Journalist

AJP

-

Korean digital platforms under threat and underprepared SEOUL, December 19 (AJP) - Global content platform TikTok announced more than $2 billion in annual safety investments on Thursday — a stark contrast to South Korea's major digital platforms, which are struggling to fend off both cyberattacks and real-world security threats. TikTok said the platform, which surpassed 1 billion monthly active users globally in 2021, continues to expand its reach, with more than 100 million videos uploaded each day. According to TikTok's second-quarter data, over 99 percent of content removed for policy violations was detected proactively, before users reported it. "We have strengthened our technology development, content moderation workforce and security infrastructure," said Yang Soo-young, a TikTok manager, speaking at the company's media day in Seoul. Beyond safety, TikTok has also emerged as a key conduit for the global spread of Korean culture. An analysis of data from more than 70 countries, including Korea, shows that roughly half of all K-culture hashtag posts created over the past three years were generated in just the past 12 months. Survey results indicate that 86 percent of U.S. consumers and 76 percent of Southeast Asian consumers say they learned more about Korean culture through TikTok, with Korean dramas and music driving interest in Korean products and brands. That proactive posture stands in sharp contrast to the mounting security crisis facing Korea's homegrown platforms. Coupang recently suffered a large-scale personal data breach affecting millions of users, while Naver and Kakao have become targets of bomb-threat posts this week, triggering police investigations. What began as online harassment has escalated into physical terror warnings, fueling public outrage and raising questions about the resilience of Korea's digital infrastructure. The gap in preparedness is reflected in spending. According to CEO Score's analysis of security investments by 585 companies from 2022 to 2024, Korean firms allocated just 0.1 to 0.13 percent of revenue to information protection. More critically, security spending accounted for only 6 to 6.2 percent of IT budgets — roughly half the U.S. benchmark of 13.2 percent. In Coupang's case, a former employee of Chinese nationality has been identified as a suspect, underscoring China's complex role in the global cybersecurity landscape. China ranks second worldwide in cybersecurity market size after the U.S., according to Statista's 2026 projections, while also harboring the world's second-largest hacker population — about 22 percent — trailing only North Korea at 33 percent. Despite being prime targets, Korean companies remain reluctant to invest meaningfully in security. The underlying calculus is economic. Since the launch of the Personal Information Protection Commission in August 2020 through September this year, 109.16 million cases of personal data leaks have been recorded, resulting in cumulative fines of 367.1 billion won ($249 million). That equates to roughly 3,300 won per breach — a trivial cost compared with the punitive damages imposed in Europe or the U.S., where data-protection penalties can be severe. "Investment alone won't solve everything, but investment has to come first," said Park Choon-sik, a professor in the Division of Information Security at Seoul Women's University. "Companies need to allocate at least 10 percent of their IT budgets to security. Only then can they hire specialists, build dedicated teams and meaningfully reduce damage." China has already moved in that direction. In 2023, it introduced its first cybersecurity insurance framework, offering tax breaks and insurance subsidies to encourage voluntary enrollment. The system establishes quantitative risk-assessment standards for key industries, standardizes cyber-risk evaluation and encourages insurers to diversify coverage, including liability protection. 2025-12-19 15:50:58

Korean digital platforms under threat and underprepared SEOUL, December 19 (AJP) - Global content platform TikTok announced more than $2 billion in annual safety investments on Thursday — a stark contrast to South Korea's major digital platforms, which are struggling to fend off both cyberattacks and real-world security threats. TikTok said the platform, which surpassed 1 billion monthly active users globally in 2021, continues to expand its reach, with more than 100 million videos uploaded each day. According to TikTok's second-quarter data, over 99 percent of content removed for policy violations was detected proactively, before users reported it. "We have strengthened our technology development, content moderation workforce and security infrastructure," said Yang Soo-young, a TikTok manager, speaking at the company's media day in Seoul. Beyond safety, TikTok has also emerged as a key conduit for the global spread of Korean culture. An analysis of data from more than 70 countries, including Korea, shows that roughly half of all K-culture hashtag posts created over the past three years were generated in just the past 12 months. Survey results indicate that 86 percent of U.S. consumers and 76 percent of Southeast Asian consumers say they learned more about Korean culture through TikTok, with Korean dramas and music driving interest in Korean products and brands. That proactive posture stands in sharp contrast to the mounting security crisis facing Korea's homegrown platforms. Coupang recently suffered a large-scale personal data breach affecting millions of users, while Naver and Kakao have become targets of bomb-threat posts this week, triggering police investigations. What began as online harassment has escalated into physical terror warnings, fueling public outrage and raising questions about the resilience of Korea's digital infrastructure. The gap in preparedness is reflected in spending. According to CEO Score's analysis of security investments by 585 companies from 2022 to 2024, Korean firms allocated just 0.1 to 0.13 percent of revenue to information protection. More critically, security spending accounted for only 6 to 6.2 percent of IT budgets — roughly half the U.S. benchmark of 13.2 percent. In Coupang's case, a former employee of Chinese nationality has been identified as a suspect, underscoring China's complex role in the global cybersecurity landscape. China ranks second worldwide in cybersecurity market size after the U.S., according to Statista's 2026 projections, while also harboring the world's second-largest hacker population — about 22 percent — trailing only North Korea at 33 percent. Despite being prime targets, Korean companies remain reluctant to invest meaningfully in security. The underlying calculus is economic. Since the launch of the Personal Information Protection Commission in August 2020 through September this year, 109.16 million cases of personal data leaks have been recorded, resulting in cumulative fines of 367.1 billion won ($249 million). That equates to roughly 3,300 won per breach — a trivial cost compared with the punitive damages imposed in Europe or the U.S., where data-protection penalties can be severe. "Investment alone won't solve everything, but investment has to come first," said Park Choon-sik, a professor in the Division of Information Security at Seoul Women's University. "Companies need to allocate at least 10 percent of their IT budgets to security. Only then can they hire specialists, build dedicated teams and meaningfully reduce damage." China has already moved in that direction. In 2023, it introduced its first cybersecurity insurance framework, offering tax breaks and insurance subsidies to encourage voluntary enrollment. The system establishes quantitative risk-assessment standards for key industries, standardizes cyber-risk evaluation and encourages insurers to diversify coverage, including liability protection. 2025-12-19 15:50:58 -

