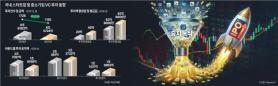

A total of 77 companies went public this year, including seven on the KOSPI and 70 on the KOSDAQ. Companies raised a combined 4.56 trillion won ($3.15 billion), up 14.9 percent from a year earlier. The number of listings was broadly unchanged from 2024, when 78 firms debuted.

Nearly nine out of 10 newly listed companies — 89 percent — traded above their IPO prices, marking the strongest post-listing performance since 2021. Market capitalization at IPO prices reached 15.32 trillion won, up 1.49 trillion won from the previous year and the highest level in seven years excluding the 2021 boom.

The KOSDAQ led the revival. Five companies debuted with market capitalizations exceeding 500 billion won, the largest such group since 2021: Reevesmed (1.36 trillion won), Semifive (809.1 billion won), AimedBio (705.7 billion won), CMTX (561 billion won) and The Pinkfong Company (545.3 billion won).

The Pinkfong Company, which listed on Nov. 18, is best known globally for producing “Baby Shark Dance,” the most-watched video in YouTube history with more than 16.5 billion views.

On the KOSPI, cosmetics maker d’Alba Global stood out as the year’s most successful listing. Since its May debut, the company — known for its “flight attendant mist” — has seen its share price jump 122.5 percent as of Tuesday’s close.

Among KOSDAQ listings, the strongest performer was Proteina, a drug development company whose shares surged nearly 700 percent between its July debut and year-end.

Kim Dae-jong, a professor of business administration at Sejong University, said Korea’s IPO market in 2025 reflected growing polarization under high interest rates and cautious investor sentiment.

“Institutional investors are increasingly demanding conservative valuations and clearer earnings visibility,” Kim said. “This has strengthened the trend toward lower IPO pricing.”

He added that the market is “transitioning from a short-term, profit-driven structure toward one that places greater weight on mid- to long-term corporate value.”

Looking ahead, a number of heavyweight candidates are waiting in the wings for next year’s IPO market, including K Bank, Musinsa, Olive Young, SK Ecoplant, Essex Solutions, Sono International and AI chipmaker Rebellion.

The outlook for new listings will be closely tied to the trajectory of the broader stock market. President Lee Jae Myung has repeatedly pledged to push the KOSPI toward 5,000 through structural reforms aimed at narrowing the so-called “Korea discount.”

“The ruling party will promote capital market advancement, strengthen shareholder value and eradicate unfair trading practices,” Park Hong-bae, a lawmaker from the Democratic Party, told AJP. “At the same time, we will enhance disclosure systems to support investor decision-making and encourage sound capital flows.”

A senior official at the Ministry of Economy and Finance also said the government remains optimistic about the KOSPI 5,000 goal, citing planned incentives for long-term shareholding.

Still, economists caution against overconfidence. Kim Yong-jin, a professor of business administration at Sogang University, said reaching the 5,000 mark would require several favorable conditions to align.

“Given the global economic environment and Korea’s own outlook, it does not appear very likely in the near term,” he said. “High market volatility makes the challenge even greater.”

Copyright ⓒ Aju Press All rights reserved.