The NPS has been asked to join fiscal and monetary authorities in a joint response council as the won drifts toward the once-unthinkable 1,500 threshold.

The world's third-largest pension fund, managing 1,322 trillion won in assets as of August, has become a critical presence in the FX market not by policy choice but because of the sheer scale of its overseas holdings.

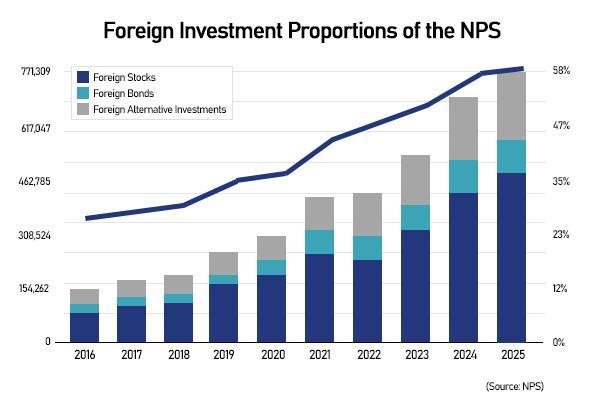

Overseas equities alone amount to 486 trillion won — already exceeding its medium-term target — compared with 196 trillion won in domestic stocks.

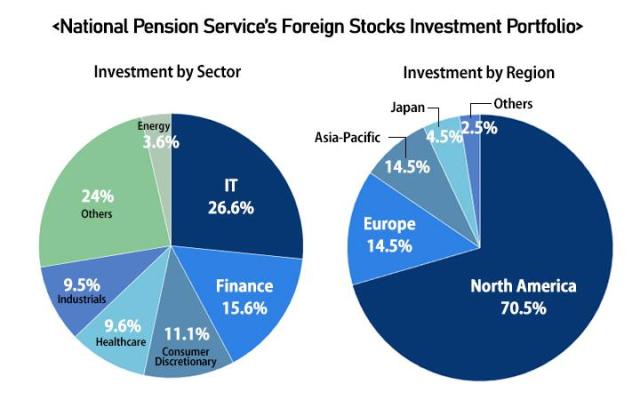

The fund has been especially aggressive in U.S. big tech. SEC filings show the NPS held $128.8 billion worth of U.S. equities through September, booking around 33.5 trillion won in paper gains this year.

It owns about 0.2 percent of Nvidia and sizable stakes in Apple, Microsoft and Broadcom, positions that have delivered hefty returns and elevated the fund's global influence.

But that global tilt is a double-edged sword.

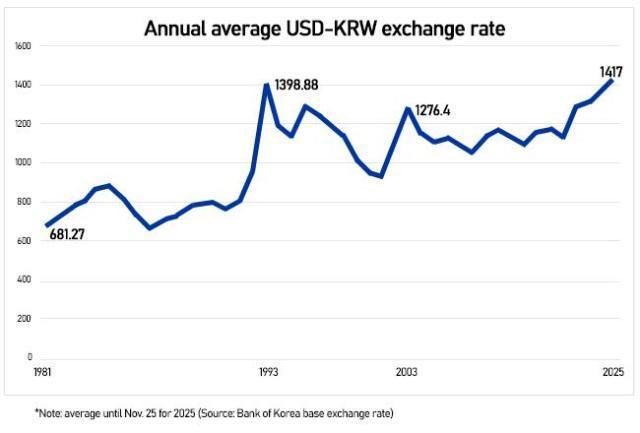

The currency traded at 1,465.8 won per dollar on Wednesday afternoon — slightly firmer than the Nov. 21 peak of 1,475.2 won after strong verbal intervention — but still nearly 100 won weaker over four months despite a current account surplus nearing $83 billion through September.

The won has approached levels previously seen only during extreme stress, including the 2009 global financial crisis and this April's political turbulence.

Stock Market Dilemma for FX

This year's roaring domestic stock rally adds to the FX pressure.

Korean shares returned an average 36.4 percent in the first eight months of the year, far outpacing foreign equities at 8.6 percent and positioning the NPS to rebalance by locking in domestic gains and reallocating abroad.

Pension funds sold roughly 800 billion won in local stocks from September to early November as the KOSPI hit a record 4,221.87. A three-percentage-point reduction in domestic equity allocation alone would require shifting about 48 trillion won — or $32.7 billion — reinforcing the fund's role as a structural dollar demander.

The simplest is adjusting the timing of its dollar purchases. While its long-term strategy requires continued expansion overseas, it faces no obligation on when it converts won into dollars.

Delaying purchases by several weeks or accelerating the repatriation of overseas returns can temporarily ease FX pressure without altering its portfolio strategy.

A second lever is recalibrating hedging ratios.

Under internal rules, the fund can hedge up to 10 percent of its overseas assets when the won trades significantly above its long-term average — a mechanism known as strategic currency hedging.

Analysts expect the fund to return to that stance as the 1,480-won level emerges as a short-term ceiling. When the NPS adopted this posture in January, the won strengthened by 20 to 30 won within days, easing into the mid-1,300s by May.

The fund can also tighten cash-flow management, temporarily holding more contributions in won or delaying scheduled FX transactions.

But the most powerful institutional lever remains the currency swap line with the Bank of Korea, which allows the NPS to borrow dollars directly from foreign reserves rather than sourcing them in the spot market.

The ceiling stands at $65 billion, up from $50 billion, and could be expanded or extended. Borrowed dollars must eventually be repaid, but the mechanism smooths sudden spikes in demand and reduces market volatility. Analysts note that both the swap arrangement and strategic hedging have proven to be the most effective tools in past episodes.

Still, the NPS cannot be treated as Korea's joker card.

The fund's mandate is to maximize long-term returns for an aging society, not to steer currency markets. "The NPS is certainly a major player in the FX market, but it operates under fundamental principles," said Park Sang-hyun of iM Securities.

"Mobilizing pension funds for currency defense at the expense of those principles is a different matter entirely." Reducing its overseas investment ratio, while technically possible, contradicts its core mandate and requires multiple layers of approval — making it infeasible as a short-term defense instrument. "For short-term exchange rate adjustments, currency hedging is realistically the optimal approach," Park added.

Copyright ⓒ Aju Press All rights reserved.