Lee Jae Myung warns against collateral-heavy lending, seeks structural banking reforms SEOUL, December 19 (AJP) - President Lee Jae Myung on Thursday renewed his criticism of what he described as the banking sector’s reliance on “easy” interest income, urging regulators to embed stronger consumer protections and tighter oversight into law. Speaking at a policy briefing of the Financial Services Commission (FSC) at the Government Complex Seoul, Lee asked whether financial institutions effectively avoid losses even when loan delinquencies occur by shifting costs to other customers. He criticized banks’ heavy reliance on collateral-based lending, arguing that lending secured mainly by land or housing while collecting interest distorts the core role of finance and should be corrected. FSC Chairman Lee Eok-won said about 70 percent of household loans in the banking sector are backed by mortgages, adding that the low risk of loss has led lenders to concentrate on such products. He questioned how much that lending structure contributes to the broader economy and said the FSC would pursue institutional reforms. President Lee responded that even when difficult reforms are implemented, policies often “snap back” over time, arguing that key changes should be locked into law to ensure durability. Lee also emphasized the need for greater financial inclusion. He said working-class households are the ones most in need of financing, while wealthier borrowers with stronger collateral and higher credit ratings are better positioned to use financial services to accumulate even more assets. Lee said high-income borrowers with strong credit gain a disproportionate advantage, widening the wealth gap. Calling this a natural outcome of market forces, he argued that only government policy can correct it and stressed the role of the financial regulators in addressing inequality. 2025-12-19 15:45:16

Lee Jae Myung warns against collateral-heavy lending, seeks structural banking reforms SEOUL, December 19 (AJP) - President Lee Jae Myung on Thursday renewed his criticism of what he described as the banking sector’s reliance on “easy” interest income, urging regulators to embed stronger consumer protections and tighter oversight into law. Speaking at a policy briefing of the Financial Services Commission (FSC) at the Government Complex Seoul, Lee asked whether financial institutions effectively avoid losses even when loan delinquencies occur by shifting costs to other customers. He criticized banks’ heavy reliance on collateral-based lending, arguing that lending secured mainly by land or housing while collecting interest distorts the core role of finance and should be corrected. FSC Chairman Lee Eok-won said about 70 percent of household loans in the banking sector are backed by mortgages, adding that the low risk of loss has led lenders to concentrate on such products. He questioned how much that lending structure contributes to the broader economy and said the FSC would pursue institutional reforms. President Lee responded that even when difficult reforms are implemented, policies often “snap back” over time, arguing that key changes should be locked into law to ensure durability. Lee also emphasized the need for greater financial inclusion. He said working-class households are the ones most in need of financing, while wealthier borrowers with stronger collateral and higher credit ratings are better positioned to use financial services to accumulate even more assets. Lee said high-income borrowers with strong credit gain a disproportionate advantage, widening the wealth gap. Calling this a natural outcome of market forces, he argued that only government policy can correct it and stressed the role of the financial regulators in addressing inequality. 2025-12-19 15:45:16 -

