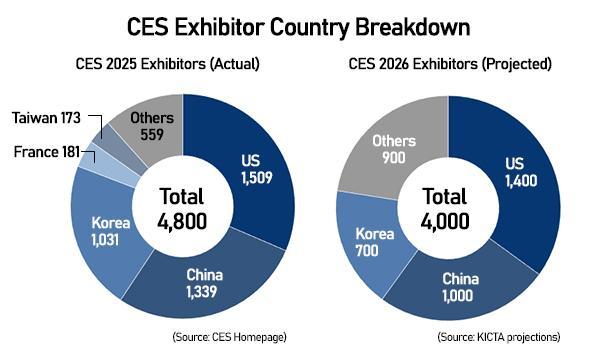

CES 2026, slated for Jan. 6 to 9 in Las Vegas, is expected to host between 700 and 800 Korean companies, down sharply from about 1,031 firms in 2025, according to industry data. The retreat is driven largely by startups and sole proprietors pulling back, but major conglomerates are also rethinking their strategies.

SK Group — which mounted large-scale, multi-company pavilions from 2019 to 2025 — will send only SK hynix.

HD Hyundai, known for showcasing next-generation autonomous vessel technologies in recent years, will skip the show entirely.

Hyundai Motor Group is scaling down its exhibition, dropping software and self-driving displays where U.S. rivals currently lead.

Samsung Electronics, meanwhile, plans to host its showcase at a private hotel rather than its usual anchor space at the Las Vegas Convention Center's Central Hall, now increasingly dominated by Chinese giants such as TCL and Hisense.

Fragmented 'Team Korea' weakens coordination

The pullback underscores a long-running issue: Korea's lack of a unified national strategy at CES.

"There is no central control tower," said Lee Han-bum, president of the Korea Information & Communication Technology Industry Association (KICTA). "KOTRA, the Seoul city government and dozens of local governments all come separately. There is confusion, and even now many participants have not received final approval."

KOTRA will lead a unified Korea Pavilion next year that brings together multiple agencies including the Seoul Metropolitan Government. The pavilion will host 469 companies, up from 445 in 2025.

But a large share of exhibitors will still go it alone. At CES 2025, 586 Korean companies participated outside the pavilion. If total Korean attendance falls to around 700, the pavilion's share would rise from 43 percent to roughly 67 percent, but it would still not function as an overarching command structure.

KOTRA also directly manages only about 140 companies through its own selection process. Much of its role remains focused on booth design, branding and coordination — not comprehensive oversight.

High costs, low returns

The financial case for attending CES is becoming tougher.

Korea is estimated to have spent around $500 million on CES 2025 but saw less than $20 million in tangible returns, Lee said.

Korea sent the third-largest national delegation in early 2025, behind the United States (1,509 firms) and China (1,339). Yet the Startup Alliance noted that many CES Innovation Award winners from Korea struggled to secure investment or overseas partnerships, raising questions about whether the heavy spending is translating into actual commercial outcomes.

Korean startups at Eureka Park, the exhibition's dedicated startup venue, accounted for nearly half of all exhibitors last year at 641 companies out of 1,400 total — a dominance that raised questions about sustainability.

A single booth can cost at least 100 million won once accommodation, logistics, patent filings and rental fees are included.

A sharply weaker won, higher operational costs and tougher U.S. visa conditions under the Trump administration are adding further pressure.

Still, Korea dominates the awards

Despite scaling back, Korea remains a standout in innovation accolades.

KOTRA said Korean companies have secured 168 awards at CES 2026, accounting for 60 percent of all awards and marking the country's third consecutive year as the event's top winner.

Korean firms swept all three Best of Innovation awards in the AI category, with honors going to Doosan Robotics, DeepFusion AI, and CityFive.

The Seoul Business Agency will support 70 startups at next year's unified pavilion — down from 104 — but is expanding assistance programs, including investor matchmaking, global IR pitch competitions, and media outreach.

"Korea needs to compete on technology, not headcount," Lee said. "That means fewer companies, but better-prepared ones."

Copyright ⓒ Aju Press All rights reserved.