SEOUL, October 29 (AJP) - Korea's relatively young pharma heavyweights Samsung Biologics and Celltrion are outgrowing their older peers at home and abroad through aggressive and unconventional expansion.

Samsung Biologics, founded in 2011, has scaled up relentlessly and now ranks No. 3 in the global contract development and manufacturing organization (CDMO) market. Within its second Bio Campus in Songdo, Incheon, the Samsung Group unit plans to complete Plants 6 to 8 by 2032, raising total capacity to 1.324 million liters — the largest for any single company worldwide.

The massive scale is expected to give Samsung Biologics a structural edge in securing long-term production contracts with multinational drugmakers and position it as an industry power rivaling Samsung’s influence in semiconductors.

Celltrion, established in 2002 as a pure drug maker, is expanding through M&A. It recently joined the small group of Korean pharma companies with production bases in the United States, which accounts for roughly half of prescription-drug sales revenue among OECD countries.

Last month, Celltrion signed a deal to acquire Eli Lilly's biopharmaceutical manufacturing plant in Branchburg, New Jersey, for about 460 billion won. With planned expansion, total investment is expected to reach 1.4 trillion won — a move designed to reduce tariff risks, cut logistics costs, and strengthen supply-chain stability for North American demand.

Their bold expansion rests on a solid bottom line and deep pipelines.

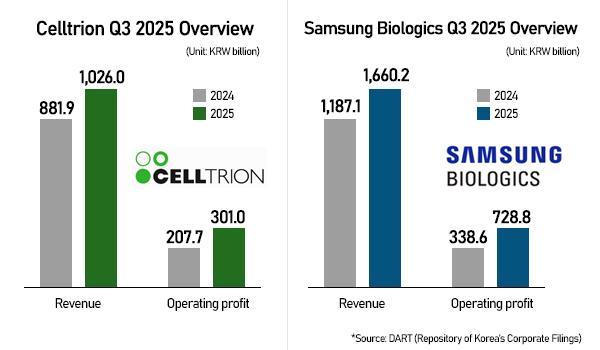

Samsung Biologics on Tuesday reported consolidated revenue of 1.66 trillion won ($1.2 billion) and operating profit of 728.8 billion won for the third quarter, up 39.9 percent and 115.3 percent on year, respectively.

Celltrion posted consolidated revenue of 1.26 trillion won and operating profit of 301 billion won, marking year-on-year gains of 16.3 percent and 44.9 percent.

Samsung Biologics has climbed to the No. 3 global CMO position behind Switzerland's Lonza and China's WuXi Biologics, according to MarketsandMarkets. The CMO market is projected to grow 8.8 percent annually, reaching $34.1 billion by 2030 from $20.5 billion in 2024.

Copyright ⓒ Aju Press All rights reserved.