How Korea's "young-40s" are redefining the premium phone market SEOUL, December 19 (AJP) - Koreans in their 40s have long been seen as digitally fluent, image-conscious and economically confident — hip moms and dads who keep pace with trends and AI tools alike. Lately, however, they have come under a new kind of mockery: for trying too hard to look young. At the center of the joke — and the shift — is the smartphone. More specifically, the iPhone, increasingly embraced as a symbol of youthfulness. What began as online “young-forties” memes poking fun at flashy, colorful iPhones has evolved into a tangible realignment in South Korea’s most competitive consumer-electronics market. The stigma has become strong enough to trigger a generational crossover: younger users are gravitating toward Samsung’s Galaxy lineup, while consumers in their 40s and above are moving into Apple’s ecosystem. Survey data point to a clear divergence. Among men in their 20s, Galaxy usage rose to 56 percent this year, overtaking iPhone at 43 percent — the widest gap in three years — according to Gallup Korea. By contrast, iPhone usage among men in their 40s jumped to 35 percent, up 16 percentage points from a year earlier, as Galaxy’s share slid into the low-60 percent range. Behavioral data reinforce the trend. Naver Data Lab shows that men in their 40s now account for the largest share of searches for flagship models such as the iPhone 17 Pro, Galaxy S25 Ultra and Samsung’s Z Fold 7, reflecting both higher purchasing power and a growing preference for premium, attention-grabbing devices. The popularity of the iPhone’s cosmic-orange colorway among 40-somethings has fueled online memes branding it the “uncle phone,” an irony that has only accelerated the shift among younger users seeking to avoid the association. “I’ve always used Galaxy for work efficiency and considered myself a loyal customer,” said Kim Dong-won, a Seoul resident who recently turned 40. “But these days, my friends and I are seriously debating whether to buy the new iPhone 17 because of its trendy look. At this age, it feels like phone design is the one thing we haven’t prioritized.” Consumer experts say the phenomenon reflects a deeper identity shift. “Koreans in their 40s increasingly want to live with a younger, trend-driven mindset,” said Lee Eun-hee, emeritus professor of consumer studies at Inha University. “There is a strong desire to signal that sensibility to others — to show that they are keeping up with contemporary culture.” Younger cohorts, meanwhile, are moving in the opposite direction. Despite the iPhone’s long-standing status as a symbol of youth among Millennials and Gen Z, Samsung’s foldable lineup — particularly the Z Flip 7 — is gaining traction. Samsung data show that users aged 10 to 30 accounted for roughly half of preorders for recent foldable devices, marking the first time that demographic has reached that level since the company introduced foldables in 2019. Perceptions of innovation are also playing a role. In a survey of 1,200 smartphone users aged 19 to 49 conducted by Embrain TrendMonitor, 70.2 percent said Apple’s innovation “feels weaker than before,” while 65.7 percent said Galaxy designs now look “more refined” than in previous generations. The crossover has narrowed what was once a clear aesthetic divide between the two brands. Workplace behavior and payments convenience add another layer. Although Galaxy has traditionally held an edge in work-related features such as call recording and file flexibility, iPhone adoption among white-collar workers rose to a record 35 percent this year, helped by expanded Apple Pay support and carrier-enabled call-recording apps. Even politics appears to mirror the demographic realignment. Gallup data show that progressive respondents display higher iPhone usage, while conservative respondents favor Galaxy — a gap that widened last year. Online political communities have amplified the dynamic, turning device choice into another form of social signaling. “The shift among Koreans in their 40s is closely tied to identity expression,” said Lee Soo-joon, professor of business at Sejong University. “Apple hasn’t introduced foldables or fundamentally new form factors, yet this group is gravitating toward the iPhone, often choosing standout colors like orange. For many, it’s a form of small self-gratification — a way to express personality at a time when bigger lifestyle upgrades, such as housing, feel financially out of reach.” For now, the cross-generational pendulum is swinging in opposite directions. And in South Korea’s hyper-competitive smartphone market, the device people carry is becoming yet another marker of age, identity and social belonging. 2025-12-19 15:27:14

How Korea's "young-40s" are redefining the premium phone market SEOUL, December 19 (AJP) - Koreans in their 40s have long been seen as digitally fluent, image-conscious and economically confident — hip moms and dads who keep pace with trends and AI tools alike. Lately, however, they have come under a new kind of mockery: for trying too hard to look young. At the center of the joke — and the shift — is the smartphone. More specifically, the iPhone, increasingly embraced as a symbol of youthfulness. What began as online “young-forties” memes poking fun at flashy, colorful iPhones has evolved into a tangible realignment in South Korea’s most competitive consumer-electronics market. The stigma has become strong enough to trigger a generational crossover: younger users are gravitating toward Samsung’s Galaxy lineup, while consumers in their 40s and above are moving into Apple’s ecosystem. Survey data point to a clear divergence. Among men in their 20s, Galaxy usage rose to 56 percent this year, overtaking iPhone at 43 percent — the widest gap in three years — according to Gallup Korea. By contrast, iPhone usage among men in their 40s jumped to 35 percent, up 16 percentage points from a year earlier, as Galaxy’s share slid into the low-60 percent range. Behavioral data reinforce the trend. Naver Data Lab shows that men in their 40s now account for the largest share of searches for flagship models such as the iPhone 17 Pro, Galaxy S25 Ultra and Samsung’s Z Fold 7, reflecting both higher purchasing power and a growing preference for premium, attention-grabbing devices. The popularity of the iPhone’s cosmic-orange colorway among 40-somethings has fueled online memes branding it the “uncle phone,” an irony that has only accelerated the shift among younger users seeking to avoid the association. “I’ve always used Galaxy for work efficiency and considered myself a loyal customer,” said Kim Dong-won, a Seoul resident who recently turned 40. “But these days, my friends and I are seriously debating whether to buy the new iPhone 17 because of its trendy look. At this age, it feels like phone design is the one thing we haven’t prioritized.” Consumer experts say the phenomenon reflects a deeper identity shift. “Koreans in their 40s increasingly want to live with a younger, trend-driven mindset,” said Lee Eun-hee, emeritus professor of consumer studies at Inha University. “There is a strong desire to signal that sensibility to others — to show that they are keeping up with contemporary culture.” Younger cohorts, meanwhile, are moving in the opposite direction. Despite the iPhone’s long-standing status as a symbol of youth among Millennials and Gen Z, Samsung’s foldable lineup — particularly the Z Flip 7 — is gaining traction. Samsung data show that users aged 10 to 30 accounted for roughly half of preorders for recent foldable devices, marking the first time that demographic has reached that level since the company introduced foldables in 2019. Perceptions of innovation are also playing a role. In a survey of 1,200 smartphone users aged 19 to 49 conducted by Embrain TrendMonitor, 70.2 percent said Apple’s innovation “feels weaker than before,” while 65.7 percent said Galaxy designs now look “more refined” than in previous generations. The crossover has narrowed what was once a clear aesthetic divide between the two brands. Workplace behavior and payments convenience add another layer. Although Galaxy has traditionally held an edge in work-related features such as call recording and file flexibility, iPhone adoption among white-collar workers rose to a record 35 percent this year, helped by expanded Apple Pay support and carrier-enabled call-recording apps. Even politics appears to mirror the demographic realignment. Gallup data show that progressive respondents display higher iPhone usage, while conservative respondents favor Galaxy — a gap that widened last year. Online political communities have amplified the dynamic, turning device choice into another form of social signaling. “The shift among Koreans in their 40s is closely tied to identity expression,” said Lee Soo-joon, professor of business at Sejong University. “Apple hasn’t introduced foldables or fundamentally new form factors, yet this group is gravitating toward the iPhone, often choosing standout colors like orange. For many, it’s a form of small self-gratification — a way to express personality at a time when bigger lifestyle upgrades, such as housing, feel financially out of reach.” For now, the cross-generational pendulum is swinging in opposite directions. And in South Korea’s hyper-competitive smartphone market, the device people carry is becoming yet another marker of age, identity and social belonging. 2025-12-19 15:27:14 -

