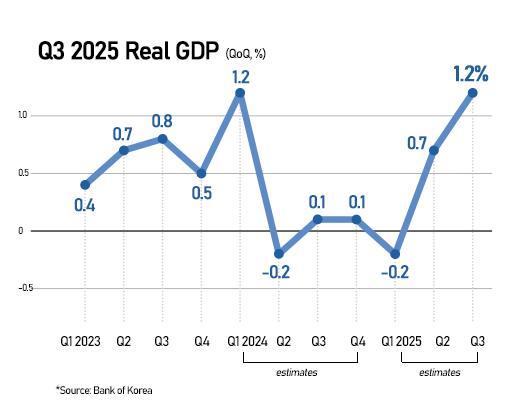

Seoul, October 28 (AJP) -South Korea’s economy grew faster than expected in the third quarter, expanding 1.2 percent on quarter on the back of a rebound in capital investment and a modest recovery in consumer spending, according to preliminary data from the Bank of Korea on Tuesday.

The stronger-than-expected growth — up from 0.7 percent in the second quarter and following a 0.2 percent contraction in the first — was largely driven by renewed capital spending in semiconductors and shipbuilding, alongside higher household consumption supported by two rounds of government stimulus vouchers.

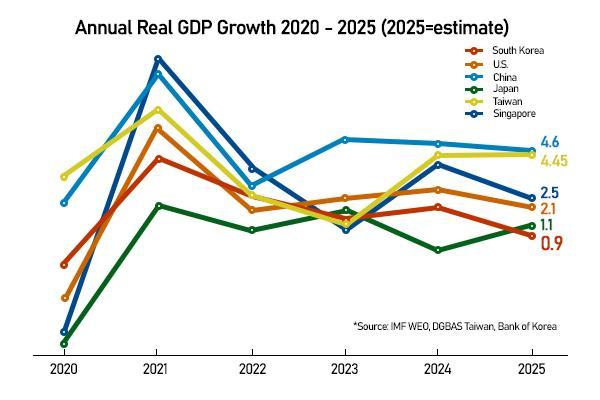

On year-on-year basis, GDP grew 1.7 percent, compared with 0.6 percent in the second quarter and zero growth in the first, keeping the country on track to meet the central bank's 0.9 percent annual growth target for 2025.

Consumer spending rose 1.3 percent, accelerating from a 0.5 percent gain in the previous quarter, while capital investment jumped 2.4 percent, reversing from contractions of 2.1 percent and 0.4 percent in the second and first quarters, respectively.

Exports increased 1.5 percent, slowing from a 4.5 percent gain in the second quarter, reflecting how record outbound shipments were concentrated in chips while other items faced headwinds from renewed U.S. tariff measures.

The better-than-expected GDP headline number was broadly ignored by the financial markets as they looked forward. The KOSPI retreated 1 percent in early Tuesday session as institutions took profit after a near 10-percent surge from an almost uninterrupted two-week rally. The Korean won slipped 1.4 versus the U.S. dollar to 1,434.9.

The fourth-quarter outlook remains jittery as concerns over housing market and trade uncertainties weighed over consumer and business confidence.

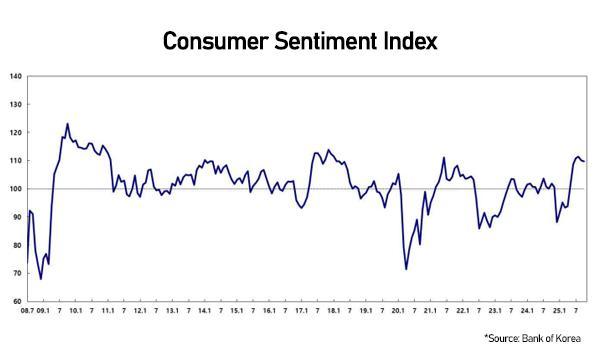

The Composite Consumer Sentiment Index for October edged down 0.3 points to 109.8, signaling softer optimism as worries mount over high home prices and fragile trade conditions, according to BOK's separate release on Tuesday.

While most sub-indices stayed stable — current living conditions at 96, living-conditions outlook at 100, household income outlook at 102, and spending outlook at 110 — the future economic outlook fell three points to 94.

“The prolonged South Korea–U.S. trade negotiations and renewed U.S.–China tensions have dampened overall sentiment,” said Lee Hye-young, head of the Bank’s economic sentiment survey team.

The housing price outlook index was up 10 points to 122, the highest since October 2021, amid steep apartment gains in the Seoul metropolitan area. The interest-rate outlook rose two points to 95, reflecting concerns about exchange-rate volatility and real-estate inflation.

Expected inflation for the next year ticked up 0.1 percentage point to 2.6 percent, while perceived inflation over the past year remained unchanged at 3.0 percent.

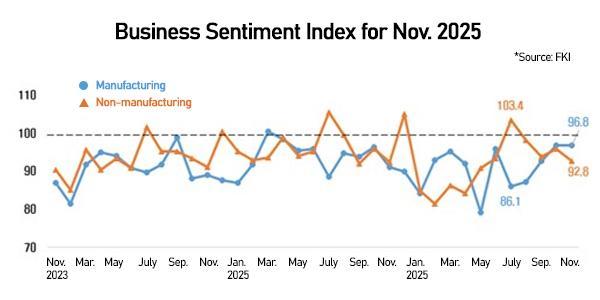

Corporate sentiment also remained downbeat.

The Business Sentiment Index for November, released by the Federation of Korean Industries, came in at 94.8, marking the 44th consecutive month below the neutral 100 threshold since April 2022. Manufacturing sentiment at 96.8 stayed flat, while non-manufacturing at 92.8 fell three points, pulling down the overall index.

Within manufacturing, general machinery and equipment at 120.0 and textiles and apparel at 107.1 showed upbeat expectations, while food and beverages and automobiles were neutral at 100. Sectors such as pharmaceuticals projected further declines. Among service sectors, information and communications at 112.5, professional services at 106.7, and utilities at 105.3 maintained positive outlooks, but transportation and warehousing at 80.8 dragged overall sentiment lower.

“Increased foreign exchange volatility and global supply chain instability are aggravating business difficulties,” said Lee Sang-ho, head of the FKI’s economic and industrial division.

Regardless of the relief in the third quarter, Korea is expected to end the year at its weakest growth since the pandemic outbreak year and perform worst among key Asian players.

Copyright ⓒ Aju Press All rights reserved.