SEOUL, December 12 (AJP) -South Korea’s import prices climbed in November despite a sharp pullback in global fuel costs, as the won’s depreciation against the U.S. dollar outweighed relief from cheaper energy, Bank of Korea data showed Friday.

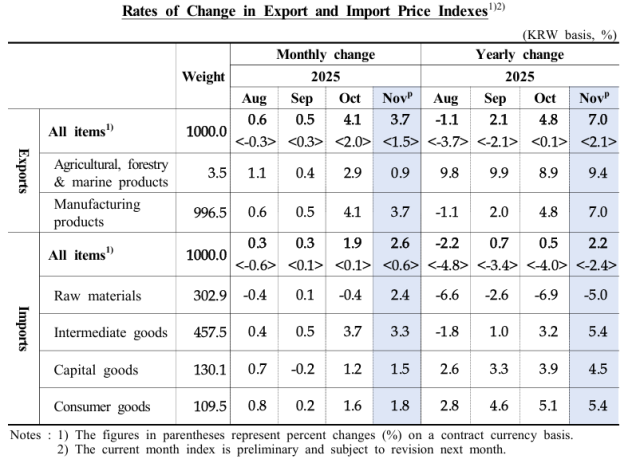

The import price index rose 2.6 percent on month and 2.2 percent on year to 141.82, accelerating from October’s 138.19 and posting the steepest monthly increase since April last year. The gains came even as Dubai crude averaged $64.47 per barrel in November, down from $65 in October, highlighting the dominant impact of exchange-rate movements on the country’s trade conditions.

The dollar averaged 1,457.77 won in November — up 2.4 percent from the previous month and 4.6 percent from a year earlier — amplifying import costs across major categories. Raw materials rose 2.4 percent, led by higher natural gas prices, while intermediate goods such as computers and electronic components climbed 3.3 percent. Capital goods increased 1.5 percent and consumer goods 1.8 percent.

Some inputs central to Korea’s industrial base posted sharp jumps. Lithium hydroxide surged 10 percent, and flash memory prices leapt 23.4 percent, reflecting a surge in chip-fabrication activity.

Bank of Korea price statistics chief Lee Moon-hee cautioned that volatility remains elevated. “The average exchange rate from December 1 to 10 rose by 0.8 percent from the previous month,” he said. “Given the uncertainty, we need to monitor exchange rate fluctuations until the end of the month.”

A weak won, however, proved supportive for exporters. The export price index climbed 3.7 percent on month and 7.0 percent on year to 139.73, boosted by a broad-based jump in semiconductor prices. DRAM led the gains with an 11.6 percent rise amid persistent supply tightness.

When measured in U.S. dollars, import prices increased 0.7 percent in value and 4.3 percent in volume, while export prices surged 9.1 percent in value and 6.8 percent in volume, improving overall trade conditions.

South Korea’s net terms of trade index rose 5.8 percent on year, marking 29 straight months of improvement. Export prices gained 2.1 percent, far outpacing the 3.4 percent decline in import prices, while the volume-based index jumped 13 percent, signaling strengthened purchasing power for the economy.

Copyright ⓒ Aju Press All rights reserved.