Gov't urges Mexico to minimize impact of looming tariff hikes SEOUL, December 19 (AJP) - Deputy minister of Trade, Industry and Resources Park Jung-sung on Friday met with Mexican Ambassador to Seoul Carlos Peñafiel Soto to discuss trade-related issues ahead of planned tariff hikes next month. Their talks came after Park consulted with relevant industry officials last week to assess the expected impact of the tariff hikes on imports of automobiles, textiles, and other goods passed by Mexico's congress earlier this month, and come up with measures. Expressing Seoul's concerns, Park urged that steps be taken to minimize the impact on South Korean companies, adding that further revisions would be necessary. Park stressed that South Korean companies have contributed significantly to Mexico's economy and urged Mexico to ensure the tariff hikes do not affect future investment or bilateral trade. Park also said that talks on a free trade agreement between the two countries should be resumed as soon as possible to strengthen cooperation in advanced industries. The two also discussed recent progress on the U.S.-Mexico-Canada Agreement (USMCA), set to take effect in July next year, replacing the North American Free Trade Agreement (NAFTA). Park said the USMCA should continue to serve as the framework for free trade in North America and urged Mexico to actively support South Korean companies operating there. 2025-12-19 15:03:38

Gov't urges Mexico to minimize impact of looming tariff hikes SEOUL, December 19 (AJP) - Deputy minister of Trade, Industry and Resources Park Jung-sung on Friday met with Mexican Ambassador to Seoul Carlos Peñafiel Soto to discuss trade-related issues ahead of planned tariff hikes next month. Their talks came after Park consulted with relevant industry officials last week to assess the expected impact of the tariff hikes on imports of automobiles, textiles, and other goods passed by Mexico's congress earlier this month, and come up with measures. Expressing Seoul's concerns, Park urged that steps be taken to minimize the impact on South Korean companies, adding that further revisions would be necessary. Park stressed that South Korean companies have contributed significantly to Mexico's economy and urged Mexico to ensure the tariff hikes do not affect future investment or bilateral trade. Park also said that talks on a free trade agreement between the two countries should be resumed as soon as possible to strengthen cooperation in advanced industries. The two also discussed recent progress on the U.S.-Mexico-Canada Agreement (USMCA), set to take effect in July next year, replacing the North American Free Trade Agreement (NAFTA). Park said the USMCA should continue to serve as the framework for free trade in North America and urged Mexico to actively support South Korean companies operating there. 2025-12-19 15:03:38 -

