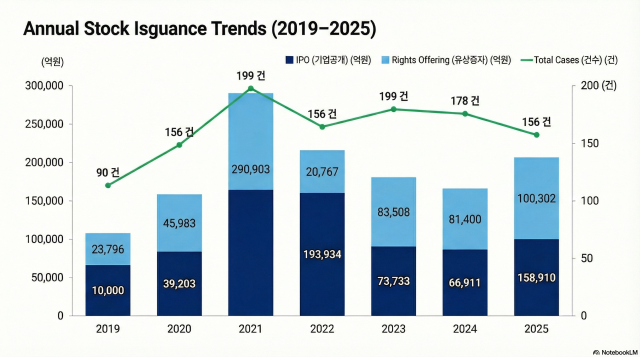

According to the Financial Supervisory Service (FSS) on Wednesday, public equity issuance last year totaled 13.71 trillion won ($9.4 billion), an increase of 55.4 percent from the previous year.

Rights offerings accounted for 10.30 trillion won of the total, skyrocketing 113.3 percent compared to 2024. The surge was primarily driven by major conglomerates, with the total value of rights offerings by large corporations alone increasing by nearly 220 percent on year.

The number of rights offerings reached 72, an increase of 28.6 percent from the 56 cases recorded in 2024.

Reflecting a growth trend skewed toward conglomerates, the push in rights offerings was led by major players. While rights offerings by large firms surged 220 percent versus the previous year, those by SMEs decreased 22.6 percent during the same period.

IPO market chills amid tightened regulations

Equity issuance through IPOs amounted to 3.68 trillion won, down 10.7 percent from a year ago. The number of IPOs fell 14 percent to 98 cases. By market, 6 cases were listed on the benchmark KOSPI, while 92 cases were on the tech-heavy KOSDAQ.

The divergence is attributed to continued strong performances by existing listed giants, while SMEs and venture firms struggled. Furthermore, the government's aggressive moves to exit "zombie companies" and block "split-off listings" have raised the bar for initial public offerings.

Corporate bond issuance totaled 276.25 trillion won, a slight decrease of 0.7 percent against the previous year. Compared to 2024, general corporate bonds and ABS increased 6.5 percent and 20.0 percent, respectively, while financial bonds fell 4.0 percent.

For general corporate bonds, refinancing accounted for the largest share at 79.6 percent, followed by operating capital (16.4 percent) and facility investment (4.0 percent). By credit rating, high-grade bonds (AA or higher) rose to 70.7 percent, while lower-rated bonds (A or lower) fell to 29.3 percent relative to the year before.

By maturity, mid-term bonds continued to dominate at 95.0 percent, with long-term and short-term bonds accounting for 3.4 percent and 1.6 percent, respectively. Among financial bonds, bank bonds and other financial bonds decreased 12.2 percent and 2.4 percent, while bonds issued by financial holding companies jumped 31.3 percent from a year earlier.

As of the end of last year, the total outstanding balance of corporate bonds stood at 756.88 trillion won, up 9.3 percent from the prior year. Meanwhile, issuance of commercial paper (CP) and short-term bonds reached 1,663.32 trillion won, marking a 27.6 percent increase over 2024.

Copyright ⓒ Aju Press All rights reserved.