SEOUL, November 26 (AJP) - Korean authorities are pleading for all-around help — from the "big-brother" National Pension Service (NPS) to brokerages and exporters — to mobilize every possible tool to defend the Korean won drifting toward the untouched 1,500-won ($1.02) watershed.

But they cannot expect sympathy, much less sacrifice, from ordinary Koreans, whose enduring appetite for overseas spending — on goods, travel, and securities — remains undeterred even as the won weakens beyond levels seen during the 1998 IMF bailout.

The weakness in the currency has done little to quell Korea's love for the foreign.

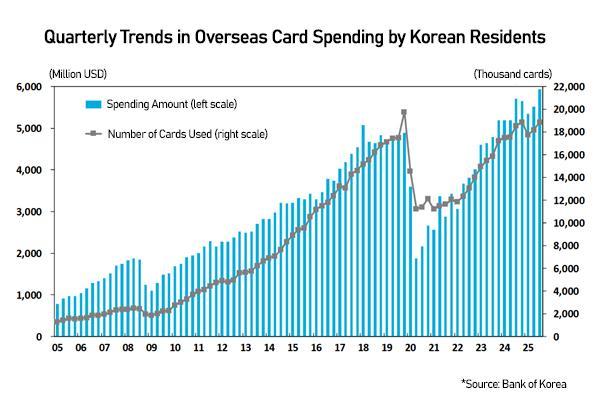

According to Bank of Korea data released Tuesday, overseas credit-card spending by Korean residents reached a record $5.93 billion in the third quarter, up 3.9 percent from last year's previous high of $5.71 billion and 7.3 percent above the second quarter's $5.52 billion. Foreign visitors, by contrast, spent just $3.76 billion on cards in Korea — barely half the amount spent by Koreans abroad and unchanged from the previous quarter, despite a record surge in inbound arrivals.

On a per-card basis, Koreans spent an average of $314 abroad in the third quarter, roughly 56 percent more than the $201 spent by foreigners inside Korea. Outbound travelers totaled 7.09 million, up 4.8 percent from the previous quarter, according to the Korea Culture and Tourism Institute.

The travel balance remains deep in deficit. Korea spent $2.5158 billion abroad versus $1.8344 billion earned from inbound tourism, generating a $681.4 million shortfall — another sign that Koreans spend far more abroad than foreign travelers spend at home.

"Prices in Korea are relatively high. While the official inflation rate hovers around 2 percent, the real figure exceeds 4 percent when housing costs are factored in," said Kim Sang-bong, economics professor at Hansung University. "For many Koreans, it's cheaper to travel overseas. A domestic trip costs 200,000 to 300,000 won per person, whereas around 2.3 million won can cover a five-day trip to Vietnam or Japan."

The pattern echoes last year's travel boom to Japan, fueled by the yen's plunge into the 800-won range.

Korea's Shopping Festa — the country's biggest shopping extravaganza and local alternative to Black Friday — has also struggled to gain traction amid high exchange rates. With the won nearing 1,500 per dollar, U.S. product prices are rising in real time, prompting a shift toward Chinese and Japanese retailers. Platforms such as 11st and Coupang still rolled out major cross-border deals, but industry officials say the dependence on North American brands that once powered sales is no longer sustainable.

Even the strong dollar has not tempered Koreans' passion for U.S. stocks.

Net overseas securities investment reached $99.8 billion between January and September, more than triple the $29.6 billion net inflow of foreign investment into Korean securities over the same period. Korea's net external financial assets — the value of foreign assets held by Koreans minus liabilities — surged from $12.7 billion in 2014 to $1.03 trillion in the second quarter, underscoring the nation's structural preference for dollar-based safe assets.

The NPS alone now holds 580 trillion won in overseas assets. Retail "Seohak ant" day traders — Koreans investing in U.S. and global stocks — have increased eightfold in just four years. Corporate direct overseas investment, too, hit a record $81.7 billion.

Experts warn that even though Korea's foreign-currency liquidity is solid in the short term, structural imbalances in dollar supply and demand continue to drive pressure on the won–dollar exchange rate.

"The real challenge is that there is no clear solution to the structural imbalance," said Wi Jae-hyun, analyst at NH Futures Research Center. "Excessive concentration of overseas investment in equities and slow repatriation of export proceeds, especially after large-scale U.S. investment commitments, are amplifying upward pressure on the exchange rate. But exchange rates driven by supply-demand dynamics behave like a rubber band — the higher they go, the more forcefully they can snap back."

In 1998, Koreans lined up to donate gold to rescue the nation.

In 2025, their wallets are overseas — and no amount of nostalgia will change that.

Copyright ⓒ Aju Press All rights reserved.