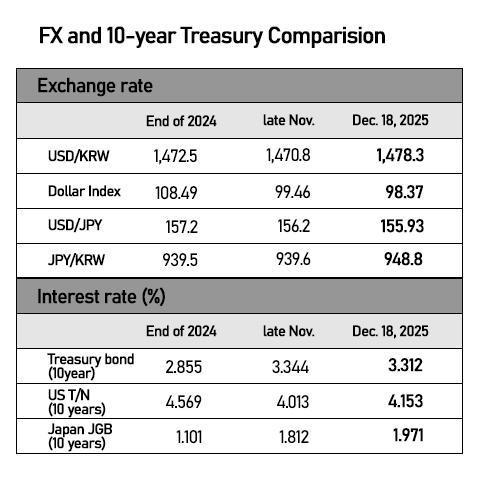

Korean markets price in Japan's rate hike to 30-year high, yen carry risk weighs SEOUL, December 19 (AJP) - Japan’s widely expected rate hike to 0.75 percent — the highest level in 30 years — delivered a mild upset to Korean markets, pressuring bond prices and the currency while lifting equities as investors positioned for a stronger yen environment. Although still low by global standards — compared with Korea’s 2.50 percent policy rate and the U.S. federal funds rate midpoint of about 3.6 percent — the Bank of Japan’s signal of further tightening to combat stubborn inflation near 3 percent marks a turning point for an economy long accustomed to deflation. For global investors, it also introduces an unfamiliar landscape in which Japanese yields are converging toward international levels. The benchmark 10-year Japanese government bond yield broke above 2.00 percent for the first time in 19 years following the decision. Korea’s 10-year government bond closed Friday at 3.342 percent, while the U.S. 10-year Treasury yielded 4.139 percent in early session. Equities advanced in Seoul, with the KOSPI ending Friday 0.65 percent up at 4,020.55 and the tech-heavy KOSDAQ gaining 1.55 percent to 915.27. The dollar rose 2.50 won to 1,479.00 won. “Given the sharp weakening of the yen, a December rate hike was widely expected, with BOJ officials openly discussing the possibility,” said Cho Yong-gu, an economist at Shinyoung Securities. Long positions in yen futures also reflected that market bet, and Korean bond and foreign-exchange markets were relieved that the period of uncertainty had ended, he added. Unlike the BOJ’s surprise first rate hike in August last year, Friday’s move — the second following a January increase — was largely anticipated. Still, Korean financial markets remain exposed to the potential unwinding of the yen carry trade, a strategy that quietly underpinned post-pandemic, liquidity-driven asset inflation. The trade involved borrowing in near-zero-cost yen to invest in higher-yielding assets abroad while Japan kept rates below or near zero even as other central banks tightened policy to curb inflation. That dynamic can reverse abruptly, with destabilizing consequences for emerging markets. According to Cho, the dollar is currently trading around 155 to 156 yen, and a move beyond 160 yen could trigger a rapid unwinding of carry trades — as seen in August last year when the dollar-yen pair briefly surged to 162. Korea, where the won has hovered near the 1,480-per-dollar level throughout December, is particularly sensitive to any sudden foreign capital outflows. The currency is already trading at levels associated with past crises. According to the Bank for International Settlements, Korea’s real effective exchange rate (REER) index fell to 87.05 at the end of November (2020=100), down 2.02 points from a month earlier. That marks the lowest level since April 2009, in the aftermath of the global financial crisis, and comes close to levels seen following the Asian financial crisis in November 1998. The REER measures a currency’s purchasing power against those of major trading partners. Korea ranked 63rd out of 64 countries in November, second only to Japan, whose REER stood at 69.4. The won has weakened steadily this year, slipping from the low-90s earlier in 2025 into the 80s by October. With the exchange rate lingering around the 1,480 range this month, analysts warn the REER could fall further. A weaker real exchange rate also raises the cost of essential imports such as wheat and gasoline, intensifying the burden on households. The Bank of Korea said the import price index rose 2.6 percent month on month in November, extending gains for a fifth consecutive month and marking the sharpest increase since April last year. Nor does currency weakness necessarily benefit exporters. The Korea Institute for Industrial Economics and Trade estimates that a 10 percent decline in the REER reduces large companies’ operating profit margins by 0.29 percentage points, reflecting Korea’s heavy reliance on imported raw materials and intermediate goods. As the won weakens, manufacturers must pay more dollars for inputs before re-exporting finished products. According to BOK on Friday, the producer price index rose 0.3 percent month on month and 1.9 percent year on year in November, with coal and fuel prices jumping 5 percent and memory chip prices rising in double digits, driven by higher import costs linked to the weak won. 2025-12-19 14:38:25

Korean markets price in Japan's rate hike to 30-year high, yen carry risk weighs SEOUL, December 19 (AJP) - Japan’s widely expected rate hike to 0.75 percent — the highest level in 30 years — delivered a mild upset to Korean markets, pressuring bond prices and the currency while lifting equities as investors positioned for a stronger yen environment. Although still low by global standards — compared with Korea’s 2.50 percent policy rate and the U.S. federal funds rate midpoint of about 3.6 percent — the Bank of Japan’s signal of further tightening to combat stubborn inflation near 3 percent marks a turning point for an economy long accustomed to deflation. For global investors, it also introduces an unfamiliar landscape in which Japanese yields are converging toward international levels. The benchmark 10-year Japanese government bond yield broke above 2.00 percent for the first time in 19 years following the decision. Korea’s 10-year government bond closed Friday at 3.342 percent, while the U.S. 10-year Treasury yielded 4.139 percent in early session. Equities advanced in Seoul, with the KOSPI ending Friday 0.65 percent up at 4,020.55 and the tech-heavy KOSDAQ gaining 1.55 percent to 915.27. The dollar rose 2.50 won to 1,479.00 won. “Given the sharp weakening of the yen, a December rate hike was widely expected, with BOJ officials openly discussing the possibility,” said Cho Yong-gu, an economist at Shinyoung Securities. Long positions in yen futures also reflected that market bet, and Korean bond and foreign-exchange markets were relieved that the period of uncertainty had ended, he added. Unlike the BOJ’s surprise first rate hike in August last year, Friday’s move — the second following a January increase — was largely anticipated. Still, Korean financial markets remain exposed to the potential unwinding of the yen carry trade, a strategy that quietly underpinned post-pandemic, liquidity-driven asset inflation. The trade involved borrowing in near-zero-cost yen to invest in higher-yielding assets abroad while Japan kept rates below or near zero even as other central banks tightened policy to curb inflation. That dynamic can reverse abruptly, with destabilizing consequences for emerging markets. According to Cho, the dollar is currently trading around 155 to 156 yen, and a move beyond 160 yen could trigger a rapid unwinding of carry trades — as seen in August last year when the dollar-yen pair briefly surged to 162. Korea, where the won has hovered near the 1,480-per-dollar level throughout December, is particularly sensitive to any sudden foreign capital outflows. The currency is already trading at levels associated with past crises. According to the Bank for International Settlements, Korea’s real effective exchange rate (REER) index fell to 87.05 at the end of November (2020=100), down 2.02 points from a month earlier. That marks the lowest level since April 2009, in the aftermath of the global financial crisis, and comes close to levels seen following the Asian financial crisis in November 1998. The REER measures a currency’s purchasing power against those of major trading partners. Korea ranked 63rd out of 64 countries in November, second only to Japan, whose REER stood at 69.4. The won has weakened steadily this year, slipping from the low-90s earlier in 2025 into the 80s by October. With the exchange rate lingering around the 1,480 range this month, analysts warn the REER could fall further. A weaker real exchange rate also raises the cost of essential imports such as wheat and gasoline, intensifying the burden on households. The Bank of Korea said the import price index rose 2.6 percent month on month in November, extending gains for a fifth consecutive month and marking the sharpest increase since April last year. Nor does currency weakness necessarily benefit exporters. The Korea Institute for Industrial Economics and Trade estimates that a 10 percent decline in the REER reduces large companies’ operating profit margins by 0.29 percentage points, reflecting Korea’s heavy reliance on imported raw materials and intermediate goods. As the won weakens, manufacturers must pay more dollars for inputs before re-exporting finished products. According to BOK on Friday, the producer price index rose 0.3 percent month on month and 1.9 percent year on year in November, with coal and fuel prices jumping 5 percent and memory chip prices rising in double digits, driven by higher import costs linked to the weak won. 2025-12-19 14:38:25 -

