SEOUL, November 24 (AJP) - The Bank of Korea is widely expected to keep its key rate unchanged at 2.50 percent this week — and likely through the first half of 2026 — as the steep slide in the Korean won and heavy private-sector debt leave little room for further easing.

The Monetary Policy Board meets Thursday for its final rate decision of the year. The base rate was cut twice in the first half, by a combined 50 basis points from 3.00 percent to 2.50 percent, and has stayed on hold since May. The pause came as housing demand reignited ahead of a hawkish incoming government, and as a frenzy for U.S. tech stocks fueled structural weakness in the won and Korean bonds, narrowing policy options for fiscal and monetary authorities.

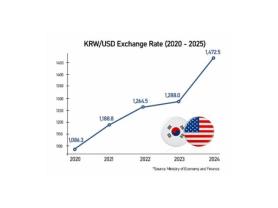

The U.S. dollar traded at 1,476 won on Monday — a level last seen during the global financial crisis in 2009 and again during the presidential impeachment in April — while Korean government bond yields hover above 3 percent. The BOK’s widening rate gap with the U.S. Federal Reserve is contributing to the pressure: the Fed’s benchmark stands at 3.75–4.00 percent, well above Korea’s 2.50 percent. A prolonged U.S. government shutdown has driven investors toward dollar assets, Treasuries, and gold, helping explain why the won continued to weaken even as $2.29 billion flowed into Korean equities.

Outbound demand for dollar assets intensifies pressure

Korea’s deepening appetite for overseas investments is adding another drag on the currency. According to BOK balance-of-payments data released November 6, outbound portfolio investment by Korean residents surged $11.2 billion in September, outpacing the $9.1 billion in foreign inflows to Korean securities. In short, Koreans bought more foreign assets than foreigners bought Korean ones.

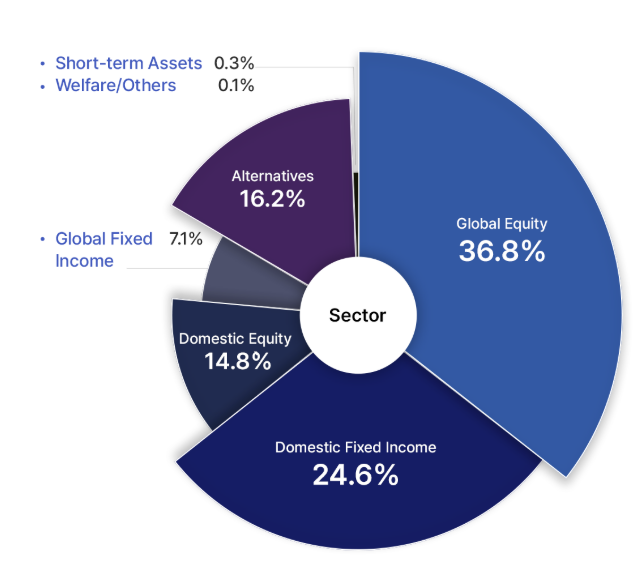

Institutional investors mirror the trend. As of August, the National Pension Service allocated 36.8 percent of its assets to overseas equities — nearly triple the 14.8 percent invested at home. Including bonds, overseas assets accounted for 43.9 percent of the NPS portfolio, exceeding its domestic holdings at 39.4 percent.

Debt overhang limits BOK’s maneuvering room

High household leverage is another constraint on policy. Korea’s household debt reached a record 2,325.8 trillion won ($1.58 trillion) at the end of June, BOK data show. The household-debt-to-net-GDP ratio climbed to 89.7 percent.

Housing loans remain the bulk of the load, totaling 1,159 trillion won in the third quarter, while margin loans used for stock leverage rose to 26.85 trillion won as retail investors borrowed aggressively during this year’s KOSPI rally.

“Korean outbound investment has become heavily concentrated in equities, and corporate demand for dollar conversion has fallen as exposure to U.S. assets has increased,” said Wi Jae-hyun, economist at NH Futures Research Center. Given expectations of continued won weakness, he said, the BOK has little choice but to stay on hold.

Shinyoung Securities researcher Cho Yong-gu also dismissed the likelihood of easing, saying he sees no rate-cut scenario at least until May next year.

Copyright ⓒ Aju Press All rights reserved.