SEOUL, November 03 (AJP) - South Korean weapons makers kept up their record-setting earnings streak in the third quarter, powered by solid demand for Korean defense systems known for proven technology and rapid delivery.

Hanwha Aerospace posted its strongest third-quarter performance on record, lifted by robust exports and solid contributions from subsidiary Hanwha Ocean — underscoring the group’s growing dominance across Korea’s expanding defense-industrial value chain.

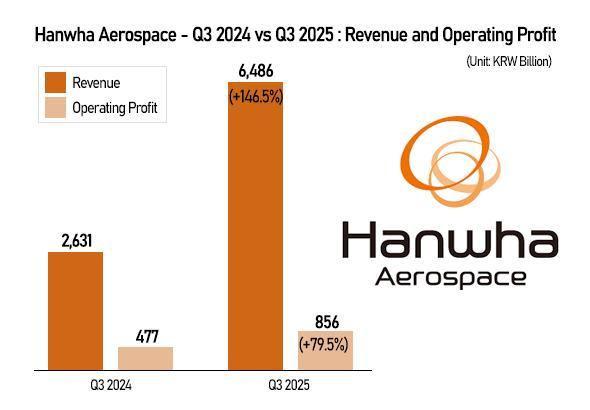

The company said Monday its Q3 revenue surged 156.5 percent on-year to 6.5 trillion won ($4.55 billion), while operating profit jumped 79.5 percent to 856.4 billion won ($600 million) — the highest level ever for a third quarter.

A key driver was the full consolidation of Hanwha Ocean, which contributed 3 trillion won in sales, representing the single largest chunk of group revenue. The land systems division, responsible for the K9 self-propelled howitzer and multiple-launch rocket systems, followed with 2.1 trillion won, trailed by Hanwha Systems — owner of Philly Shipyard — at 807 billion won and the aerospace arm at 604 billion won.

Most of the profit, however, came from land systems, which generated 573 billion won in operating profit, or roughly 27 percent of the companywide total. Hanwha Ocean logged 290 billion won.

Hanwha Systems saw a temporary earnings dip due to costs tied to its Philly Shipyard acquisition, while the aerospace segment swung back to profit after its Risk and Revenue Sharing Program (RSP) — a joint development mechanism where partners share profit and losses by equity ratio — turned profitable. RSP projects are known to incur front-loaded costs, so the turnaround is viewed as evidence the aerospace unit is entering a more stable earnings phase.

“The land-systems backlog now stands at 31 trillion won, or around 69 percent of total orders,” a Hanwha Aero official said, adding that earnings momentum is expected to extend through 2029 as defense expansion remains the primary growth engine.

Hanwha Aero is also accelerating its European push. The company plans to begin construction on a new production base in southern Romania by year-end, with local manufacturing to start in 2027. Hanwha entered the Romanian market last July by signing a 1.38 trillion-won deal to supply 54 K9 howitzers and 36 K10 armored ammunition resupply vehicles. It plans to partner with Romanian defense company PRO OPTICA and Italy’s Iveco for the new plant, ultimately targeting Romania’s infantry fighting vehicle (IFV) market.

Hanwha Aerospace rose 6.44 percent to close at 1,042,000 won.

Hyundai Rotem delivers best results since founding

Hyundai Rotem also posted its best-ever results since its establishment, buoyed by soaring global demand for armored vehicles and main battle tanks.

From January to September, the company recorded cumulative revenue of 4.2 trillion won and operating profit of 738 billion won — up 44 percent and 150 percent, respectively, from a year earlier. Even on a Q3-only basis, revenue rose 48 percent year-on-year, while operating profit more than doubled, up 102 percent.

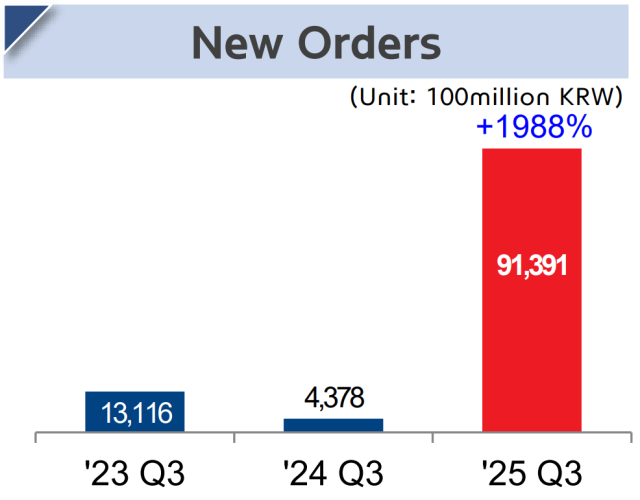

Like Hanwha Aero, Rotem’s standout performance came from its defense division. Cumulative new defense orders soared from 438 billion won in the first three quarters of last year to 9.14 trillion won this year — an explosive 1,988 percent jump — driven by skyrocketing demand for K2 main battle tanks across NATO states such as Poland and Romania, along with new export contracts for wheeled armored vehicles (WAVs) with Peru.

Made-in-Korea armored assets have long been recognized for strong fundamentals, backed by Korea’s advanced manufacturing capabilities and its operational credibility as a nation effectively still at war. Sales gained renewed momentum after Russia’s invasion of Ukraine. Bordering NATO states, particularly Poland and Romania, began rushing to place large-scale tank orders amid mounting security concerns. Korean producers gained an edge with faster delivery timelines and high-performance systems, rivaling established European defense giants Rheinmetall and Krauss-Maffei Wegmann (KMW).

Riding on its strengthened global position, Hyundai Rotem plans to continue research into hypersonic vehicles and dual-mode ramjet propulsion systems, aiming to develop maneuverable hypersonic missiles — a technology critical for penetrating missile defense systems and striking high-value targets. The company is also working to integrate robotics and drone technologies from Hyundai Motor Group to expand into next-generation autonomous and unmanned defense platforms.

Hyundai Rotem shares surged 6.07 percent to 244,500 won.

Eugene Investment & Securities analyst Yang Seung-yoon remains bullish on Korea’s broader defense sector, which also includes Korea Aerospace Industries and LIG Nex1, known for missile and radar capabilities.

“NATO’s upward revision of defense spending targets and the EU’s exemption of defense-related debt limits could create meaningful opportunities,” Yang said.

Copyright ⓒ Aju Press All rights reserved.