SEOUL, January 05 (AJP) - The United States’ surprise armed intervention in Venezuela is sending shockwaves through global markets, rekindling demand for traditional safe-haven assets as investors reassess geopolitical risk.

The overnight operation targeting Venezuela’s leadership — followed by U.S. President Donald Trump publicly touting it as an “incredible thing” that could be repeated because “nobody can stop us” — has raised fears that Washington’s actions may send the wrong signal to other expansion-minded powers, notably China and Russia.

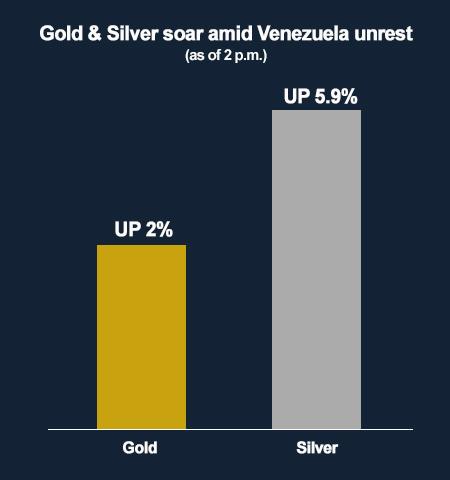

As of 1:50 p.m. Monday, gold surged 2 percent to $4,416 per troy ounce, nearing last year’s record high of $4,565. Silver jumped 5.9 percent to $75. The U.S. Dollar Index edged up 0.3 percent to 98.71, underscoring renewed demand for dollar-denominated safe assets.

Asian Currencies Buckle Under Dollar Strength

The rush into safe havens weighed on Asian currencies, traditionally vulnerable during periods of heightened geopolitical stress.

The Korean won slipped 0.3 percent to 1,447 per dollar, while the Japanese yen weakened 0.1 percent to 157 per dollar by 2 p.m., both struggling against the greenback despite verbal interventions and hints of additional rate hikes from their respective monetary authorities.

Precious Metals Take Center Stage

Gold and silver remain at the heart of the current market rally.

In 2025, gold prices climbed 65 percent, while silver soared an extraordinary 160 percent, driven by its dual role as both a safe-haven asset and a critical industrial input. Persistent supply deficits in silver have amplified its price swings during periods of stress.

Earlier warnings that the rally had become overstretched briefly materialized in a correction, with gold falling 4 percent and silver dropping 10 percent. The Venezuelan operation, however, has abruptly reversed expectations of a cooling market.

Geopolitical Shock Overrides Prior Forecasts

Before the strikes, several analysts — including Avi Gilburt of ElliottWaveTrader — had expected safe-haven gains to be capped this year, projecting gold to peak near $5,000 and silver to face resistance in the $75–$80 range.

Those projections were upended as U.S. military action injected fresh geopolitical uncertainty into markets.

Historically, bullion has served as a frontline hedge during global shocks. Gold and silver jumped 5.7 percent and 5.2 percent, respectively, on the day of the September 11 attacks, and rose 3.2 percent and 4.5 percent following Russia’s invasion of Ukraine.

“Geopolitical uncertainty directly translates into increased demand for gold, silver and other safe-haven assets,” said Kim Doo-eun, senior research fellow at Hana Securities. Citing precedents such as the Iraq War and 9/11, Kim said prices could climb an additional 10 to 20 percent, warning that markets are particularly sensitive to actions perceived as setting dangerous precedents.

‘Wrong Signal’ Risk Looms Large

Concerns are mounting that Washington’s logic in Venezuela could be mirrored elsewhere.

“The logic used by the U.S. could be co-opted by China to justify a crackdown on so-called separatist forces in Taiwan, or by Russia to rationalize further military action in Ukraine,” said Lee Jun-seok, leader of the Reform Party, in a Facebook post Sunday.

Lee also warned that North Korea — long accused of cyberattacks and illicit activities — could respond with provocation amid heightened global tensions.

Similar concerns were echoed by Kenneth Rogoff, Maurits C. Boas Professor at Harvard University, who said at the American Economic Association meeting that the Venezuelan operation could serve as a future military pretext for China over Taiwan.

Rally Faces Structural Limits

Despite the sharp move, analysts are doubtful of a prolonged surge.

“Safe-haven assets typically require a broader economic slowdown to sustain a long-term rally,” Kim of Hana Securities said. “From that perspective, it is unlikely that gold and silver can maintain this pace indefinitely.”

Choi Jin-young, a commodity analyst at Daishin Securities, projected that while precious metals may continue to rise through the first half of the year, demand could soften in the second half as capital rotates toward energy markets.

Rising oil and gas prices often divert investment away from bullion. Venezuela’s oil production — accounting for less than 1 percent of global output — is unlikely to trigger a supply shock large enough to stabilize energy markets in the near term, Choi added.

Copyright ⓒ Aju Press All rights reserved.