SEOUL, November 24 (AJP) - South Korea’s fiscal and monetary authorities, constrained in their ability to slow the won’s steep decline, are turning to an unlikely player for relief: the National Pension Service (NPS), the country’s largest institutional investor and one of the biggest structural movers of the dollar–won rate.

Working-level officials from the NPS met finance ministry counterparts at the Sejong Government Complex on Monday. In a press statement, the finance ministry said it has formed a joint "council" with the NPS, the Ministry of Health and Welfare that oversees the pension, and Bank of Korea to "monitor" the foreign exchange impact of the fund's overseas investment portfolio.

The irony is that the fund is one of the biggest sellers of Korean currency as it finances a record expansion of its overseas portfolio—especially U.S. equities concentrated in the same big-tech and AI names now at the center of global bubble concerns.

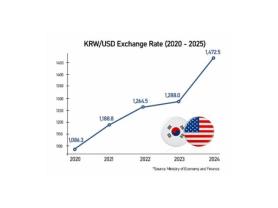

The dollar has strengthened more than 3 percent over the past month, nearing 1,480 won—a level touched only during extreme stress periods such as the 2009 global financial crisis or this April’s political turmoil.

The won’s weakness has persisted even as foreign investors were record buyers of Korean shares last month, only to abruptly reverse course amid renewed fears of overvalued AI stocks in the U.S.

Finance Minister Koo Yun-cheol, after meeting with the Bank of Korea governor and top financial regulators earlier this month, underscored the need to “improve structural imbalances” in FX supply and demand. The government has been consulting with major exporters and the NPS to help “smooth” excessive won depreciation.

A giant investor—and a structural source of dollar demand

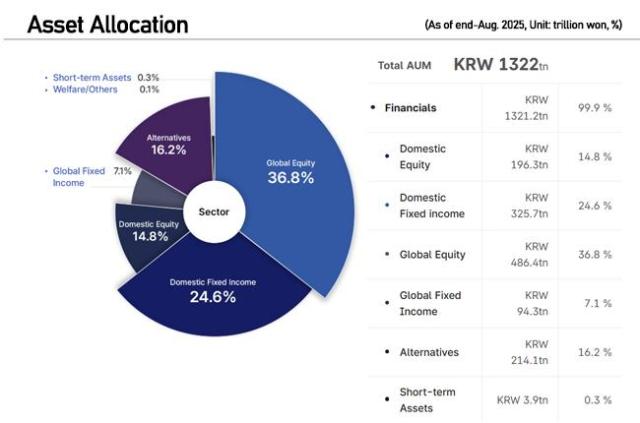

Policymakers’ concern centers on the sheer offshore footprint of the NPS, one of the world’s largest institutional investors. As of end-August, the fund managed 1,322 trillion won, with 486.4 trillion won—36.8 percent—allocated to global equities, according to official data.

Separate U.S. SEC filings show that U.S. holdings now form the sharpest edge of this exposure.

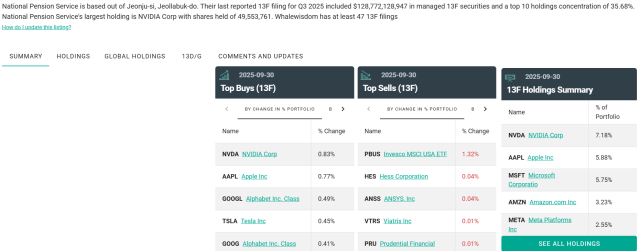

In a Form 13F filed on Nov. 4, the NPS reported $128.8 billion in U.S. equities across 552 companies, up 11.2 percent from the previous quarter as both buying and valuations increased.

At the top of its holdings sit Nvidia, Apple, Microsoft, Amazon, and Meta—America’s AI and cloud heavyweights. According to Fintel, the NPS holds roughly 49.6 million Nvidia shares, making it one of the world’s largest institutional shareholders.

From the government’s perspective, the NPS is simultaneously a potential stabilizer in the FX market and a structural driver of dollar demand. Korean individuals separately hold $99.85 billion in overseas securities as of September.

The NPS features prominently in recent FX-related verbal intervention, but its mission is fundamentally long-term: sustaining retirement payouts in a rapidly aging society. Its mid-term allocation plan calls for a continued increase in overseas and risk assets while trimming domestic bonds to improve returns.

Each incremental shift into foreign stocks requires fresh dollar buying—a persistent downward force on the won that no one-off FX operation can meaningfully offset. This dynamic also explains why movements in Korea’s FX reserves remain modest despite recent volatility.

Authorities, however, cannot exert too much pressure without inviting accusations of politicizing the nation’s last-resort retirement savings.

Still, the combination of record overseas allocation and an AI-heavy portfolio is one of the most sensitive macro-financial issues facing policymakers.

Analysts doubt the NPS will bend easily to government wishes. Details of Monday’s meeting remain sealed, but the market’s verdict was clear: the dollar gained an additional 3.9 won to close at 1,475.90.

Copyright ⓒ Aju Press All rights reserved.