chemical products — rose 3.8 percent, signaling higher input costs for manufacturers. Coal and petroleum products dipped 1.5 percent on cheaper feedstock oil.

Within intermediate goods, computers, electronic and optical equipment saw the steepest price increases, rising 9.7 percent. Basic metals climbed 5.7 percent, electrical equipment 2.8 percent and chemical products 1.5 percent. Prices for semiconductor-related materials showed particularly sharp gains: printed circuit boards rose 8.3 percent, ammonia used in chip fabrication jumped 15.2 percent and refined copper, essential for wiring and metallization, advanced 10.3 percent.

Export prices rose even faster, climbing 4.1 percent in October after a 0.5 percent increase in September. The jump was driven by the weaker currency and solid global demand for Korean-made goods.

Prices for computers, electronic and optical equipment — a category that includes semiconductors — surged 10.5 percent. Basic metals rose 4.9 percent, while transport equipment, including passenger cars, gained 2 percent.

Memory chips posted some of the most dramatic increases. DRAM prices surged 20.1 percent and flash memory jumped 41.2 percent from the previous month, buoyed by surging investment in artificial intelligence data centers and rising demand for high-performance chips.

Metal exports also gained. Refined copper rose 9.9 percent, supported by increasing orders for high-voltage power cables. South Korea remains a major force in the global copper industry, home to LS MnM, the second-largest single-site copper smelter in the world.

Silver bars climbed 18.8 percent, helped by strong demand for solar panels — which consume significant amounts of silver — as well as renewed interest in safe-haven assets amid global uncertainty.

Copyright ⓒ Aju Press All rights reserved.