Century-old Buddhist pavilions gain heritage status SEOUL, December 19 (AJP) - The Korea Heritage Service (KHS) announced on Friday that it will designate three pavilions from the late Joseon Dynasty as "Treasures," while elevating two iconic medieval stone pagodas to the status of "National Treasures." The three newly recognized pavilions include the Chimgyeru Pavilion at Songgwangsa Temple in Suncheon, the Mansaeru Pavilion at Bongjeongsa Temple in Andong, and the Cheonboru Pavilion at Yongjusa Temple in Hwaseong. Typically situated in front of a temple’s main Buddha hall, these pavilions served as essential social and spiritual hubs during the Joseon era, hosting Buddhist rituals, lectures, and community gatherings. The KHS also officially promoted the 5-story stone pagodas of Bowonsa Temple and Gaesimsa Temple to National Treasures. Both structures represent the pinnacle of Goryeo-era (918–1392) masonry and had been classified as "Treasures" since 1963. 2025-12-19 14:30:57

Century-old Buddhist pavilions gain heritage status SEOUL, December 19 (AJP) - The Korea Heritage Service (KHS) announced on Friday that it will designate three pavilions from the late Joseon Dynasty as "Treasures," while elevating two iconic medieval stone pagodas to the status of "National Treasures." The three newly recognized pavilions include the Chimgyeru Pavilion at Songgwangsa Temple in Suncheon, the Mansaeru Pavilion at Bongjeongsa Temple in Andong, and the Cheonboru Pavilion at Yongjusa Temple in Hwaseong. Typically situated in front of a temple’s main Buddha hall, these pavilions served as essential social and spiritual hubs during the Joseon era, hosting Buddhist rituals, lectures, and community gatherings. The KHS also officially promoted the 5-story stone pagodas of Bowonsa Temple and Gaesimsa Temple to National Treasures. Both structures represent the pinnacle of Goryeo-era (918–1392) masonry and had been classified as "Treasures" since 1963. 2025-12-19 14:30:57 -

PHOTOS: Annual lantern festival lights up Seoul SEOUL, December 19 (AJP) - Seoul's annual lantern festival has arrived at the perfect time, illuminating the city for the holy, jolly holiday season. Now in its 17th year, the festival runs until the first week of the coming year, featuring around 500 lanterns, along with illuminating displays and other festive decorations. Visitors can explore various installations along the Cheonggye Stream, stretching from Gwanghwamun in central Seoul to Dongdaemun Design Plaza (DDP) and parts of northern Seoul, under four different themes, showcasing the city's past, present and future. Among the highlights is a 73-meter-long installation featuring Magikarp, a piscine Pokémon with reddish-orange scales. A 15-meter-high, moon-themed installation can also be seen from bridges above the stream, accompanied by numerous structures and decorations inspired by animated characters. The nighttime festival, which kicked off on Dec. 12, runs until Jan. 4, transforming the capital into a magical winter wonderland with glittering lights and seasonal glows. 2025-12-19 14:24:10

PHOTOS: Annual lantern festival lights up Seoul SEOUL, December 19 (AJP) - Seoul's annual lantern festival has arrived at the perfect time, illuminating the city for the holy, jolly holiday season. Now in its 17th year, the festival runs until the first week of the coming year, featuring around 500 lanterns, along with illuminating displays and other festive decorations. Visitors can explore various installations along the Cheonggye Stream, stretching from Gwanghwamun in central Seoul to Dongdaemun Design Plaza (DDP) and parts of northern Seoul, under four different themes, showcasing the city's past, present and future. Among the highlights is a 73-meter-long installation featuring Magikarp, a piscine Pokémon with reddish-orange scales. A 15-meter-high, moon-themed installation can also be seen from bridges above the stream, accompanied by numerous structures and decorations inspired by animated characters. The nighttime festival, which kicked off on Dec. 12, runs until Jan. 4, transforming the capital into a magical winter wonderland with glittering lights and seasonal glows. 2025-12-19 14:24:10 -

