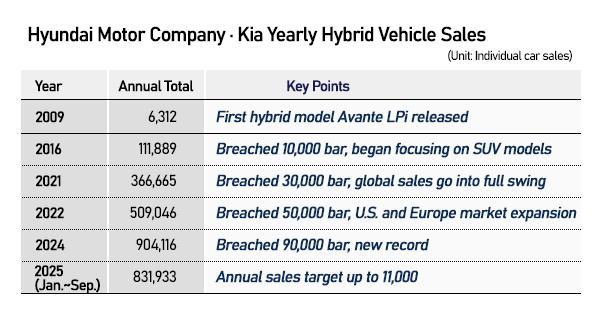

The group's two marques – Hyundai and Kia – sold 831,933 hybrid vehicles globally in the first nine months of 2025, up 27.2 percent from 654,067 units a year earlier, according to available data. At this pace, annual hybrid sales are projected to surpass 1 million units for the first time.

Mid-size sport utility vehicles led the surge. The Tucson Hybrid sold 132,991 units and the Sportage Hybrid 120,054 units through September, rapidly replacing their gasoline counterparts in key markets including the United States and Europe. In exports, Tucson Hybrid sales were more than triple those of its gasoline equivalent.

Hyundai said in its third-quarter earnings that robust SUV hybrid demand helped lift its U.S. market share to a record high, with hybrid sales up 3.6 percent on-year in the July–September period. Kia posted a 4.8 percent gain.

The shift reflects mounting pressures on automakers from shrinking EV subsidies, higher battery costs, and tariff uncertainty. In the United States, where federal EV tax credits of up to $7,500 were eliminated last month, a wider industry pullback is unfolding. General Motors is reportedly weighing 1,200 job cuts at its Detroit EV plant, Ford Motor is reassessing its plan to build 200,000 EVs next year, and Nissan Motor has postponed the 2028 launch of two EV models.

Hyundai halted production of the Genesis GV70 electric model at its Alabama plant and sharply increased output of the Santa Fe Hybrid, whose production jumped more than 140 percent to roughly 62,000 units through September.

The automaker also launched the Palisade Hybrid in the U.S. in September. Since debuting in South Korea in April, the model sold 26,930 units through September, outpacing the gasoline version's 18,005 units.

Hybrids are typically priced 3 million to 5 million won ($2,038–$3,397) higher than conventional vehicles but command stronger profit margins and face far less consumer resistance than fully electric models. The hybrid Palisade costs more than 5 million won above the gasoline version, yet delivers about 1.45 times greater fuel efficiency.

Industry experts view hybrids as a pragmatic bridge during the transition to full electrification.

"The biggest reason people prefer hybrid vehicles over electric vehicles is safety concerns. While hybrid vehicles do have batteries, they are comparatively smaller than those in full electric vehicles," said Lee Jae-won, a professor of energy engineering at Dankook University.

"Charging remains an issue, as it takes much more time to fully charge an EV than to refuel a gasoline car. Given time, improved infrastructure and institutional support, we still believe electric vehicles will become the new norm," he said.

Responding to questions about its hybrid push, Hyundai Motor Group said consumer hesitation around EVs remains strong and that hybrids serve as a necessary intermediate step.

"We have been taking incremental steps toward electrification through hybrid vehicles rather than radical changes, and our strategy has aligned well to drive these successful hybrid sales," a Hyundai Motor Group spokesperson said.

Copyright ⓒ Aju Press All rights reserved.