SEOUL, November 05 (AJP) - The South Korean won’s recovery — fueled by the Korea-U.S. trade deal during APEC week and a bullish stock market — proved short-lived as the U.S. dollar climbed to a seven-month high amid renewed concerns over frothy AI-related stocks.

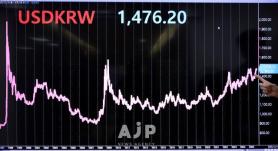

The dollar hit 1,446.3 won on Wednesday, its strongest level since April, as foreign investors dumped more than 2 trillion won worth of KOSPI shares as of 2:00 p.m., dragging the benchmark index down more than 3 percent.

While the heavy foreign profit-taking reflects the KOSPI’s staggering 70 percent gain so far this year, the upward pressure on the dollar-won exchange rate is largely driven by external factors — leaving Seoul with limited policy options.

According to central bank data released Wednesday, South Korea’s foreign reserves stood at $429 billion at the end of October, up $6.8 billion from the previous month. It marked the sixth straight monthly increase and the highest level in 21 months, occurring despite verbal interventions aimed at curbing excessive bias toward a weaker won.

The rise in reserves suggests authorities have refrained from deploying significant firepower to defend the currency.

Foreign currency deposits increased $7.4 billion to $25.9 billion, supported by robust export performance. Exports in October climbed 3.6 percent year-on-year to a record $59.6 billion, with the cumulative trade surplus already surpassing last year’s total — a factor likely boosting foreign-currency deposits.

Improved investment returns at domestic pension funds and financial institutions also contributed. The National Pension Service’s Investment Management Division reported an 8.6 percent return on its overseas equity portfolio — including major U.S. stock market holdings — from January through August.

Globally, South Korea moved up one notch to ninth place in foreign-reserve rankings, overtaking Hong Kong, whose holdings fell by about $2.5 billion in October.

Despite strong exports and a buoyant stock market, the won has remained weak after briefly strengthening to 1,430 per dollar following Seoul and Washington’s final agreement on payment terms for Korea’s $350 billion investment package last week.

The dollar, which averaged 1,453.39 won in January, had eased to 1,364.66 won in June before rebounding to a monthly average of 1,431.17 won as of Nov. 4.

According to Park Sang-hyun, researcher at iM Securities, the pressure largely reflects a renewed risk-off mood.

“The chance of another rate cut at the January 2026 FOMC meeting is diminishing,” Park said. “Concerns over the financial instability of U.S. regional banks and the prolonged federal government shutdown have restricted liquidity flows, pushing the dollar higher.”

Park added that the U.S. Supreme Court’s review of the cross-tariff legality case has further supported the dollar. The court began hearings Wednesday on a lawsuit filed by Democratic-led states and small-business associations challenging the legality of the mutual tariff framework. A ruling against the policy could invalidate the bilateral tariff agreement, dimming prospects for future rate cuts and bolstering the dollar’s strength.

The launch of Prime Minister Takaichi Sanae’s new cabinet in Japan — which reaffirmed a policy stance favoring a weaker yen — also weighed on the won-yen pair. Since South Korea and Japan compete directly in key export markets and product categories, Seoul has little choice but to partially align its monetary stance with Tokyo’s to maintain competitiveness.

Copyright ⓒ Aju Press All rights reserved.