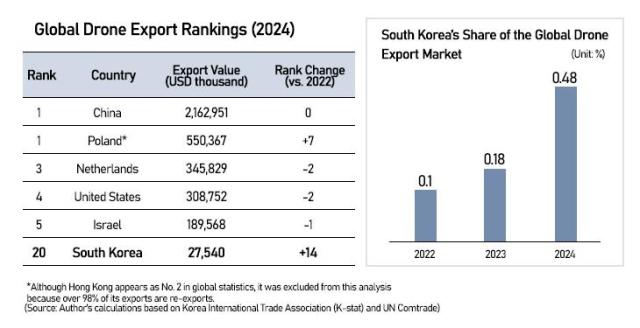

According to a report released on Friday by the Korea International Trade Association (KITA), the country's exports of drones surged from $2.81 million in 2022 to $27.54 million in 2024.

"Despite the rise in export volumes, the country's market competitiveness still lags far behind that of major overseas players," said Kim Mu-hyun, a senior researcher at the KITA.

Although the number of drone manufacturers has increased in response to surging demand in this nascent high-tech industry, many lack sufficient infrastructure and R&D facilities, hindering further growth.

Among some 265 drone manufacturers surveyed by the Korea Institute of Aviation Safety Technology in 2023, only 71 had such facilities, forcing many of them to conduct limited experiments that constrain consistent research and development."

However, of nearly 7,000 firms in the industry, average revenue stood at a mere 200 million won. According to market researcher Hana Institute of Finance, even firms with more than seven years in the industry posted average annual sales of just 350 million won.

Among the major global players, China dominates the market, accounting for nearly 90 percent, followed by the U.S. and Israel. South Korea ranked 20th as of 2024, although it had jumped significantly over the previous three years.

Most domestic firms have heavily relied on Chinese imports for essential parts and components, which account for nearly 70 percent of all drones made here.

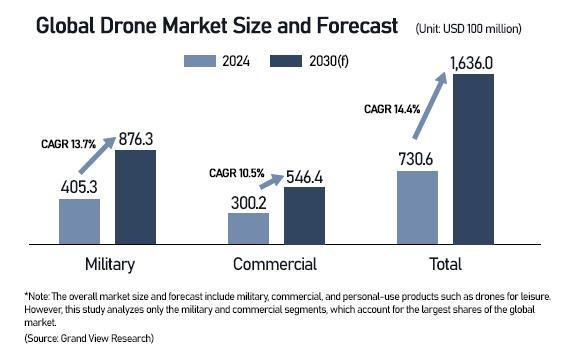

He added that developing commercial models is crucial for nurturing the industry, as this would stimulate demand among businesses, creating a virtuous cycle that increases the use of locally produced components.

For example, in the U.S., retail giant Walmart has partnered with startups such as DroneUp, Zipline, and Flytrex to roll out drone-based commercial delivery services, leveraging its nationwide store network and IT infrastructure to provide these startups with stable demand.

Swedish DIY retailer IKEA has deployed autonomous indoor drones developed by local startup Verity since 2021 to track and manage inventory across more than a dozen stores in Belgium, Germany, and other countries.

Copyright ⓒ Aju Press All rights reserved.