SEOUL, November 18 (AJP) - South Korean institutional investors have emerged as the primary force behind the KOSPI’s world-leading rally this year, reaping sizable gains from their long-position strategy fueled largely through exchange-traded funds (ETFs).

Domestic financial institutions made aggressive bets on Korean equities via ETFs, significantly boosting their bottom line.

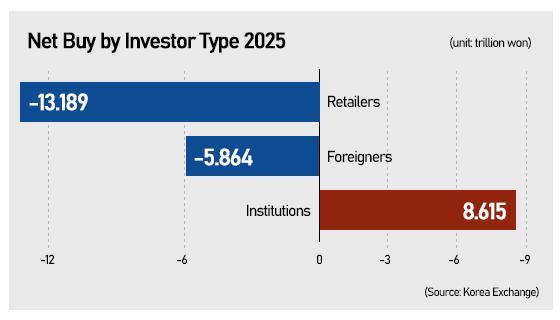

According to the Korea Exchange, foreigners have been net sellers of 5.86 trillion won (around $4 billion) and retail investors 13.19 trillion won so far this year, taking profits after the record-setting rally.

Despite this offloading, the KOSPI has maintained one of the strongest performances among major global indices — rising more than 60 percent — thanks to steady long positioning by local institutions, predominantly financial investment firms.

Institutions purchased a net 8.61 trillion won this year, with financial investment accounts alone buying 19.09 trillion won. Financial funds maintained a net-buying stance for most of the year except January.

Financial investment accounts refer to brokerage-run proprietary trading divisions that execute arbitrage, hedging, and market-making strategies. Their yearly positions typically net out to near zero, but the surge of ETF inflows has shifted that pattern.

When money flows into ETFs, brokers are required to buy the underlying stocks, and these purchases appear in market-making accounts — contributing to consistent net buying by financial investment firms.

Analysts note this ETF-driven structure is now offsetting the impact of foreign selling. Even with foreigners unloading around 9 trillion won this month, passive ETF inflows have kept the KOSPI’s upward momentum intact. Passive funds do not shift positions abruptly, reducing the risk of sharp corrections.

“The influence of financial investments and ETF flows is becoming more significant than foreign investors in driving the domestic stock market,” said Heo Jae-hwan of Eugene Investment & Securities. “This structure helps limit the downside even if the pace of gains slows.”

The long-term bet has been especially lucrative for insurers, who account for a large share of Korea’s typically-long institutional capital.

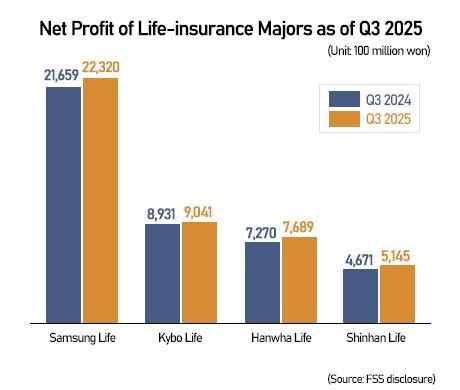

According to the Financial Supervisory Service's electronic disclosure system, Hanwha Life Insurance posted accumulated net profit of 768.9 billion won as of September, up 5.8 percent from a year earlier. Its investment income more than doubled, jumping from 195.6 billion won to 582.2 billion won.

Samsung Life’s net profit rose 3 percent to 2.232 trillion won in the third quarter, despite a 6.7-percent drop in insurance profit, as investment income expanded 9 percent to 1.38 trillion won.

Kyobo Life also reported a 1.2-percent rise in net profit to 904.1 billion won, driven by an almost 50-percent surge in investment returns.

Shinhan Life logged the strongest growth among insurers, with net profit up 10 percent to 514.5 billion won as investment income more than doubled to 128.6 billion won.

Copyright ⓒ Aju Press All rights reserved.