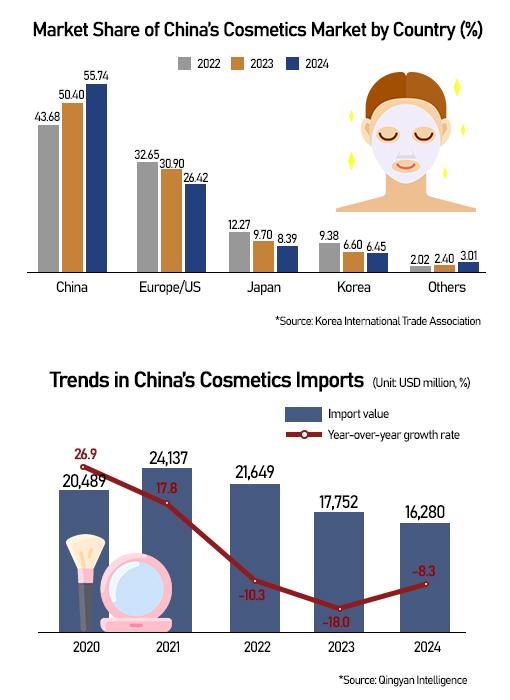

SEOUL, November 18 (AJP) - Korean beauty brands were virtually absent from this year's Singles' Day shopping festival — often dubbed China's version of Black Friday — marking a stark retreat from a market they once dominated and positioning K-beauty as the next collateral damage of China’s localization drive after smartphones and cars.

The simultaneous withdrawal of Korean players underscores both the sophistication and rising confidence of Chinese manufacturing — from AI phones to skincare — under Beijing's state-steered industrial system.

It also highlights the failure of Korean brands to either localize deeply or assert a distinctive identity compelling enough to withstand China’s fast-advancing competitors.

China's largest e-commerce platform, Tmall, reported that Proya, a Chinese skincare giant, was the top-selling beauty brand this Singles' Day. Proya surpassed 100 million yuan ($14 million) in sales within the first minute of pre-sales and ranked No.1 throughout the Oct. 15 to Nov. 11 promotion period.

Chinese beauty labels consolidated their dominance across platforms. Five domestic brands — Proya, Winona, Kefumei, Herborist, and Mao Geping — made the Tmall top-20 ranking, reaffirming the sector’s shift to high-performing local names. With the exception of Mao Geping, a color-cosmetics specialist, most are skincare labels built around plant-based ingredients, hydration, and sensitive-skin solutions.

No Korean brands made Tmall's top-20 list. LG Household & Health Care's luxury label, The History of Whoo, managed only ninth place on Douyin's beauty sales chart.

Demand for dermacosmetics — functional skincare that blends dermatology with cosmetics — is also surging in China, particularly for sensitive-skin consumers.

According to the Korea Trade-Investment Promotion Agency's Hangzhou office, 36.1 percent of Chinese women today have sensitive skin, a figure projected to reach 48 percent by 2030 due to pollution, stress, UV exposure, and changing lifestyles. This shift has rapidly fueled demand for irritation-free, dermatology-backed products — a category where Chinese brands have strengthened capabilities far faster than their Korean rivals.

Kim Hee-jong, CEO of the China-based Sangsangrak Creative Center and a researcher with the China Specialist Forum (CSF) under the Korea Institute for International Economic Policy, noted that "Guochao" — China's homegrown consumer-product wave — is reshaping sectors from cosmetics and food to home appliances and apparel.

"Guochao products may look trendy, but their core appeal is high quality at practical prices," he said. "People used to distrust domestic brands, but once they try them, they find the quality surprisingly strong. With social-media-savvy Gen Z embracing Guochao as cultural identity, the trend is here to stay."

Lee Wook-yon, a professor of Chinese Culture at Sogang University, said in a CSF column that Guochao first gained momentum in 2018, the year U.S. sanctions on Huawei escalated the U.S.–China tech rivalry. "What began as niche consumer behavior under external pressure has now become a mass phenomenon," he said.

A similar story has played out in China's smartphone market. Xiaomi, Samsung, Huawei, and Apple once competed fiercely. But when U.S. sanctions throttled Huawei's access to advanced 5G chips in 2019, citing security risks, its market share collapsed. Apple captured the premium segment as Xiaomi, Oppo, and Vivo strengthened their grip on mid-range categories.

Defying restrictions, Huawei partnered with China's SMIC to develop its own 7-nanometer chips. Its 2023 launch of the Mate 60 Pro, powered by the Kirin chipset, marked a symbolic return to 5G prowess. While Huawei still faces hurdles abroad, its domestic brand power has sharply rebounded.

Korean firms lost ground. Samsung, which held nearly 20 percent of China's smartphone market a decade ago, now has less than a 3 percent share. Chinese EVs and SUVs account for more than half of the automotive market, pushing Hyundai Motor to shut down its Beijing sales unit in September as demand in major cities wanes.

Business prospects in the world's second-largest consumer market have grown dimmer as Beijing intensifies its push for self-sufficiency and domestic consumption.

China's research and development spending surpassed 700 trillion won ($477 billion) last year — more than Korea's entire fiscal budget. According to the National Bureau of Statistics, China's R&D expenditure reached 3.63 trillion yuan in 2023, up 8.9 percent from a year earlier. From 2021 to 2024, R&D spending grew at an average annual rate of 10.5 percent, underscoring its accelerated drive for technological competitiveness.

Copyright ⓒ Aju Press All rights reserved.