SEOUL, October 29 (AJP) - SK hynix plans to “significantly” ramp up facility investment next year after reporting a milestone operating profit of $8 billion in the third quarter, reinforcing its ambition to stay at the forefront of the global AI transition and ride what it calls an “unprecedented super cycle.”

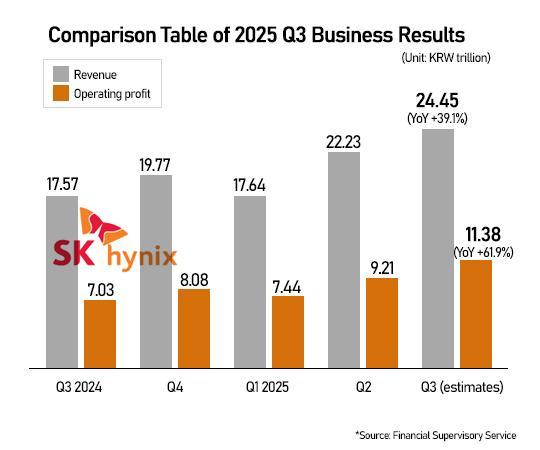

The Korean memory giant on Wednesday reported an operating profit of 11.38 trillion won ($7.9 billion) for the July–September period, up 62 percent from a year earlier and 24 percent from the previous quarter. Revenue rose 39 percent on year and 10 percent on quarter to 24.45 trillion won, underscoring its strengthened dominance in high-performance memory for AI servers and data centers.

Operating margin as the result was as high as 47 percent, increased from 41 percent in the previous quarter to suggest widened lead over Samsung Electronics, whose decades-long No. 1 status in memory has been overtaken this year.

Shares of SK hynix rose 5 percent and touched a record 547,000 won in Wednesday’s session as investors cheered the company’s robust outlook for the current chip boom.

“The biggest difference is the scope of demand,” he said during a conference call. “AI is creating entirely new application sources—from servers to self-driving vehicles—resulting in structurally constrained supply under explosive demand.” He dismissed speculation that the upcycle may fizzle out in its second year as typically done in the past rounds.

The profit windfall boosted cash on hand to 27.9 trillion won as of end-September, with cash-equivalent assets up 10.9 trillion won from June. Net cash reached 3.8 trillion won while total debt stayed steady at 24.1 trillion won.

The balance sheet resilience gives SK hynix "sufficient" room to push forward capacity expansion, Kim said, adding that next year's capex will rise “considerably” from this year— without specifying figures.

SK hynix had earlier guided 29 trillion won in 2025 capex, 62 percent higher than 2024.

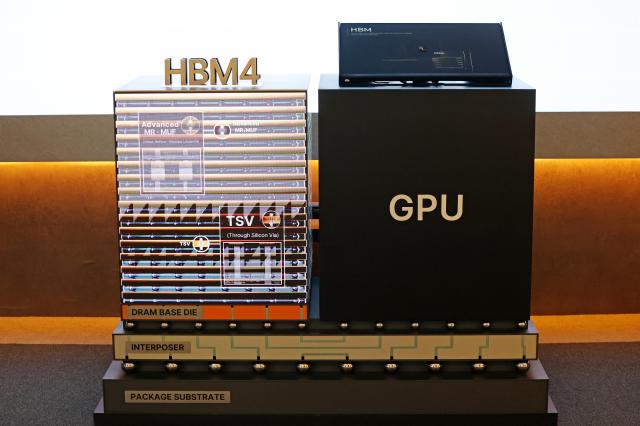

SK hynix’s leap to the top of the global memory market stems from its early and aggressive bet on HBM, a high-bandwidth memory used in premium servers and AI systems. It accounted for 62 percent of global HBM bit shipments in the second quarter, ahead of Micron’s 21 percent and Samsung’s 17 percent, according to Counterpoint Research.

The company’s rising profit share suggests its HBM lead has only deepened, given that HBM sells at several times the price of conventional DRAM and roughly five times that of DDR5.

“Demand for memory across the board surged on AI infrastructure spending,” the company said in a statement, citing stronger prices for DRAM and NAND flash and sharp shipment increases of high-performance chips. Shipments of 128-GB-and-up DDR5 more than doubled from the second quarter, while enterprise SSDs for AI servers now account for a larger portion of NAND sales.

The company will begin shipping HBM4 in the fourth quarter—destined for Nvidia’s next-generation processors—and has already secured full-year supply contracts for HBM, DRAM, and NAND for 2026.

Its HBM breakout is rooted in its multi-story stacking technology, which has advanced from 3D to 4D through triple-level cell (TLC) architecture, enabling higher density and power efficiency suitable for Nvidia’s stringent specifications.

SK hynix this week also began the world’s first commercialization of 321-layer NAND flash, aimed at rising AI mobile workloads.

To meet undying global demand, the company will expedite cleanroom openings, expand output via the M15X fab, and accelerate the migration to sixth-generation 10-nanometer production across DRAM lines. It expects DRAM demand to grow more than 20 percent next year, following this year's estimated gain in high-10-percent range.

Copyright ⓒ Aju Press All rights reserved.