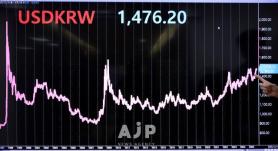

The move was decided during another emergency meeting among the heads of the finance ministry, financial regulator, and the central bank Thursday morning after the U.S. dollar tested 1,480 won on the previous day. As of 1:30 p.m., the dollar has retreated to 1,477.70 won.

Under the plan, supervisory actions tied to enhanced FX liquidity stress tests for financial institutions will be suspended through the end of June next year.

The enhanced test evaluates banks’ ability to withstand foreign-exchange funding stress by measuring daily inflows against outflows. Institutions that fail to meet a required “survival period” — when inflows exceed outflows — had to submit liquidity-boosting plans to regulators.

Authorities said the supervisory burden has led some institutions to hold more FX liquidity than needed for normal operations through the effect of relaxing forward FX position limits for local subsidiaries of foreign banks.

Forward FX transactions involve agreements to buy or sell foreign currency at a predetermined exchange rate on a future date. Korea’s forward FX position system, introduced in 2010, caps banks’ net forward positions relative to equity to prevent excessive capital inflows and a buildup of external debt.

Until now, local units of foreign banks — including SC First Bank Korea and Citibank Korea — have been subject to the same 75% limit as domestic lenders, despite operating with business models similar to foreign bank branches that rely heavily on funding from overseas headquarters. Authorities said this discrepancy has acted as a constraint on FX inflows.

Under the new plan, the forward FX position limit for these local subsidiaries will be eased to 200%. Domestic banks will continue to face a 75% cap, while foreign bank branches will remain subject to a higher limit of 375%.

The government will also further relax restrictions on FX loans for won-denominated uses by exporters.

Won-use FX loans refer to cases in which companies borrow in foreign currency — such as U.S. dollars — but convert the funds into won for domestic use rather than for imports. An increase in such loans can boost dollar selling in the FX market, helping to ease upward pressure on the exchange rate.

Previously, FX banks were allowed to extend such loans only for exporters’ domestic facility investment. Under the revised framework, exporters will also be able to use FX loans for domestic working capital.

In addition, authorities said they will promote “integrated foreign investor stock accounts,” which would allow overseas retail investors to trade South Korean equities directly through foreign brokerages without opening separate accounts at local securities firms. Officials said broader overseas participation could attract new investment funds and support FX inflows.

Regulators also plan to clarify guidance that foreign companies listed on overseas exchanges qualify as professional investors, easing procedural hurdles in FX derivatives trading. Despite their status, unclear interpretations have required advance documentation and verification, discouraging FX transactions and capital inflows.

The government said follow-up measures under the plan will be completed by year’s end.

* This article, published by Economic Daily, was translated by AI and edited by AJP.

Copyright ⓒ Aju Press All rights reserved.