SEOUL, October 27 (AJP) - Samsung Heavy Industries surged Monday to a new 52-week high on multiple catalysts — the successful domestication of its liquefied natural gas (LNG) storage-tank technology, speculation over a possible visit by U.S. President Donald Trump to its shipyard during APEC 2025, and a string of new orders.

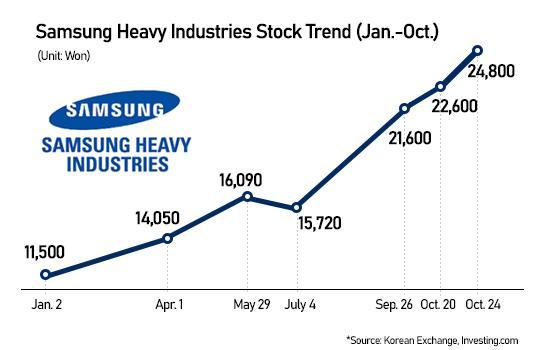

Shares of Samsung Heavy jumped about 16 percent to 28,800 won ($20.1) as of 3 p.m., nearly tripling from roughly 11,000 won at the start of the year.

The rally followed the company’s announcement Monday morning that its first vessel equipped with the independently developed KC-2C liquefied LNG storage-tank system had completed a successful trial voyage. Until now, Korean LNG carriers had relied on the membrane-type containment systems exclusively licensed by France’s Gaztransport & Technigaz (GTT), forcing domestic shipbuilders to pay substantial royalties.

According to Democratic Party lawmaker Kim Jung-ho, Korean shipbuilders paid a total of about 7.4 trillion won in royalties to GTT between 1995 and this year. Samsung Heavy’s KC-2C design is reportedly comparable to GTT’s membrane system but more efficient in both construction and operation — and, crucially, free from costly licensing fees.

Investor sentiment was also lifted by a swelling orderbook. U.S. LNG company Delfin Midstream has chosen Samsung Heavy as contractor for its first floating liquefied natural gas (FLNG) production unit off the coast of Louisiana, with the second and third units expected to follow. FLNG facilities extract and liquefy gas at sea before loading it directly onto tankers — a technically demanding process requiring advanced offshore-engineering capabilities. The deal marks a major turning point for Samsung Heavy’s offshore-plant division, which has logged more than 1 trillion won in losses in recent years.

The builder also secured a major FLNG order from Italy’s ENI Coral in July for a project in Mozambique, putting it close to meeting its annual order target. Should Delfin proceed with two more plants, the company is likely to achieve the target in full.

Momentum is also returning to the container segment. Taiwan’s Evergreen Marine last week placed an order for seven container vessels — a welcome boost in a market where Chinese shipyards still command more than 70 percent of global capacity.

According to IBK Securities analyst Oh Ji-hoon, Samsung Heavy’s third-quarter consolidated operating profit is expected to reach 120 billion won, up roughly 58 percent from a year earlier. “If the company secures the remaining FLNG and LNG contracts, it should comfortably hit its annual targets, with offshore-plant revenue leading the earnings improvement,” Oh said.

Speculation that President Donald Trump may visit a Korean shipyard during his APEC tour further buoyed the sector. As of 3 p.m., HD Hyundai Heavy Industries rose 4.6 percent to 620,000 won, while Hanwha Ocean gained 3.3 percent to 139,500 won. Nam Chae-min, a researcher at Korea Investment & Securities, said Samsung Heavy “outlined multiple collaboration plans with U.S. shipowners during a recent conference call,” adding that a Trump visit could accelerate discussions on the MASGA Project, a proposed maritime-technology partnership between the two nations.

Copyright ⓒ Aju Press All rights reserved.