SEOUL, July 23 (AJP) - BYD, the Chinese electric vehicle manufacturer that began as a modest battery startup three decades ago, reported record revenue of 777.1 billion yuan ($107 billion) for 2024, overtaking Tesla’s $97.7 billion.

The milestone comes as BYD sold 4.27 million new energy vehicles last year — a 41 percent jump from 2023 — making it the world’s fourth-largest automaker by volume. The achievement marks a stunning ascent for a company founded in 1995 with just 20 employees in the southern Chinese city of Shenzhen.

That company, started by 29-year-old chemical engineer Wang Chuanfu, initially made rechargeable batteries to undercut expensive Japanese nickel-cadmium cells.

BYD — short for “Build Your Dreams” — entered the automotive industry in 2003 with the acquisition of a struggling local carmaker, setting the stage for Wang’s long-term vision of integrating battery technology into the future of transportation.

At the time, the notion of electric cars as a mainstream product was far-fetched. But Wang’s strategy gained critical validation in 2008 when Warren Buffett’s Berkshire Hathaway bought a 9.89 percent stake for $230 million.

The deal, encouraged by Buffett’s longtime partner Charlie Munger, gave BYD a credibility boost during the global financial crisis and helped accelerate its EV ambitions. As of mid-2024, Berkshire still held a 6.9 percent stake, despite gradually reducing its position amid soaring share prices.

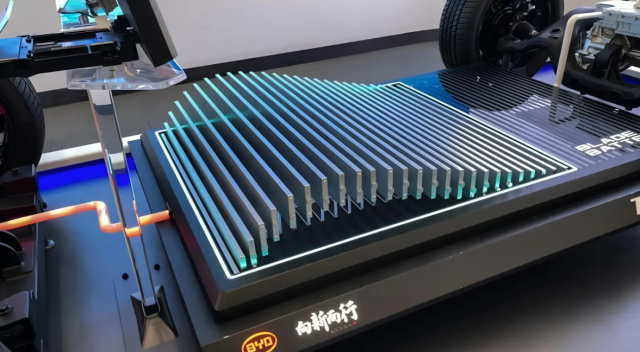

A key technological leap came in 2020 with the introduction of the company’s Blade Battery, a lithium iron phosphate design known for its high energy density, safety, and low cost.

Produced by BYD’s battery arm, FinDreams, the Blade Battery became a defining feature of the company’s competitive edge, allowing it to offer EVs at significantly lower prices without compromising on quality.

That technological self-sufficiency is central to BYD’s model. About 75 percent of its vehicle components — from semiconductors to electric motors — are produced in-house. The company operates more than 30 industrial parks globally and employs over 900,000 people, making it China’s largest private-sector employer after several state-owned enterprises.

The numbers reflect the scale of its success. BYD’s net profit for 2024 surged 34 percent to 40.25 billion yuan, with cash reserves reaching a record 154.9 billion yuan. Interest-bearing debt, meanwhile, fell to just 4.9 percent of total liabilities — one of the lowest ratios in the global auto industry. The company’s R&D spending also rose sharply, reaching 54.2 billion yuan, exceeding its annual profit by more than a third.

BYD’s product lineup is as diversified as it is expansive. The Dynasty series, with bestsellers like the Han sedan and Tang SUV, targets mass-market consumers.

The Ocean line — including the Dolphin hatchback and Seal sedan — caters to younger drivers. At the higher end, Denza, Yangwang, and Fangchengbao serve the luxury and off-road markets, with prices ranging from under $10,000 to over $100,000.

Globally, BYD has become a formidable rival to Tesla.

In the first half of 2024, it captured 21 percent of global EV sales, nearly double Tesla’s 11 percent. BYD produced 1.78 million fully electric vehicles last year, slightly edging out Tesla’s 1.77 million. In the final quarter of 2024, it outsold Tesla by 100,000 vehicles, intensifying the race for market leadership.

International sales are growing rapidly.

Overseas deliveries rose 72 percent to 417,204 vehicles last year, generating more than 220 billion yuan in revenue. BYD now operates or is building manufacturing plants in Thailand, Indonesia, Brazil, Hungary, Turkey, and Mexico — part of a strategy to reduce logistics costs, bypass trade restrictions, and localize production.

Europe has become a critical proving ground. The company sponsored the 2024 UEFA European Football Championship and launched advertising campaigns across the continent.

With compact EV models and rapid-charging technologies, BYD is positioning itself to challenge legacy players like Volkswagen and BMW.

But it faces headwinds, including the European Union’s potential tariffs on Chinese-made EVs, which could complicate pricing strategies in an already competitive market.

BYD’s ambitions go well beyond transportation. It has become a comprehensive clean energy provider, manufacturing solar panels and large-scale energy storage systems. This diversification leverages its battery expertise while reducing reliance on vehicle sales.

Research and innovation remain at the heart of BYD’s growth engine. The company employs more than 104,000 R&D workers and holds over 48,000 patents.

Its latest breakthrough, the Super e-Platform, claims to deliver 400 kilometers of range with just five minutes of charging — double the peak speed of Tesla’s current Supercharger network.

Still, challenges loom. BYD has set an ambitious target of 5 to 6 million vehicle sales in 2025. But intensifying competition from both legacy automakers and startups, potential trade friction, and the need to maintain margins while scaling globally could test the company’s resilience.

Yet few companies have upended a global industry so quickly or so decisively.

From a modest factory floor in Shenzhen to the top of the world’s EV rankings, BYD is no longer just building its dreams — it’s driving them.

Copyright ⓒ Aju Press All rights reserved.