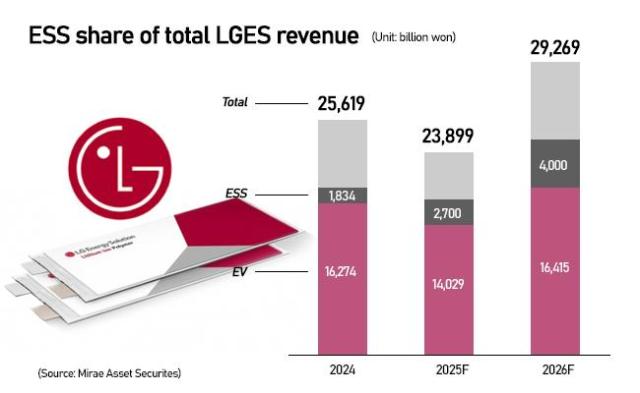

LGES, the country’s top battery producer, has been betting heavily on ESS to offset a slowdown in electric vehicle demand. According to Mirae Asset Securities, its ESS revenue is expected to reach 2.7 trillion won ($2.0 billion) in fiscal 2025, accounting for 11.3 percent of total sales, up from 7.15 percent last year. The shift underscores how reliant the company has become on storage projects, making the latest fire especially sensitive for both investors and policymakers.

The company has already been struggling. Consolidated revenue slid 24 percent year-on-year to 25.6 trillion won in 2024, with operating profit plunging 74 percent. While LGES does not disclose detailed ESS revenue, it cited “substantial growth from grid-scale projects” in its Q3 2024 earnings and has pinned high hopes on storage to shore up profits amid weakening EV demand.

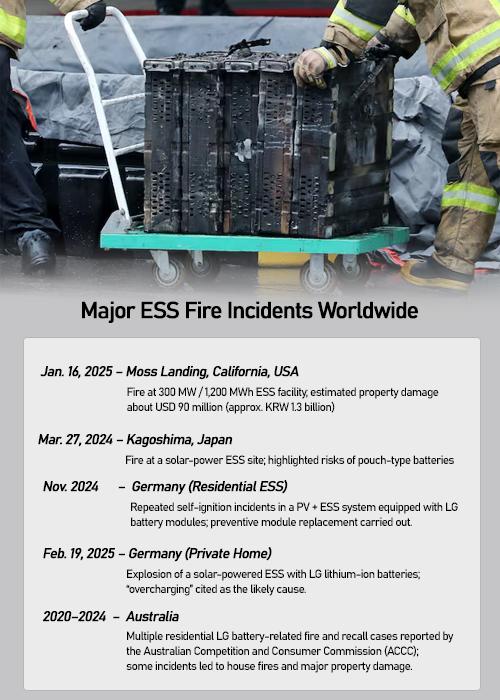

The business, however, remains fraught with safety concerns. In January 2025, a blaze ripped through the 300-megawatt Moss Landing facility in California—once the world’s largest storage site—equipped with LG’s nickel manganese cobalt cells. Operator Vistra Corp wrote down $400 million in losses.

In Europe, two German residential fires raised alarms. A November 2024 basement fire in Werne involving an LGES module led to precautionary replacements in 77 homes. In February 2025, an explosion in Schönberg destroyed part of a newly built home. In Australia, regulators have tracked multiple home-battery fires and recalls since 2020, affecting around 18,000 units, with 15 incidents causing property damage.

While not all incidents were conclusively tied to LG cells, the repeated accidents have intensified scrutiny of the company’s technology and manufacturing standards.

"In automotive battery packs, we design systems to prevent domino-effect failures by containing thermal runaway to one or two cells," said Kim Jin-yong, a mechanical engineering professor at Hanyang University ERICA. "ESS manufacturers need to develop similar safety-focused designs, including thermal insulation between batteries, to prevent these recurring accidents."

Global ESS installations, however, are still set to accelerate. BloombergNEF forecasts annual additions will reach 94 gigawatts and 247 gigawatt-hours in 2025, growing at a 14.7 percent compound rate through 2035.

“Such high-profile accidents are unlikely to derail ESS growth, but what matters is how operators manage the risk,” said Han Byung-hwa, senior analyst at Eugene Investment & Securities. “There is no alternative to ESS today. The challenge is rapid detection, containment, and revenue protection through tools like AI-based monitoring.”

Competition is also intensifying. Chinese producers, which dominate in lithium iron phosphate (LFP) cells—cheaper and considered safer than nickel-based chemistries—are quickly capturing share in stationary storage. Samsung SDI and SK On, also pivoting toward ESS to offset sluggish EV sales, face similar headwinds.

LGES stressed that maintenance and replacement of the government’s UPS battery were the operator’s responsibility, adding that it continues to strengthen safety protocols. “We have no further comment as we only supplied the battery pack to CNS, the contractor responsible for the installation,” an LGES official said.

The latest fire—three years after the 2022 “Kakao blackout” spurred calls for stronger safeguards—has reignited debate over whether Korea’s ESS ambitions can advance without renewed focus on safety and redundant backup systems.

Copyright ⓒ Aju Press All rights reserved.