Despite its IT advances and heavy R&D spending ratio against GDP, South Korea has not a single domestically developed model to boast, apart from the memory mounting on U.S.-designed chips. As with earlier innovations, Korea makes an early adopter of AI, but not a breakout innovator.

The adoption gap

A Bank of Korea survey from May and June found that 63.5 percent of Korean workers had experimented with generative AI, while 51.8 percent deployed it in their professional tasks.

In contrast, a Federal Reserve survey reported only about 28 percent of American workers using AI at work in 2024, with the figure climbing to about 55 percent by August 2025.

The penetration rate in China is around 36.5 percent. The country counted 515 million generative AI users as of June 2025, with the user base doubling within six months, according to a report from the China Internet Network Information Center.

Usage patterns reveal similar intensity in Korea. Workers integrating AI into their jobs dedicate five to seven hours weekly — roughly 12 to 17 percent of a typical work week. Daily engagement shows an even wider gap: 78.5 percent of Korean AI users log at least one hour per day, a rate 2.5 times higher than the 31.8 percent recorded in the United States.

Korean use of ChatGPT reached 60 percent three years after the generative AI commercial debut, which is exceptionally fast when considering internet usage in Korea stopped at 7.8 percent three years after introduction in the 1990s.

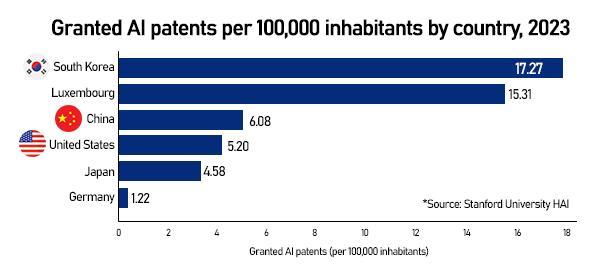

"China and U.S. are well ahead in R&D but in usage and awareness, South Korea is at the top," said Kwon Jae-jin, professor of Industrial Management Engineering at Induk University and CEO of private institution Korea AI Edu Center.

The model race: U.S. dominance, Chinese challengers

ChatGPT dominates 67.8 percent of the generative AI app market in Korea and Google's Gemini 19.5 percent, although the latter's share may change given the hyped reception of the 3.0 update.

OpenAI reports Korea holds second place worldwide for paid ChatGPT subscriptions after the U.S.

The U.S. currently dominates the AI narrative — OpenAI with the ChatGPT series, Anthropic's Claude, Google's Gemini, and Meta's Llama.

China is fast rising. DeepSeek, a startup backed by quantitative hedge fund High-Flyer, stunned the industry in January 2025 when its R1 reasoning model matched the performance of OpenAI's offerings at a fraction of the cost — reportedly $5.6 million for training.

Moonshot AI's Kimi represents another Chinese success story. The Beijing-based startup's chatbot surpassed 15 million users in China by late 2024, and its Kimi K2 model, released in July 2025 with one trillion parameters, achieved state-of-the-art performance in coding benchmarks while being open-sourced under a modified MIT license. By late 2024, Kimi ranked among the top three most-used AI assistants in China.

Established tech players also are eagerly fielding their candidates — Alibaba's Qwen, Baidu's Ernie, and ByteDance's Doubao each command significant domestic user bases.

Korea's sovereign AI gap

Seoul has been making strides in the catch-up game under the ambitious goal to join the top three powerhouses in AI, although lacking a star player.

Last August, South Korea's Ministry of Science and ICT designated five consortia to spearhead sovereign AI development. The ministry selected Naver Cloud, SK Telecom, LG AI Research, NC AI, and startup Upstage from a pool of 15 candidates, committing roughly $390 million in public funding through 2027.

The government's total pledge reaches 530 billion won — about $383 million — with 450 billion won targeting GPU infrastructure.

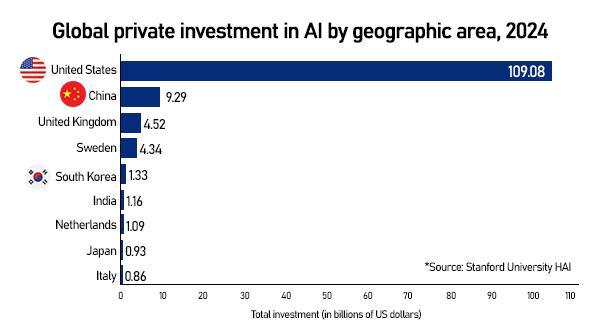

Yet none of these domestic initiatives have achieved the global reach or performance benchmarks set by ChatGPT and similar platforms. The sheer difference in spending matters as the economics of scale define the AI race.

For Kwon Min-gu, a 27-year-old Korean freelancer juggling nine AI services supporting his workflow — from Gemini and ChatGPT for research to Midjourney for image generation — only two originated domestically.

"The performance and accessibility differences remain vast," he said.

Hardware strengths, software gaps

Korea has some leverage over hardware.

Samsung and SK hynix jointly represent roughly 70 percent of global DRAM manufacturing and nearly 80 percent of global revenue in high-bandwidth memory (HBM) that powers AI accelerators. During the first quarter of 2025, SK hynix held 70 percent of worldwide HBM market share, with its HBM3E chips generating over half of all HBM revenue.

