SEOUL, November 20 (AJP) - South Korea's Samsung Electronics has narrowly reclaimed its No. 1 rank in global DRAM sales in the third quarter after yielding the position to its home rival SK hynix in the first half for the first time amid the surge in high-bandwidth memory (HBM) demand.

The shift underscores rapidly strengthening DRAM prices due to frantic stockpiling of memory chips that power servers and a wide range of electronic devices, driven by fears of supply shortages as manufacturers prioritize output for AI servers, a latest market study showed.

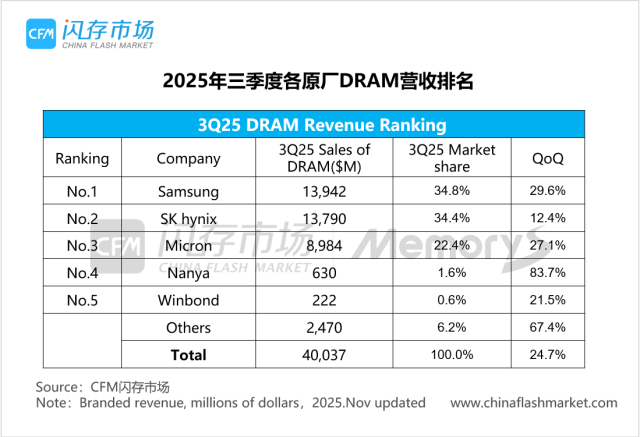

According to China Flash Market (CFM) data posted earlier this week, Samsung Electronics accounted for 34.8 percent of global DRAM sales in the third quarter, up 29.6 percent on quarter and edging SK hynix at 34.4 percent, whose quarterly gain slowed to 12.4 percent. Micron also logged a big of 27.1 percent, closely trailing in third place with a 22.4 percent share.

The latest DRAM data mirrors a cut-throat market without the clear, decisive winner seen in past cycles, as AI reshapes the DRAM segment amid structural output shortages from hyperscale servers to laptops, intensified by growing demand for high-performance chips and sanctions on Chinese producers of legacy memory.

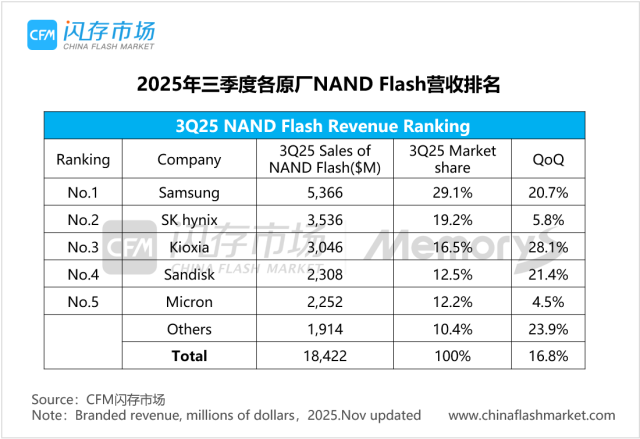

The global DRAM market expanded 24.7 percent on quarter and 54 percent on year to $40.037 billion in the third quarter, while the NAND Flash market grew 16.8 percent to $18.422 billion. Combined, the semiconductor memory market reached a record $58.459 billion and is expected to continue its record-setting streak in the fourth quarter, the Chinese market watcher said.

Both DRAM average selling prices and bit shipments increased in the past quarter, lifting quarterly revenues for all suppliers.

Samsung returned to the No. 1 position, driven by an 85 percent quarter-on-quarter surge in HBM bit shipments and strong pricing in conventional DRAM, pushing its total DRAM revenue to a historic high.

Chinese memory suppliers also accelerated capacity to offset the supply gap left by some competitors exiting older product lines, expanding their market presence amid rising prices.

Samsung Electronics, which also produces smartphones, comfortably retained the top spot in the sales of NAND Flash powering mobile devices with a 29.1 percent share, followed by SK hynix at 19.2 percent and Japan’s Kioxia at 16.5 percent.

Global NAND Flash revenue reached $18.422 billion in the third quarter, rising 16.8 percent on quarter but declining 3.1 percent on year. Although bit shipments continued to increase, rapid inventory reductions and migration to more advanced nodes have constrained output for some suppliers heading into the final quarter, the report said.

Copyright ⓒ Aju Press All rights reserved.