SEOUL, July 09 (AJP) - As South Korea prepares for high-stakes tariff negotiations with the United States over the next three weeks, the country’s shipbuilding industry has emerged as a central element of Seoul’s diplomatic and strategic playbook.

Government officials said Wednesday that cooperation in the shipbuilding sector is being positioned as more than just a bargaining chip in ongoing trade discussions.

A senior official at the presidential office noted that the Korea–U.S. partnership in shipbuilding “will not be used merely as leverage,” underscoring its broader significance within the countries’ economic and security relationship.

The talks, which include not only trade policy but also defense cost-sharing and the role of U.S. military forces stationed on the peninsula, are being shaped by a growing recognition of shipbuilding’s dual role — as both a geopolitical asset and an industrial powerhouse. Korean officials believe highlighting the sector's strategic utility will help frame negotiations more comprehensively.

That positioning gained momentum this week when Hanwha Ocean announced it had secured its third U.S. Navy maintenance contract — this time for the USNS Charles Drew, a supply ship in the Navy’s 7th Fleet.

The deal involves maintenance, repair and overhaul (MRO) work scheduled to begin in mid-July at Hanwha’s Geoje shipyard and conclude by the end of the year.

The Charles Drew, a 41,000-ton non-combat vessel tasked with transporting cargo and ammunition, follows two earlier contracts awarded to Hanwha for the Wally Schirra and the Yukon in 2024. The Yukon is expected to leave the Geoje yard later this month after completing repairs.

Hanwha is targeting five to six MRO projects in 2025 and is preparing to transition into direct ship construction for the U.S. market following facility expansions at its recently acquired Philadelphia shipyard.

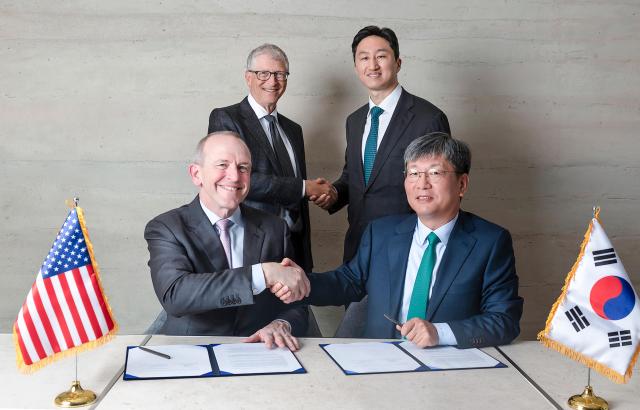

Meanwhile, HD Hyundai Heavy Industries, South Korea’s largest shipbuilder, signed a memorandum of understanding with Huntington Ingalls Industries, the top American military shipbuilder.

The agreement aims to explore collaboration in areas such as process innovation and workforce development — areas seen as critical to the revitalization of American naval production capacity.

Industry officials describe South Korea’s major shipbuilders as among the few realistic partners capable of supporting the U.S. Navy’s modernization ambitions.

Their strengths in eco-friendly vessel construction and smart shipyard technologies are also seen as a counterweight to China’s expanding shipbuilding footprint, particularly in the military domain.

The geopolitical undercurrents of the sector were highlighted by President Lee Jae Myung during remarks Tuesday at a defense industry forum marking the country’s first National Defense Industry Day.

Lee described the defense sector as a “future growth engine” and pledged to diversify the industry’s ecosystem away from its traditional conglomerate-centered model. He also committed to expanding government-to-government cooperation and making South Korea one of the world's top four defense powers.

Copyright ⓒ Aju Press All rights reserved.

View more comments