SEOUL, December 03 (AJP) - South Korea's economy grew faster than earlier estimated on the back of stronger capital investment, but its nominal income declined against a strong dollar, reflecting the Korean won’s status as one of the weakest performers among major traders.

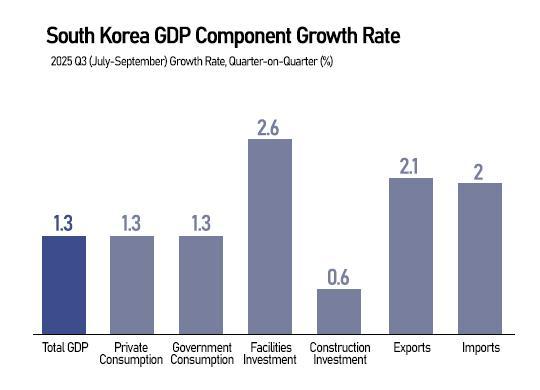

According to the Bank of Korea (BOK) on Wednesday, real gross domestic product increased 1.3 percent from the previous quarter — the strongest since the fourth quarter of 2021 — accelerating from the 0.7 percent gain in the second quarter and 1.2 percent in preliminary data.

Against a year-ago period, real GDP expanded 1.8 percent, setting the economy on track to meet this year's revised annual growth target of 1.0 percent. The economy added 1.6 percent in the second quarter and zero growth in the first.

The upward revision owed to increases in construction investment (0.6 percent), facilities investment (2.6 percent), and intellectual property investment (1.2 percent), the BOK said.

Other data on the domestic front also showed improvements.

Private consumption grew 1.3 percent, driven by gains in both goods, such as passenger cars, and services, such as dining out.

Government expenditure increased by 1.3 percent, centered on the cost of goods and health insurance benefits.

The external environment, however, turned dim.

Exports expanded 2.1 percent, slowing from the 4.5 percent growth in the second quarter, while imports also slowed to 2.0 percent from 4.2 percent in the second quarter.

In nominal terms, GDP added just 0.7 percent, compared to 2 percent in the second quarter, placing gross operating surplus growth at 0.8 percent versus 4 percent previously, due to the strength of the dollar against the Korean won, which fell around 6 percent in the third quarter.

The GDP deflator, which reflects the level of prices, rose by 2.7 percent.

The gross national income (GNI) in nominal terms decreased 0.3 percent from the previous quarter.

The fall was significantly impacted by the shrinkage in net factor income from the rest of the world (NFIA) — the difference between the country’s earnings from foreign investments and payments made to foreign investors — which fell from 14.1 trillion won ($9.6 billion) to 8 trillion won.

In real terms, GNI rose 0.8 percent from the previous quarter, marking a slight slowdown from the 1 percent increase recorded in the second quarter.

The deterioration in the terms of trade also contributed to sluggish GNI, with the real loss on terms of trade widening from 8.6 trillion won ($5.86 billion) to 10.3 trillion won. Real net factor income from the rest of the world also added downward pressure, declining from 10.2 trillion won in the second quarter to 8.6 trillion won in the third quarter.

Gross national income fell 0.1 percent. Both the savings rate and the investment rate declined, painting a darker picture for the economy moving forward.

The gross saving ratio fell 1.2 percentage points to 34.4 percent, while the net household saving ratio inched up 0.1 percentage point to 8.9 percent.

The gross national investment ratio also fell 0.2 percentage point sequentially to 28.6 percent.

Copyright ⓒ Aju Press All rights reserved.