Responding to appeals from domestic manufacturers, the Ministry of Economy and Finance on Thursday announced provisional anti-dumping tariffs of 21.17 percent to 43.6 percent on multi-jointed industrial robots with four or more axes from China and Japan. The duties will apply for four months from Nov. 21 through March 20.

The measure marks South Korea's first anti-dumping action on industrial robots in 20 years as the government seeks to shield local producers from "predatory pricing by foreign competitors."

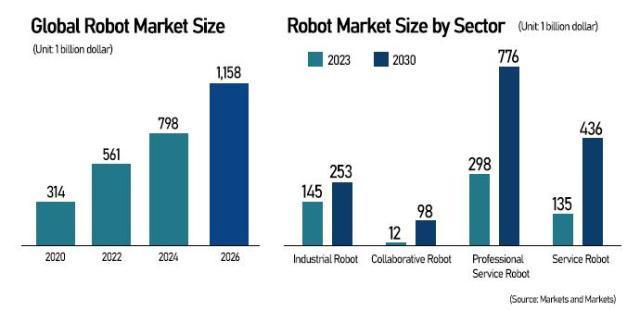

Industrial robots account for about half of Korea's 6 trillion won (4 billion dollars) robotics market. Of the country's 2,525 robotics firms, 567 focus on industrial applications, according to late-2024 government data.

The duties target major manufacturers including Japan's Kawasaki Heavy Industries, Fanuc and Yaskawa Electric, as well as China's Kuka Robotics. The Trade Commission will continue investigations through March 20 before determining final tariff rates.

Domestic complaints say foreign companies have been undercutting Korean products by selling 28 percent to 44 percent below market rates. One Korean firm's complaint filed in March 2024 said China's Kuka and Japan's Fanuc sold robots at steep discounts to clear inventory.

Chinese and Japanese incursions into Korea's market have intensified pressure on domestic suppliers. Korean industrial robotics makers, led by HD Hyundai Robotics and Yuil Robotics, now command only 30 percent of the home market. Their position is even weaker globally, where China dominates robot installations with 54.4 percent market share, supported by prices 20 percent to 30 percent lower than Korean models and extensive state backing.

Even if finalized, the anti-dumping duties offer limited relief as local firms confront a new challenge abroad.

Last month, the US Commerce Department launched a Section 232 investigation into whether imports of robots, industrial machinery and medical devices threaten national security. The probe includes industrial robots and other computer-controlled mechanical systems such as stamping, cutting, welding and metalworking equipment. The department will submit recommendations to the White House within 270 days, after which the president will decide on potential tariffs.

As a US ally and major supplier of industrial robots, Korea's exports are already governed under the Wassenaar Arrangement, which regulates dual-use technologies among member states. While the agreement makes security threats or improper technology transfers highly unlikely, Korean companies fear that the investigation could delay investments and affect operations.

According to industry insiders, LG Electronics, LG Chem and LG Energy Solution recently submitted an opinion paper to the US Commerce Department highlighting risks to their American facilities. The companies wrote: "Robots and industrial machines are core capital goods essential to production."

They added: "Applying tariffs or other import restrictions to a wide range of robots and industrial machines could result in unintended negative consequences including cost increases and reduced productivity and efficiency."

Other Korean companies have submitted similar filings, including Doosan Robotics, which acquired US robotics solutions firm ONExia last July.

Despite mounting challenges, industry leaders see promise in the AI-driven robotics boom. During a visit to Seoul, NVIDIA CEO Jensen Huang said Korea is best qualified to spearhead the robotics era and pledged to supply 260,000 GPUs to accelerate automation.

"Robots are bringing innovation across daily life through convergence with AI, going beyond manufacturing efficiency," said Kim Jin-ho, president of the Korea Association of AI Robot Industry, during opening remarks at Robot World 2025 on Wednesday. "With the expanding role of robots in physical AI and healthcare, the golden age of robotics has arrived."

Copyright ⓒ Aju Press All rights reserved.