SEOUL, November 26 (AJP) - South Korea’s finance minister signaled the government had even asked major exporters for help in propping up the won — a reversal of the usual dynamic that underscores the urgency on the FX front. But expectations for meaningful action remain low, as companies tied to massive U.S. investment commitments have little incentive to part with their dollar reserves.

The won’s annual average has already exceeded 1,400 per dollar this year, surpassing the 1997 Asian financial crisis level of 1,398.88, according to market data. The currency’s depreciation has coincided with Korean firms accelerating overseas investment, especially in the United States, while delaying dollar conversions amid deepening uncertainty over the dollar’s trajectory.

Data from the Bank for International Settlements (BIS) shows Korea’s real effective exchange rate (REER) slid to 89.09 at the end of October — its lowest since August 2009. A REER below 100 signals an undervalued currency, reflecting broad weakness against major trading partners. The index is expected to fall further in November as the dollar has strengthened more than 3 percent over the past month.

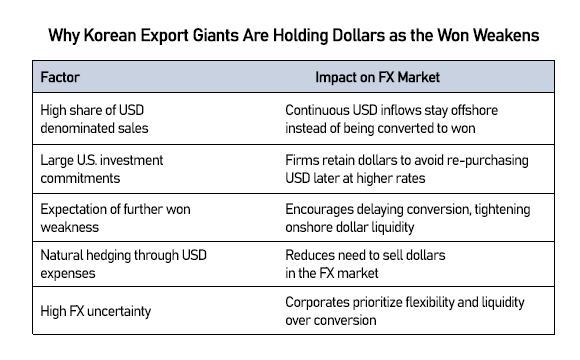

A weaker won traditionally boosts export competitiveness, but today’s environment is anything but typical. Korea’s biggest exporters are generating large dollar inflows while committing to multiyear overseas investments denominated in dollars — leaving them with few reasons to repatriate foreign currency.

“Companies are hoarding dollars simply because they don’t expect the dollar to weaken,” said Jang Bo-seong, senior researcher at the Korea Capital Market Institute. “It is common sense to avoid a money-losing practice.”

Jang noted that exporters naturally hedge by holding dollars, since payments for overseas investments, equipment and raw materials are often settled in dollars. “Without a clear signal that the dollar will weaken, holding dollar assets is seen as the safer choice.”

Chipmakers — responsible for roughly a quarter of Korea’s exports — epitomize the mixed effects. A strong dollar boosts revenue on U.S.-denominated sales but simultaneously raises import costs for equipment and materials while inflating the won value of massive overseas investments.

SK hynix, whose U.S. exposure is particularly large with about 70 percent of sales linked to American customers, says its FX posture hinges primarily on its investment cycle rather than daily market moves. “Dollar inflows from exports are managed in line with overseas investment, procurement and payment schedules,” a company official said, adding that hedging strategies are used to reduce volatility.

Samsung Electronics, Hyundai Motor and LG Electronics either did not respond to requests for comment or declined to discuss their foreign-currency management.

The corporate preference for holding dollars is now directly shaping FX market dynamics. “Foreign exchange markets are ultimately driven by supply and demand,” Jang said. “When large corporates hold onto dollars instead of converting them, it inevitably tightens dollar supply in the domestic market.”

This imbalance is magnified by Korea’s massive overseas investment pledges. Korean companies have committed more than $350 billion to U.S. projects as they seek to hedge geopolitical risks and secure access to advanced manufacturing ecosystems. A persistently weak won raises the won-denominated cost of those investments, further reinforcing incentives to stockpile dollars.

For now, authorities have little choice but to hope for a retreat in the dollar. “If the dollar index begins to decline meaningfully, companies may reassess their currency positions,” Jang said. “For the time being, however, holding dollars remains rational from a corporate risk-management perspective.”

As the won tests levels unseen even during past crises, policymakers and markets alike are closely watching whether corporate dollar hoarding — once viewed as a cyclical defensive move — is becoming a structural feature of Korea’s FX landscape.

Copyright ⓒ Aju Press All rights reserved.