SK Signet to raise 30 billion won to expand global EV charger business SEOUL, December 19 (AJP) - EV charger maker SK Signet said on Friday its board had approved a third-party share sale worth about 30 billion won, with parent company SK Inc. set to participate in the offering. The company said the proceeds will be used to expand production infrastructure to support global growth and to strengthen product competitiveness. SK Signet plans to gradually increase capacity and improve operating efficiency centered on its production base in Texas, while accelerating research and development to broaden its lineup of high-power, ultra-fast chargers. The company also aims to secure key raw materials in advance and reinforce its global supply chain, it said. SK Signet said participation in the U.S. government’s National Electric Vehicle Infrastructure (NEVI) program is expected to lift revenue in the coming years. In 2023, the company established a local manufacturing plant in Plano, Texas, and secured key permits, laying the groundwork for entry into the NEVI market. Through exclusive supply contracts with U.S. charging point operators including Francis Energy and Gilbarco, SK Signet said it is currently the only South Korean manufacturer participating in the NEVI program. Looking beyond North America, SK Signet said it plans to gradually expand its business footprint into Europe, South America and Oceania. CEO Cho Hyung-ki said in a press release that the company will leverage favorable market momentum, including the resumption of the NEVI program, to further strengthen its technology and quality competitiveness, while positioning itself as a leading global provider of end-to-end EV charging solutions. 2025-12-19 14:08:06

SK Signet to raise 30 billion won to expand global EV charger business SEOUL, December 19 (AJP) - EV charger maker SK Signet said on Friday its board had approved a third-party share sale worth about 30 billion won, with parent company SK Inc. set to participate in the offering. The company said the proceeds will be used to expand production infrastructure to support global growth and to strengthen product competitiveness. SK Signet plans to gradually increase capacity and improve operating efficiency centered on its production base in Texas, while accelerating research and development to broaden its lineup of high-power, ultra-fast chargers. The company also aims to secure key raw materials in advance and reinforce its global supply chain, it said. SK Signet said participation in the U.S. government’s National Electric Vehicle Infrastructure (NEVI) program is expected to lift revenue in the coming years. In 2023, the company established a local manufacturing plant in Plano, Texas, and secured key permits, laying the groundwork for entry into the NEVI market. Through exclusive supply contracts with U.S. charging point operators including Francis Energy and Gilbarco, SK Signet said it is currently the only South Korean manufacturer participating in the NEVI program. Looking beyond North America, SK Signet said it plans to gradually expand its business footprint into Europe, South America and Oceania. CEO Cho Hyung-ki said in a press release that the company will leverage favorable market momentum, including the resumption of the NEVI program, to further strengthen its technology and quality competitiveness, while positioning itself as a leading global provider of end-to-end EV charging solutions. 2025-12-19 14:08:06 -

Samsung unveils Exynos 2600 chip, expected to power Galaxy S26 series SEOUL, December 19 (AJP) - Samsung Electronics on Friday unveiled its Exynos 2600 mobile application processor, a chip widely expected to power the company’s next flagship Galaxy smartphone lineup, set for release early next year. According to Samsung Electronics’ website, the Exynos 2600 was designed by Samsung’s System LSI Business and manufactured by Samsung Foundry, both part of the company’s Device Solutions (DS) division. The chip is produced using a 2-nanometer process incorporating gate-all-around (GAA) transistor technology. An application processor serves as the primary computing chip in smartphones, handling tasks ranging from system operations to artificial intelligence workloads. Industry watchers view the Exynos 2600 as a likely candidate for the Galaxy S26 series, although Samsung has not formally confirmed this. Samsung lists the Exynos 2600’s status as “mass production” on its website, a designation generally interpreted as indicating that manufacturing yields have reached a level suitable for large-scale output. The company said the Exynos 2600 is the first mobile system-on-a-chip in the industry to incorporate a heat pass block, a technology designed to reduce thermal resistance by up to 16 percent and maintain stable internal temperatures under heavy workloads. Built on the latest Arm architecture, the deca-core central processing unit delivers up to 39 percent higher computing performance compared with its predecessor, the Exynos 2500, Samsung officials said. The chip also features a more powerful neural processing unit, boosting generative artificial intelligence performance by 113 percent. 2025-12-19 13:53:06

Samsung unveils Exynos 2600 chip, expected to power Galaxy S26 series SEOUL, December 19 (AJP) - Samsung Electronics on Friday unveiled its Exynos 2600 mobile application processor, a chip widely expected to power the company’s next flagship Galaxy smartphone lineup, set for release early next year. According to Samsung Electronics’ website, the Exynos 2600 was designed by Samsung’s System LSI Business and manufactured by Samsung Foundry, both part of the company’s Device Solutions (DS) division. The chip is produced using a 2-nanometer process incorporating gate-all-around (GAA) transistor technology. An application processor serves as the primary computing chip in smartphones, handling tasks ranging from system operations to artificial intelligence workloads. Industry watchers view the Exynos 2600 as a likely candidate for the Galaxy S26 series, although Samsung has not formally confirmed this. Samsung lists the Exynos 2600’s status as “mass production” on its website, a designation generally interpreted as indicating that manufacturing yields have reached a level suitable for large-scale output. The company said the Exynos 2600 is the first mobile system-on-a-chip in the industry to incorporate a heat pass block, a technology designed to reduce thermal resistance by up to 16 percent and maintain stable internal temperatures under heavy workloads. Built on the latest Arm architecture, the deca-core central processing unit delivers up to 39 percent higher computing performance compared with its predecessor, the Exynos 2500, Samsung officials said. The chip also features a more powerful neural processing unit, boosting generative artificial intelligence performance by 113 percent. 2025-12-19 13:53:06 -

