SEOUL, October 28 (AJP) - Seoul and Tokyo exchanges shed their longstanding labels of "Korea bargain" and "lost decades" this year, emerging as the world's two best-performing markets as global capital rotates out of an overheated U.S. equity space and into Asia's two technology powerhouses.

According to Japan's Ministry of Finance, foreign investors bought ¥7.53 trillion ($49.9 billion) worth of Japanese equities in the week ending Oct. 18 — one of the largest weekly inflows this year. Cumulative net foreign purchases since January have reached ¥52.8 trillion ($349 billion), more than double the amount recorded a year earlier.

The rally has pushed Japan's Nikkei 225 above the 50,000-point threshold for the first time, buoyed by a weaker yen, expectations of additional stimulus by the new pro-growth prime minister, and the Bank of Japan's ultra-loose monetary stance. The Nikkei has risen around 30 percent year-to-date, based on gains from the first trading day of 2025.

Corporate reforms have further bolstered sentiment. Since the Tokyo Stock Exchange launched its capital-efficiency program in 2023, listed firms have markedly increased dividends and buybacks. Corporate repurchases topped ¥10 trillion ($66 billion) in 2024 — an all-time high.

Korea, long snubbed and left out of last year's global rally, is also enjoying a breakout year. The benchmark KOSPI has surged nearly 70 percent, briefly crossing the 4,000 mark for the first time in its history.

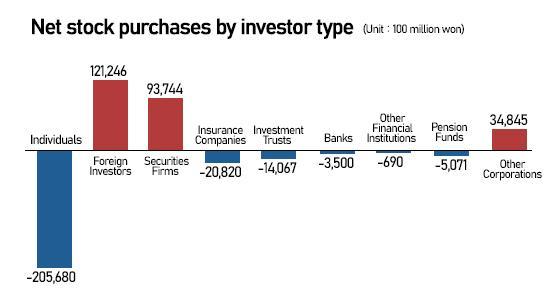

Foreign investors have been the main engine behind the rally. Data from the Bank of Korea and the Financial Supervisory Service show they purchased $4.34 billion of Korean equities in September — the largest monthly inflow in 19 months.

According to KRX, foreign net buying reached ₩5.6 trillion ($4 billion) from Sept. 26 to Monday in KOSPI shares, suggesting a still-hot buying spree.

By end-September, foreign holdings of listed Korean shares reached ₩1,014.6 trillion ($714 billion), representing 28.7 percent of total market capitalization — the highest proportion since 2022 and up from 27.5 percent a month earlier.

Most of the buying was concentrated in semiconductor and AI-related names such as Samsung Electronics and SK hynix, which continue to benefit from a rebound in global chip demand. Net foreign purchases reached ₩6.28 trillion ($4.5 billion) in July, the strongest in more than a year.

The eastward shift reflects a broader global portfolio reallocation. With U.S. stocks trading at stretched valuations and the dollar softening, investors are seeking more attractive pricing and stronger structural growth in Asia. LSEG Lipper data show that non-U.S. equity funds attracted $13.6 billion in July — the most in over four years.

The International Monetary Fund projects that about 70 percent of global economic growth in 2025 will come from Asia, underscoring the region's increasing weight in the world economy.

Near-zero interest rates in Japan and Korea's dovish 2.5 percent policy rate, coupled with weaker exchange rates, have also made their assets more attractive relative to the U.S., where average market yields hover around 4 percent.

Copyright ⓒ Aju Press All rights reserved.