But after catching its breath, the market may be setting its sights on the next psychological milestone — 5,000 — in 2026, according to a growing chorus of domestic and foreign brokerages.

Among 11 local brokerages that have published 2026 outlooks, the average upper-end forecast stands at 4,979, while the average lower-end projection is 3,737.

Roh Dong-gil, an analyst at Shinhan Investment & Securities, predicted that the Korean stock market will enter “an uncharted new world” next year, driven by structural expansion in corporate earnings.

“Growth sectors such as artificial intelligence, semiconductors, secondary batteries, healthcare and renewable energy will lead earnings growth,” Roh said.

KB Securities analyst Lee Eun-taek also forecast what he described as a “best-ever bull market,” contingent on government-led capital market reforms and a strengthening won reinforcing investor confidence.

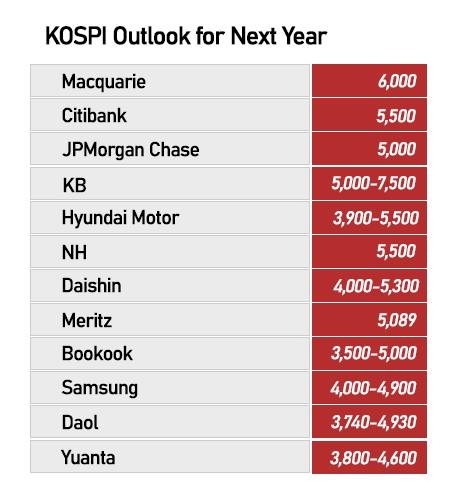

Foreign investment banks are even more bullish.

JPMorgan expects the KOSPI to reach 5,000 next year, Citi sees it climbing to 5,500, while Macquarie has raised its target to 6,000. Talk of a 7,500 KOSPI has also entered market discourse. In a report released on Nov. 6, KB Securities set its 2025 target at 5,000, while outlining a long-term bull-case scenario of 7,500.

Both domestic and global institutions have recently upgraded their growth forecasts for the Korean economy. Nomura raised its 2026 GDP growth projection to 2.3 percent from 1.9 percent, while the OECD forecasts 2.2 percent. The Korean government, the Korea Development Institute and the International Monetary Fund each project 1.8 percent growth, while the Korea Institute of Finance sees 2.1 percent.

Earnings expectations for major chipmakers are fueling the bullish case. SK hynix’s operating profit is forecast at 74.65 trillion won ($50.66 billion) next year, up 75.2 percent from this year, while Samsung Electronics’ operating profit is projected to jump 114.4 percent to 83.24 trillion won. Together, the two firms are expected to drive aggregate earnings growth among KOSPI-listed companies in 2025.

Additional tailwinds include strong earnings momentum in AI-related sectors, government-led capital market reforms, and expectations of dollar weakness amid declining global interest rates.

Many strategists believe a liquidity-driven rally could begin next year as the U.S. Federal Reserve continues its easing cycle, having already cut rates three times this year.

Samsung Securities, in particular, expects the share of pro-Trump policymakers within the Fed to increase, amplifying calls for further rate cuts. With Chair Jerome Powell’s term set to expire in May, the next Fed leadership could tilt toward a more growth-friendly stance aligned with former President Donald Trump’s policy preferences.

Still, economists warn against excessive optimism.

“Levels such as 6,000 or even 7,500, as projected by Macquarie or some local brokerages, represent the extreme end of bullish scenarios,” said Kim Dae-jong, a professor of business administration at Sejong University.

“Such targets would require a synchronized combination of global liquidity easing, a semiconductor supercycle and effective policy reform,” he said.

“KOSPI 5,000 is not simply about economic recovery,” Kim added. “It ultimately depends on how far corporate profit structures improve and how deeply capital market reforms take root.”

Copyright ⓒ Aju Press All rights reserved.