SEOUL, November 19 (AJP) - South Korea’s two dominant memory names Samsung Electronics and SK hynix are showing signs of divergence and avoiding a head-on clash in the red-hot high bandwidth memory (HBM) market, with strengthening DRAM prices reducing the pressure to take risks.

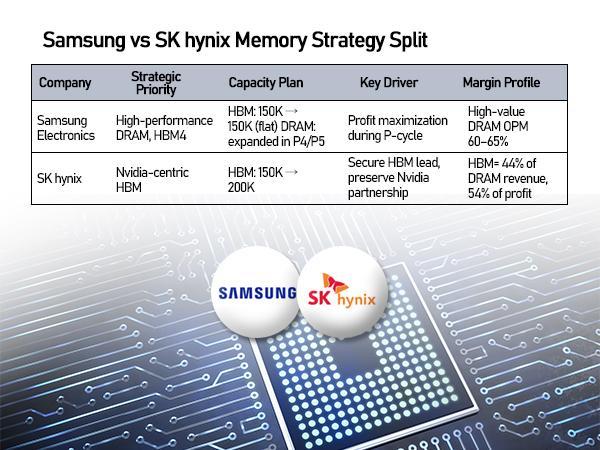

Samsung Electronics, a long-time frontrunner in DRAM until the rise of HBM powering AI chips, appears to be in no hurry to ramp up its lagging HBM capacity, holding output at 150,000 wafers per month from late 2025 to 2026 after identifying that margins in high-end DRAM are increasingly outpacing those of HBM.

DRAM prices have been rising rapidly due to low yields, with chipmakers devoting most of their wafer space to HBM.

“High-value DRAM profitability is now surpassing HBM, which reduces Samsung’s incentive to aggressively expand HBM capacity,” said Cha Yong-ho, analyst at LS Securities, adding that Samsung is positioning itself to “maximize profitability during the P-cycle (price strengthening cycle) rather than chase volume.”

Samsung Electronics declined to confirm or deny.

“We will ready capacity to readily address market changes as we expect mid- to long-term rise in demand," said a company official.

The company has recently given a go-ahead to the structure work on Pyeongtaek Campus Plant 5, a project previously delayed due to unfavorable market conditions. The new line, dedicated to HBM production, is expected to become operational from 2028.

The company official, however, disagreed to the reference of advanced chipmaking restricted to HBM these days.

“High-value products refer to not only HBM, but also high-spec and high-capacity DRAM such as graphics DRAM. You can view our strategy in that broader context.”

The company is prioritizing premium DRAM and next-generation HBM4 while continuing to build out its P4 and P5 fabs in Pyeongtaek using a flexible “first-shell” approach.

SK hynix, enjoying its first-ever market dominance and hot earnings streak, meanwhile has all hands on deck in HBM, upping output from 150,000 to 200,000 wafers per month in 2026 upon increased orders from Nvidia.

With HBM in structural shortage and Nvidia relying heavily on SK hynix for its AI accelerators, the company has little room to share capacity with general DRAM even as prices climb.

SK hynix remains focused, regardless of the decisive strengthening in DRAM prices.

"DRAM prices rose because suppliers focusing on HBM shifted wafer capacity to HBM, creating supply-side shortages. It’s more of a market phenomenon than a reason for us to adjust strategy. Our priority remains HBM," a company official said.

HBM has already transformed SK hynix’s earnings structure: although it accounts for only 14% of DRAM shipments, it represents 44% of DRAM revenue and more than half of operating profit, driven by unit prices nearly five times higher than DDR5. Most of its HBM supply for 2025 is sold out, with 2026 volumes largely pre-committed.

Reflecting the strength of the HBM cycle, the SK hynix official confirmed that “our HBM capacity for 2026 is already sold out.”

This divergence reflects the broader transition into a P-cycle, where memory makers benefit more from higher selling prices than expanding output. Monthly HBM demand is expected to surpass one million wafers in 2026, while global supply remains around 400,000 wafers, reinforcing an extended period of tightness. DDR5 contract prices have already risen 165% from the start of 2025, underscoring how performance-oriented AI demand is reshaping the market.

A key variable for the next investment cycle is China’s CXMT, whose expansion remains capped at 280,000 to 300,000 wafers per month through 2026 due to U.S. export controls restricting access to advanced DRAM equipment.

Beijing’s third semiconductor investment fund is prioritizing equipment localization, raising expectations that CXMT may resume aggressive expansion in 2027 if domestic tools stabilize. Any such shift would force Samsung and SK hynix to restart large-scale capex to defend global market share, reviving Korea’s materials, parts and equipment suppliers.

For now, the market is defined by divergence rather than direct rivalry: Samsung leaning into high-performance DRAM profitability during the P-cycle, and SK hynix fortifying its lead in HBM as AI infrastructure investment accelerates.

Copyright ⓒ Aju Press All rights reserved.