Asian markets in modest gains Friday ahead of BOJ rate decision SEOUL, December 19 (AJP) - Asian equity markets were moderately up early Friday as they await the rate decision from the Bank of Japan. In South Korea, the KOSPI was trading 0.4 percent up at 4,011 as of 10:30 a.m., retracing some of its earlier gains after rebounding 1 percent to track overnight Wall Street rise. Institutional investors led the buying with net purchases of 94 billion won, while retail investors added 33.8 billion won ($23 million). Conversely, foreign investors remained net sellers, offloading 117 billion won. The Korean won traded at 1,478.6 per dollar, down 2.1 won from the previous session. Concerns over potential volatility is looming in the morning session on the best on a rate hike in Japan. Leading stocks showed a marked divergence. Samsung Electronics fell 0.9 percent to 106,600 won amid concerns over increasing competition from Chinese DRAM producers. However, SK hynix gained 1.5 percent to 560,000 won, as its strategic focus on high-bandwidth memory (HBM) and cutting-edge chips continued to draw investor interest. The secondary battery sector remained under pressure. LG Energy Solution dropped 2.7 percent to 368,000 won, and Samsung SDI shed 1.8 percent to 272,000 won. SK Innovation, the parent of SK On, was also trading 1.35 percent lower at 103,400 won. The Hyundai Motor Group saw mixed results. Hyundai Motor and Kia fell 0.9 percent and 1.5 percent respectively, while Hyundai AutoEver, viewed as a key player in the group's transition to Software-Defined Vehicles (SDV), jumped 2.5 percent to 264,000 won. In the shipbuilding sector, Hanwha Ocean surged 4.7 percent to 108,500 won after announcing a 2.6 trillion won contract to build seven LNG carriers before the market open. The junior KOSDAQ was up 0.5 percent at 906. New listing Rznomics, an RNA-editing drug developer, hit its daily limit, trading at 117,000 won—a 30 percent jump from its IPO price. Satellite solution startup Nara Space Technology extended its rally, climbing 20.7 percent to 37,650 won in its second day of trading. In Tokyo, the Nikkei 225 rose 0.9 percent to 49,430, tracking overnight gains in the U.S. market. Toyota spearheaded the advance, gaining 1.8 percent to 3,425 yen ($22). Honda, however, remained flat at 1,544 yen due to ongoing supply chain issues and recall concerns in the U.S. Japanese semiconductor shares tracked their U.S. peers higher. Ibiden gained 3 percent, Tokyo Electron rose 2.8 percent, and Advantest was up 1.5 percent. Taiwan’s TAIEX advanced 1.3 percent to 27,820, with TSMC leading the charge, up 1.75 percent to 1,455 Taiwan dollars ($46.1). Mainland China markets remained largely flat as investors moved into a wait-and-watch mode ahead of the BOJ decision. The Shanghai Composite was little changed at 3,878, while the Hang Seng Index and Shenzhen Component edged up 0.2 percent and 0.3 percent respectively. 2025-12-19 11:18:04

Asian markets in modest gains Friday ahead of BOJ rate decision SEOUL, December 19 (AJP) - Asian equity markets were moderately up early Friday as they await the rate decision from the Bank of Japan. In South Korea, the KOSPI was trading 0.4 percent up at 4,011 as of 10:30 a.m., retracing some of its earlier gains after rebounding 1 percent to track overnight Wall Street rise. Institutional investors led the buying with net purchases of 94 billion won, while retail investors added 33.8 billion won ($23 million). Conversely, foreign investors remained net sellers, offloading 117 billion won. The Korean won traded at 1,478.6 per dollar, down 2.1 won from the previous session. Concerns over potential volatility is looming in the morning session on the best on a rate hike in Japan. Leading stocks showed a marked divergence. Samsung Electronics fell 0.9 percent to 106,600 won amid concerns over increasing competition from Chinese DRAM producers. However, SK hynix gained 1.5 percent to 560,000 won, as its strategic focus on high-bandwidth memory (HBM) and cutting-edge chips continued to draw investor interest. The secondary battery sector remained under pressure. LG Energy Solution dropped 2.7 percent to 368,000 won, and Samsung SDI shed 1.8 percent to 272,000 won. SK Innovation, the parent of SK On, was also trading 1.35 percent lower at 103,400 won. The Hyundai Motor Group saw mixed results. Hyundai Motor and Kia fell 0.9 percent and 1.5 percent respectively, while Hyundai AutoEver, viewed as a key player in the group's transition to Software-Defined Vehicles (SDV), jumped 2.5 percent to 264,000 won. In the shipbuilding sector, Hanwha Ocean surged 4.7 percent to 108,500 won after announcing a 2.6 trillion won contract to build seven LNG carriers before the market open. The junior KOSDAQ was up 0.5 percent at 906. New listing Rznomics, an RNA-editing drug developer, hit its daily limit, trading at 117,000 won—a 30 percent jump from its IPO price. Satellite solution startup Nara Space Technology extended its rally, climbing 20.7 percent to 37,650 won in its second day of trading. In Tokyo, the Nikkei 225 rose 0.9 percent to 49,430, tracking overnight gains in the U.S. market. Toyota spearheaded the advance, gaining 1.8 percent to 3,425 yen ($22). Honda, however, remained flat at 1,544 yen due to ongoing supply chain issues and recall concerns in the U.S. Japanese semiconductor shares tracked their U.S. peers higher. Ibiden gained 3 percent, Tokyo Electron rose 2.8 percent, and Advantest was up 1.5 percent. Taiwan’s TAIEX advanced 1.3 percent to 27,820, with TSMC leading the charge, up 1.75 percent to 1,455 Taiwan dollars ($46.1). Mainland China markets remained largely flat as investors moved into a wait-and-watch mode ahead of the BOJ decision. The Shanghai Composite was little changed at 3,878, while the Hang Seng Index and Shenzhen Component edged up 0.2 percent and 0.3 percent respectively. 2025-12-19 11:18:04