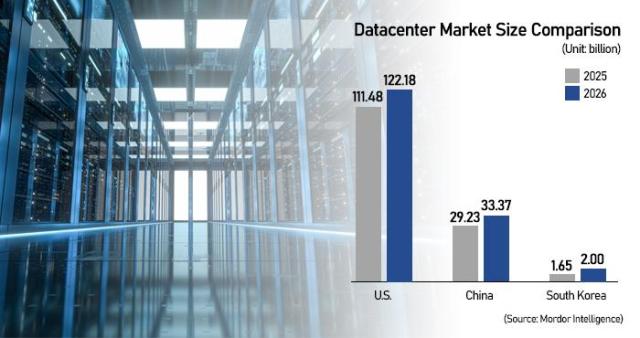

Korea currently ranks third globally in GPU infrastructure holdings, positioned behind only the United States and China, according to Ha Jung-woo, presidential chief of staff for AI Future Planning.

Under an agreement with Nvidia, 260,000 GPUs will reach South Korea by 2030, with 50,000 units allocated to government facilities and the remaining 210,000 divided among Samsung, SK Group, Hyundai Motor Group, and Naver.

But hardware prowess alone cannot secure leadership.

U.S.-based Nvidia commands nearly 80 percent of GPU markets. Korea relies on key imports to produce chips and batteries to run data centers. The vast electricity capacity required in power-short Korea is another matter.

U.S. big techs can afford to solve the energy issue.

Microsoft signed a 20-year power purchase agreement with Constellation Energy to restart Three Mile Island's Unit 1 reactor, which will supply 835 megawatts exclusively to its data centers by 2028. Amazon committed about 1.9 gigawatts, Google partnered with Kairos Power to deploy 500 megawatts, and Meta followed with a 20-year agreement for 1.1 gigawatts.

China’s approach is entirely government-led. The East Data, West Compute initiative funnels data center construction into eight western provinces where renewable energy is abundant and land is cheap. The project aims to power new data centers with 80 percent green energy by 2025 — a dramatic shift from the current 70 percent coal reliance in eastern coastal regions.

Government response

The momentum behind Korea's AI push reflects an administration betting heavily on technological transformation.

President Lee Jae Myung, who assumed office in June, has positioned AI as central to his economic agenda. In his budget pitch at the National Assembly in November, Lee called the spending plan "Korea's first budget for the AI era," allocating 10.1 trillion won for AI — more than triple this year’s level.

The administration has also secured international backing. In September, Lee met with Larry Fink, chairman and CEO of BlackRock, in New York. The two signed a memorandum of understanding to develop hyperscale AI data centers powered by renewable energy. Fink pledged to help make Korea the "AI capital of Asia" by drawing global investment into the country's AI infrastructure.

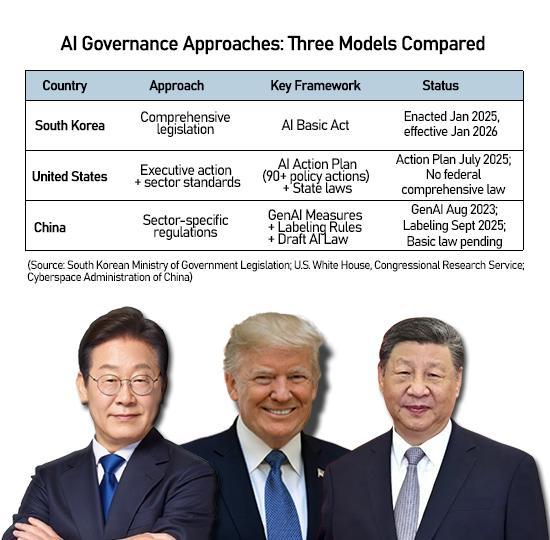

At the APEC summit in Gyeongju last month, Lee outlined Korea's AI governance framework to world leaders. "We are building an AI highway and are about to implement the Basic Act on AI, which will balance industrial development with responsible use of artificial intelligence," he said.

The talent question

Korea’s long-term viability in AI competitiveness hinges on its ability to secure and retain talent.

The 2024 Global AI Index from Tortoise Media placed South Korea sixth among 83 nations in overall AI competitiveness — yet the country dropped to 13th place in talent metrics.

To address the gap, the Education Ministry unveiled its inaugural national AI talent blueprint this November, committing 1.4 trillion won to develop expertise from elementary school through postgraduate research. One initiative creates a fast-track program enabling exceptional students to earn bachelor's, master's, and doctoral degrees in 5.5 years, rather than the typical eight-plus.

"But to say our people are using the full potential of AI, that would be a different story," said Kwon Jae-jin. "Around six or seven out of ten users use AI as search engines, so many are unfamiliar with basic prompting concepts."

A lack of shared understanding of why AI is needed — or broader consensus around AI applications — may prove an obstacle.

"Ever since the first AI models' launch, humans have focused on learning about AI," Kwon said. "Now, we believe AI will try to understand humans. Learning what AI does and how it functions will be crucial in the next era soon to come."

Copyright ⓒ Aju Press All rights reserved.