SEOUL, November 25 (AJP) - TMC, a South Korean industrial cable producer, said Tuesday it will use funds from its planned initial public offering to expand in the United States, aiming to capitalize on what it described as a “supercycle” driven by surging AI-related data demand.

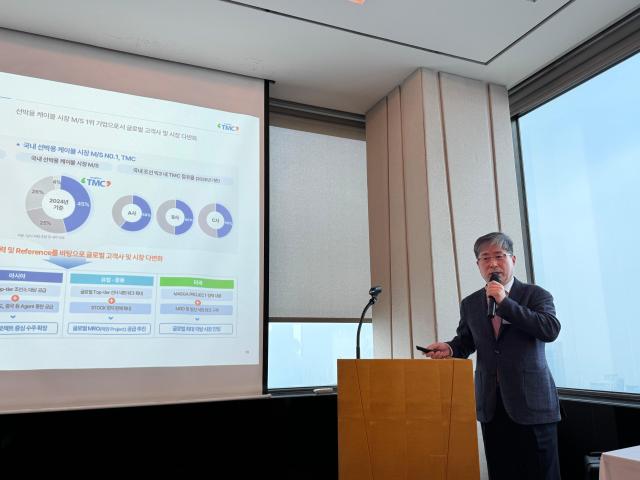

“At a time when the cable market has entered a new supercycle, we plan to strengthen our foothold in the expanding U.S. cable industry and secure new growth engines after listing,” CEO Ji Young-won told reporters in Seoul.

Founded in 1991, TMC manufactures cables for ships, offshore plants, nuclear power facilities and optical communications, and is a leading supplier in South Korea’s marine cable market.

The company will conduct an institutional bookbuilding process for IPO through Nov. 27, with retail subscriptions set for Dec. 3–4. TMC expects to raise 33.5 billion won from IPO, allocating 32 billion won for facility investments and 1.4 billion won for operating capital.

The spending will support the expansion of U.S. production lines, completion of certification processes, and growth in high-value segments such as shipbuilding, nuclear, data centers and telecommunications infrastructure, Ji said.

The company plans targeted U.S. investments across three sectors: nuclear power, shipbuilding, and broadband infrastructure. TMC established a production subsidiary in Texas in April, with manufacturing starting this month.

TMC is also expanding in nuclear and optical cable segments. The company has secured contracts to supply cables for Shin Hanul Units 3 and 4, following earlier deals for Saeul Units 3 and 4, with deliveries to begin late next year.

* This article, published by Aju Business Daily, was translated by AI and edited by AJP.

Copyright ⓒ Aju Press All rights reserved.