SEOUL, November 21 (AJP) - South Korea’s retail giants, squeezed by the rapid proliferation of online shopping and a prolonged slump in domestic consumption, are betting on mega-sized mixed-use malls to regain foot traffic by drawing customers through leisure and tourism appeal.

Gwangju has become the latest city to embrace the trend, breaking ground this week on a large-scale multi-complex mall that blends retail with entertainment.

These mega malls combine shopping with dining, games and cultural activities, positioning themselves as weekend destinations for families. Unlike traditional department stores or hypermarkets, they devote a significant share of space to non-retail functions — from VR attractions to libraries — in a bid to differentiate themselves and extend visitor stay.

"Malls are not only about purchasing items — they are spaces to eat, spend time and hang out," Lotte Department Store CEO Jeong Jun-ho said, noting that this approach aligns with the preferences of Korea’s MZ generation.

At Lotte World Mall in Seoul, one of the capital’s most visited complexes, retail accounts for just 30 percent of the total area, while entertainment takes up 57 percent and food and beverage 13 percent. The mall drew more than 8 million visitors during July and August amid a severe heat wave, according to operator Lotte Property & Development. Purchasers made up 66 percent of visitors in July and 63 percent in August, meaning that more than a third came primarily for non-shopping activities.

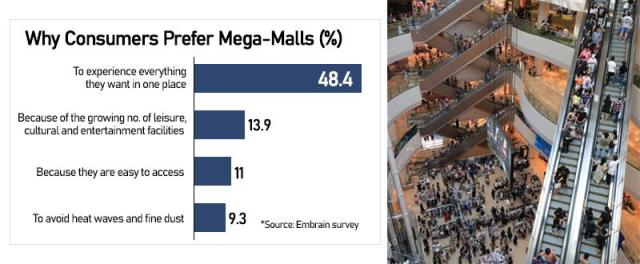

A survey by Embrain, a Korean market-research firm, found that 48.4 percent of respondents prefer multi-complex malls because they "can experience almost everything in one place." Other reasons included expanded entertainment and cultural facilities, convenient accessibility and the ability to escape heat waves or air pollution — key considerations that influence indoor activity choices in Korea’s extreme seasonal climate.

Visitor numbers at major complexes have continued to rise. From January to April 2024, footfall at large malls such as The Hyundai Seoul, I’Park Mall and Starfield increased 28.8 percent compared with the same period in 2022.

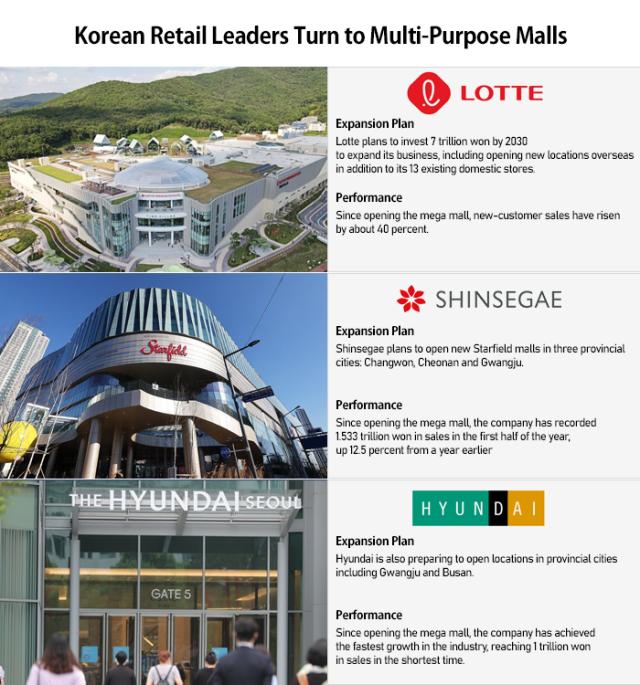

South Korea’s three major retail groups — Shinsegae, Lotte and Hyundai — are now racing to expand their mall portfolios. Of the 21 new department stores or malls planned by the groups, 19 are multi-complex malls.

As consumer behavior shifts toward "experience-based consumption," with shoppers seeking leisure and culture alongside purchases, retailers are moving away from traditional department store-centered strategies.

Lotte Group plans to convert nine large land parcels — originally secured for department stores and outlets — into malls, including sites in Songdo and Daegu. Seven existing outlets will also be renovated or expanded into mall formats. Lotte Department Store said it aims to reduce department stores’ share of total revenue from 75 percent today to 60 percent by 2030, while increasing mall revenue from 1 percent to 30 percent.

Shinsegae Group plans to open 13 new locations within five years, 11 of them multi-complex malls. Its development arm, Shinsegae Property, will invest about 13 trillion won ($9.4 billion) by 2030. "Malls offer an offline experience that online shopping cannot provide," a Shinsegae official said. "This increases the time customers spend on-site and boosts non-retail revenue."

Hyundai Department Store is also expanding the model pioneered by its flagship The Hyundai Seoul into regional markets. It will break ground next month on The Hyundai Busan, a 7.343-trillion-won project targeting a 2027 opening. A separate site in Gwangju, a metropolitan city of 1.4 million people, is slated to open in 2028 with an estimated project cost of 1.2 trillion won — the largest single retail development in Hyundai’s history.

"We have focused on the Seoul metropolitan area for years, but expanding into major regional cities will create a new growth axis," a Hyundai official said.

Copyright ⓒ Aju Press All rights reserved.