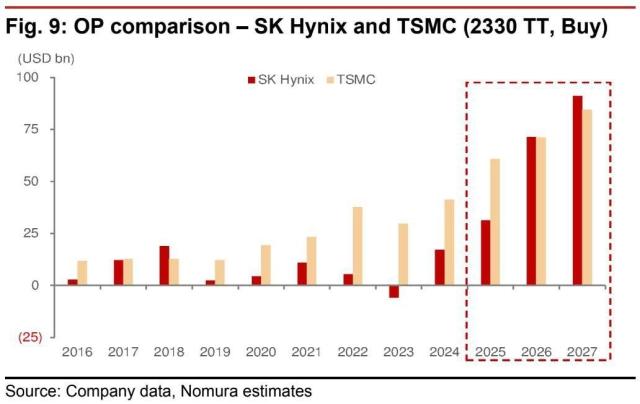

SEOUL, November 02 (AJP) - SK hynix can outshine dominant pure-play foundry Taiwan Semiconductor Manufacturing Co. (TSMC) in income from chip sales by 2027, placing the South Korean leader in AI memory the biggest winner of the chip "super cycle" that is expected to run at least two more years, according to Japanese investment bank Nomura Securities.

SK hynix has already been stellar among memory makers, reporting a record operating profit of $8 billion in the third quarter, and plans to significantly increase capital spending next year to meet with growing demand for its proprietary high bandwidth memory (HBM) chips as well as other advanced memory for servers.

Nomura raised its target price for the company to 840,000 won from 540,000 won, a jump of more than 55 percent — the most optimistic forecast among both domestic and global brokerages. SK hynix finished last Friday at 559,000 won after testing new high near 570,000 won on the previous day, more than tripling from its humble closing of 171,200 on the first trading day of 2025.

Among Korean firms, Heungkuk Securities currently holds the highest target at 750,000 won among local firms, followed by KB Securities and Shinhan Securities at 730,000 won, and NH Investment & Securities at 710,000 won. JPMorgan last month raised its own target price from 460,000 won to 650,000 won.

“Super-cycle to continue through 2027F, growing to an unprecedented revenue level due to limited supply expansion until 2027F,” Nomura wrote in its latest report released on Sunday.

The brokerage expects the super-cycle that began in 2023 to continue through 2027, as tight cleanroom capacity and long construction lead times are likely to limit supply expansion until mid-2027. Industry-wide output acceleration, Nomura said, is expected to begin only in late 2027, driving revenue to record levels.

Reflecting this outlook, Nomura lifted SK hynix’s operating profit forecasts to 99 trillion won for 2026 and 128 trillion won for 2027, representing increases of 38 percent and 46 percent, respectively. The 2027 projection would make SK hynix the most profitable chipmaker, ahead of TSMC.

The report pointed to explosive demand not only for AI servers but also for traditional cloud servers equipped with AI inference capabilities, pushing up prices for HBM as well as general-purpose DRAM and NAND (SSD) chips. Nomura also raised its 2026 price growth outlook for DRAM and NAND to 57 percent and 65 percent, respectively, from 38 percent and 36 percent.

Meanwhile, SK hynix has already secured customer orders through next year for all DRAM and NAND products amid surging AI-related demand. The company has also completed HBM supply agreements with key clients including NVIDIA, paving the way for faster shipments.

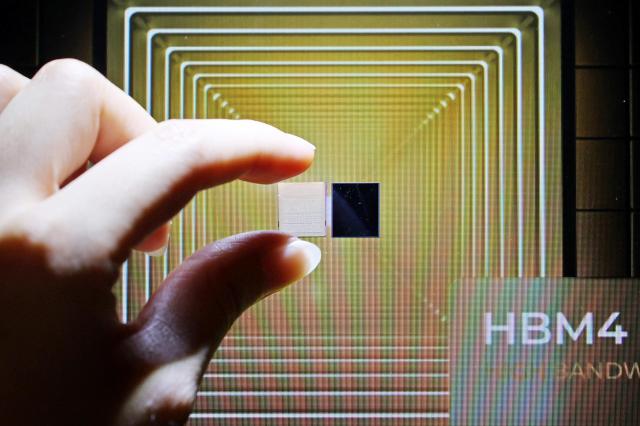

The firm’s sixth-generation HBM4, developed in September and now in mass production, fully meets performance requirements and supports industry-leading speeds. It plans to begin shipping the chip in the fourth quarter and to expand full-scale sales in 2026.

Copyright ⓒ Aju Press All rights reserved.