POSCO signaled last month during its third-quarter earnings call that a potential deal remained in its "early review" phase and that no significant progress had been made. Still, people familiar with the matter say the steelmaker has assembled a heavyweight advisory team — including Samil PwC and Boston Consulting Group — to explore the feasibility of an acquisition.

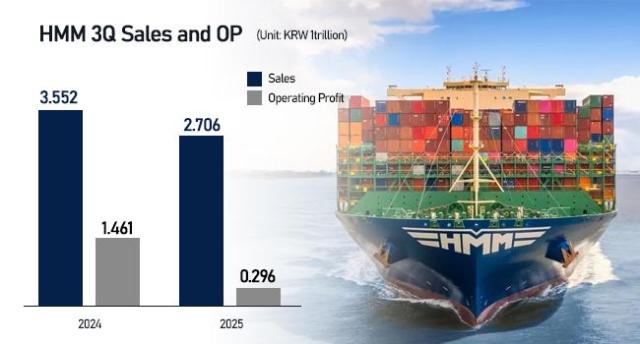

The renewed scrutiny comes as HMM on Thursday posted an earnings shock for the July-to-September period. Operating profit plummeted 80 percent from a year earlier to 296.8 billion won, deepening the decline from the second quarter, when income slipped 64 percent.

The carrier blamed the rout on deteriorating global shipping conditions. The Shanghai Containerized Freight Index averaged 1,481 points in the third quarter, down 52 percent from a year earlier, as trade volumes weakened under escalating tariff disputes and a glut of Chinese capacity weighed on prices.

"Global container market rates remain fluid depending on carriers' supply adjustments, with structural limitations to fare increases," said Jung Yeon-seung, an analyst at NH Investment & Securities. "While HMM is diversifying its fleet led by bulk carriers, near-term operating profit recovery will be challenging as container rates stabilize downward."

For POSCO, timing may be favorable. HMM's share price now sits nearly 30 percent below the 26,200 won price used in the company's 2.2 trillion won buyback completed in September.

Attention is focused on whether the carrier's main shareholder, state-owned Korea Development Bank, will move to divest its stake. POSCO has acknowledged that it is reviewing potential synergies from an acquisition, though KDB has said all options remain open. The Korea Ocean Business Corporation, which holds a similar-sized stake, said it is working to identify a "private" owner for HMM but stressed that discussions remain preliminary.

"We alone cannot make any decisions, and we are to cooperate with any decisions made with related government bodies," a KOBC spokesperson said.

HMM — formerly Hyundai Merchant Marine — absorbed key assets and the trans-Pacific East Coast route of Hanjin Shipping after its collapse in 2017. KDB owns 35.42 percent of the company and KOBC 35.08 percent, with their combined stakes temporarily diluted during the share buyback before rising again after a retirement of roughly 8.1 percent of outstanding shares.

POSCO faces mounting pressures of its own, including weak steel demand, high U.S. tariffs and persistent Chinese dumping. Its fast-growing battery materials division is also pushing forward with diversification amid sluggish electric vehicle sales.

The group spends an estimated 3 trillion won annually on logistics to import coal, iron ore and battery materials, and it has argued that an HMM acquisition could lower freight costs while offering a hedge against global supply-chain disruptions.

But the idea has met resistance from Korea's shipping industry.

The Korea Shipowners' Association and several domestic operators have voiced strong opposition, warning that "if POSCO, whose main business is steel, acquires HMM, not only will professional shipping management become difficult, but the entire Korean shipping industry will face heightened risks should POSCO's business deteriorate."

Copyright ⓒ Aju Press All rights reserved.