SEOUL, February 02 (AJP) - Korean markets saw panicky selling on Monday following Donald Trump’s nomination of Kevin Warsh as the next chair of the U.S. Federal Reserve, with equities and the won sliding sharply on concerns that his policy framework could reinforce dollar strength and drain global liquidity.

Whether Warsh would ultimately comply with Trump’s long-standing calls for lower borrowing costs remains uncertain. Investors, however, moved quickly to price in a scenario in which rate cuts coexist with tighter underlying liquidity — a mix widely viewed as unfavorable for emerging-market currencies such as the Korean won.

Trump announced Warsh’s nomination last Friday. He is set to succeed Jerome Powell, whose term expires on May 15 after a tenure frequently marked by public friction with the White House.

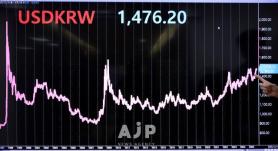

The selloff was broad-based. The KOSPI closed down 5.26 percent at 4,949.67, falling below the psychologically important 5,000 level. Intraday volatility triggered a sell-side “sidecar” trading halt, underscoring the disorderly nature of the move. The won weakened to 1,464.3 per dollar, down 24.8 won by late afternoon.

Commodity markets echoed the risk-off mood. Gold futures fell 11.4 percent to $4,745.10 per troy ounce, while silver futures plunged 31.4 percent to $78.531, marking their steepest single-day declines since January 1980, when former Fed chair Paul Volcker unleashed aggressive rate hikes to rein in inflation.

Hawkish by structure, not by label

Warsh is not generally regarded as a traditional monetary hawk. Paradoxically, that nuance has unsettled markets.

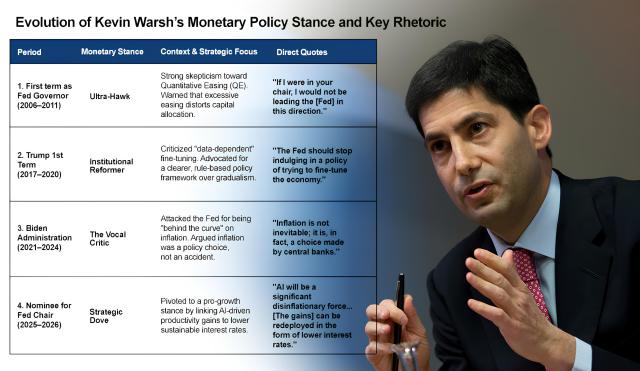

Investors point to his record as a Fed governor, particularly his clashes with Ben Bernanke over the second round of quantitative easing (QE2). At the time, Warsh openly opposed large-scale asset purchases, warning Bernanke, “If I were in your chair, I would not be leading the Fed in this direction.” That history has reinforced expectations that Warsh, even if willing to lower policy rates, would prioritize balance-sheet discipline — keeping the dollar scarce and underpinning its value.

Warsh’s more recent thinking suggests a hybrid approach: cutting rates to support investment while continuing quantitative tightening (QT) through Treasury sales. The goal is to stimulate corporate activity without undermining the dollar.

Under such a framework, rate cuts would not necessarily weaken the greenback. Instead, reduced global dollar liquidity could persist, weighing on currencies like the won and making Korean assets less attractive on a currency-adjusted basis.

Warsh has defended the apparent contradiction by arguing that productivity gains from artificial intelligence can offset inflationary pressures. In a July interview, he said the AI revolution would be a “significant disinflationary force,” allowing looser policy without destabilizing prices.

He has also cited Alan Greenspan as a reference point, praising Greenspan’s decision to refrain from preemptive rate hikes during the 1990s technology boom as productivity gains kept inflation in check.

For South Korea, that historical parallel is unsettling.

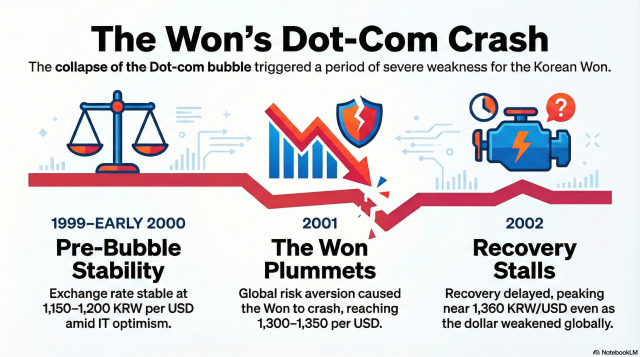

Greenspan’s accommodative stance ultimately preceded the 2000 dot-com collapse, when the Nasdaq plunged 78 percent and the U.S. dollar index weakened sharply. Korea was hit harder still: the KOSDAQ fell nearly 80 percent, while the won depreciated from the 1,100 range to around 1,360 per dollar.

Analysts warn that a similar combination of equity volatility and currency weakness could re-emerge if global liquidity tightens more aggressively than markets expect under a Warsh-led Fed.

Liquidity stress back on the radar

Concerns are also resurfacing over potential liquidity stress as QT drains bank reserves. In September 2019, heavy Treasury issuance combined with corporate tax payments pushed the U.S. repo rate from 2 percent to 10 percent, forcing emergency Fed intervention.

Some market participants fear that under Warsh, such stress might be tolerated — or allowed to run longer — as part of balance-sheet normalization.

“Unlike in 2019, there is now a broader consensus that normalizing the balance sheet itself is a core policy objective,” a KB Securities official said on condition of anonymity. NH Investment & Securities similarly cautioned that a rapid policy pivot should not be assumed.

A tougher outlook for the won

Optimism earlier this year that the won could stabilize near 1,400 per dollar, as suggested by Lee Jae Myung, is now being reassessed.

For Korean markets, the concern is less about Warsh’s personal ideology than about whether the next Fed chair institutionalizes a framework that favors a strong dollar by design. If that proves to be the case, Monday’s panicky selling may mark the start of a longer adjustment rather than a one-off reaction.

Copyright ⓒ Aju Press All rights reserved.