SEOUL, November 21 (AJP) - South Korea’s KOSPI has been the strongest-performing major Asian index this year, but this week’s rout has laid bare its structural fragility — an equity market dominated by a few tech bellwethers and increasingly shunned by foreign investors as the won sinks to new lows.

Until just days ago, enthusiasm bordered on euphoria. Forecasts that the KOSPI could surge to 5,000 or even 7,000 became commonplace.

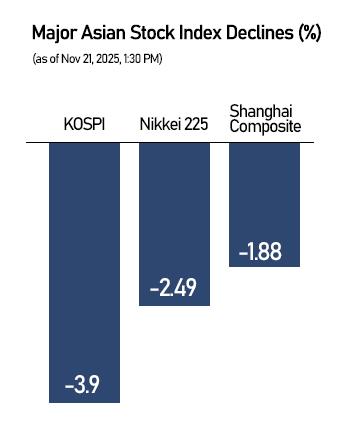

Even after Friday’s 3.8 percent plunge — the sharpest drop among major Asian markets — the benchmark is still up 60.5 percent for the year, rising from 2,399.49 at the end of 2024 to 3,853.26.

Outsized weight of mega-caps and the AI fad

Korea’s equity market has become more concentrated than ever.

According to Leaders Index, the combined market-cap share of the top five conglomerates — Samsung, SK, Hyundai Motor Group, LG, and HD Hyundai — rose from 45.9 percent at the start of the year to 52.2 percent as of Nov. 3. More than half of the KOSPI is effectively tied to a handful of corporate groups.

AI-driven semiconductor giants Samsung Electronics and SK hynix alone account for over a quarter of total capitalization. When they fall, the entire index buckles.

On Friday, SK hynix plunged 8.76 percent to 521,000 won, while Samsung Electronics slid 5.77 percent to 94,800 won — the two steepest drops among Korea’s market heavyweights. Traders call it a “follow-the-leaders market,” with sector performance rarely diverging from the megacaps.

Even power-related stocks — which should benefit from surging AI electricity demand — remain dominated by conglomerates. Hyundai Motor Group controls key nuclear-construction player Hyundai Engineering & Construction, while HD Hyundai owns transformer leader HD Hyundai Electric. Both fell sharply Friday: HD Hyundai Electric slid 7.85 percent to 751,000 won, and Hyundai E&C dropped 3.73 percent to 59,300 won.

The squeeze on smaller companies is intensifying.

A joint survey by the Korea Chamber of Commerce and Industry and the Korea Venture Capital Association found that 91.8 percent of VCs dependent on policy financing struggled to raise private capital this year.

The IPO market, meanwhile, is frozen. As of Nov. 21, only seven companies had listed on the KOSPI — the same anemic tally as last year, when the index barely moved.

FX volatility fans foreign outflows

Tech concentration alone does not fully explain the KOSPI’s vulnerability. Taiwan’s TAIEX is similarly top-heavy — TSMC represents roughly 40 percent of the index, and the top five names exceed half of total market cap. Yet Taiwan has suffered far less from the global AI correction.

The critical difference is currency risk.

On Friday, the Korean won traded at 1,475.1 per U.S. dollar, down nearly 8 percent from the June average of 1,366.92.

With Korea’s benchmark rate at 2.50 percent — far below the U.S. Fed Funds target range of 3.75–4.00 percent — the carry disadvantage leaves Korean assets exposed. A persistently weak won also deprives foreign investors of the chance to earn FX gains.

Rate hikes are largely off the table. Korea’s economy is expanding at under 1 percent annualized, and household debt remains one of the highest among advanced economies.

Bank of Korea Governor Rhee Chang-yong has repeatedly noted the limits of intervention, saying the won’s weakness reflects external forces such as broad dollar strength and heavy Korean retail investment in U.S. equities.

“Given Korea’s internal constraints, the country has little choice but to hope for external relief such as U.S. rate cuts,” said Cho Yong-gu, a researcher at Shinyoung Securities.

Weaker FX buffers than regional peers

South Korea’s foreign-exchange reserves stand at $420 billion, or about 23 percent of GDP — well below Taiwan’s $600.2 billion, which equals 77.4 percent of its GDP.

The gap gives Taipei far stronger firepower to defend its currency or cushion capital-flow shocks.

Copyright ⓒ Aju Press All rights reserved.