SEOUL, November 18 (AJP) - The three-way memory race in the high-stakes AI battlefield has spilled onto South Korean campuses, as the U.S. contender Micron Technology aggressively hunts for engineering talent on its rivals’ home turf amid intensifying competition in advanced chipmaking.

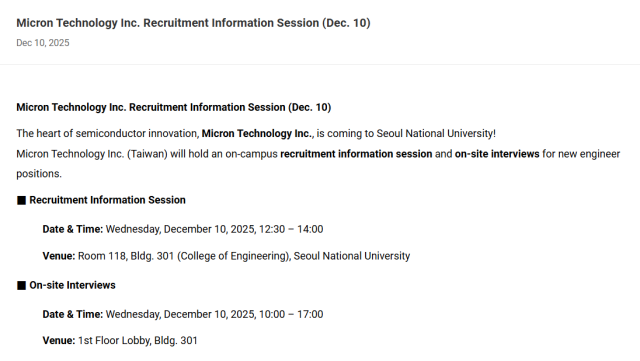

Micron has been posting multiple Korea-based engineering roles on LinkedIn — including HBM system architecture, DRAM product engineering, and logic-integration positions — and will hold a recruiting session at Seoul National University’s College of Engineering next month, along with visits to other top tech universities.

The SNU event advertises Micron’s global talent programs, relocation tracks, and “fast-track” or on-site engineering recruitment. The company toured Seoul, Daejeon, and Busan last year in a similar talent drive.

Micron’s push comes as demand for high-performance memory surges on the back of AI and hyperscale servers. The U.S. company produces high-bandwidth memory (HBM) for GPUs powering AI applications across three regions — design and development in the U.S., memory fabrication in Japan, and advanced packaging and testing in Taiwan. DRAM accounts for nearly 70 percent of Micron’s revenue, with most NAND output — the remaining 30 percent — manufactured in Singapore. Recruits from Korea largely join these Asian operations.

According to Micron’s post on SNU’s job board, the Idaho-based company hired 98 graduates and soon-to-be graduates from Korea for its Taiwan operations last year.

Micron declined to comment on its reasons for stepping up recruitment in Korea.

Korean memory makers, however, are well aware of their U.S. rival’s intentions.

“Talent competition among the three DRAM makers has always existed. Micron’s activity in Korea appears tied to the intensifying HBM race, but Korean companies are not yet worried about a meaningful drain of engineers,” said a source familiar with SK hynix’s HR affairs. Samsung Electronics also declined to comment.

Still, both Korean chipmakers have recently strengthened compensation packages to hold on to skilled engineers.

Graphics by AJP Song Ji-yoon

Graphics by AJP Song Ji-yoon

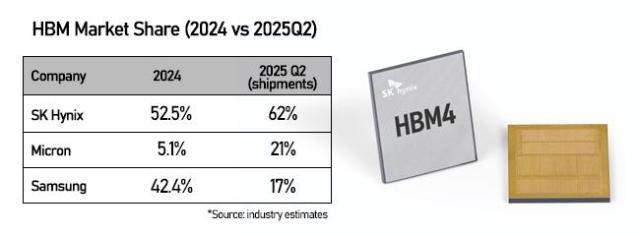

Samsung Electronics, long the comfortable leader among the three companies that together command more than 90 percent of the global DRAM market, has been losing ground since HBM emerged as the defining metric of DRAM leadership in the hyperscale era.

As of June 2025, SK hynix leads the HBM market with a 62 percent share, followed by Micron at 21 percent and Samsung at 17 percent. Micron — once a distant third — has surged on strong U.S. demand for HBM.

The company is now targeting engineers with one to three years of hands-on experience in HBM packaging, through-silicon via (TSV) technologies, and DRAM design — a talent pool heavily concentrated in South Korea.

Without stronger defenses, Korea’s chip supremacy — built on its high-quality engineering base — is at risk, experts warn.

“Korean engineers are among the most attractive in the global market. Losing mid-career engineers to overseas companies will directly weaken Korea’s chip competitiveness,” said Ahn Ki-hyun, executive director at the Korea Semiconductor Industry Association.

Micron, which is racing to narrow the gap with Samsung and SK hynix in HBM3E and HBM4, is simultaneously expanding engineering capabilities across Boise, Singapore, Taiwan, and Japan. Analysts say Micron must deepen its expertise in advanced packaging and DRAM-logic integration to compete in AI-era data-center memory — the fastest-growing segment in the semiconductor market.

Korean universities have become a critical battleground, leveraging long-standing academic-industry networks that accelerate testing and commercialization of next-generation chips.

Copyright ⓒ Aju Press All rights reserved.