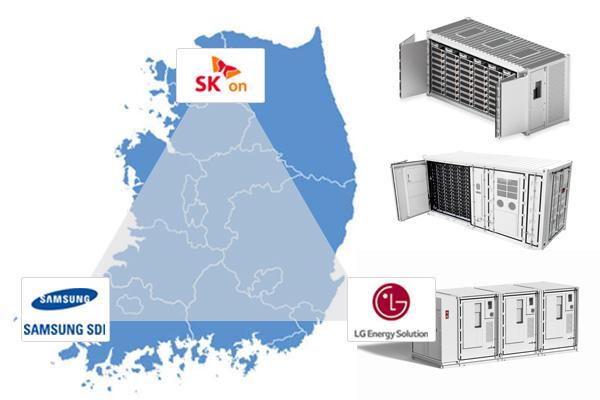

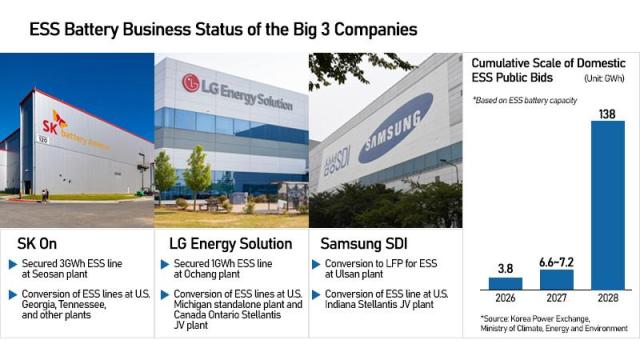

The facility, designed to roll out ESS capacity sufficient to power 40 to 50 large-scale data centers annually, will mark SK On's first domestic LFP production base, following what industry sources described as a decisive loss to Samsung SDI in the first round of government ESS tenders.

In ESS tenders across five provinces awarded by the Ministry of Climate, Energy and Environment in July, Samsung SDI captured nearly 80 percent of total volume, largely due to its existing domestic infrastructure.

SK On plans to convert battery production lines originally designated for electric vehicle nickel-cobalt-manganese (NCM) cells at the Seosan plant into ESS-dedicated LFP facilities.

"We plan to go after the government's second ESS tender, a 3.3 GWh procurement round scheduled for 2027 delivery," an SK On spokesperson said.

The ministry aims to install 138 GWh of ESS capacity nationwide by 2038 to support the expansion of solar and wind power generation, representing a cumulative project pipeline valued at 20 trillion to 30 trillion won ($13.5 billion to $20.3 billion).

The capital expenditure around Seosan, however, extends beyond domestic tenders.

SK On's aggressive LFP push is unlikely to immediately alter the plans of larger local rivals, which have already crowded into the ESS segment as the electric vehicle market stagnates.

LG Energy Solution last month said it would establish a 1 GWh ESS production line at its Ochang plant, previously the largest ESS project of its kind in Korea before SK On's announcement.

Samsung SDI, meanwhile, faces a strategic dilemma. Its NCM batteries carry higher production costs than LFP cells, which are about 30 percent cheaper and better suited to the temperature extremes and long charge-discharge cycles typical of grid-scale storage. As rivals expand domestic LFP capacity, Samsung's early advantage — rooted in local manufacturing scale — could erode unless it pivots.

The domestic competition is unfolding against a backdrop of intensifying global pressure. Chinese manufacturers CATL, Hithium and EVE Energy dominate the global ESS market, leveraging low-cost LFP production at scale. Korean battery makers account for roughly 24 percent of the global EV battery market, but less than 10 percent of the ESS segment as of mid-2025.

Still, the structural outlook favors grid storage. Battery Council International projects the global ESS market will expand nearly sixfold, from 200 GWh in 2025 to 1,200 GWh by 2030, noting that a single large data center can require as much as 1 gigawatt of power to operate.

Compared with the stagnant EV market — highlighted by SK On's split with Ford after sluggish EV sales weighed on their joint venture — demand driven by AI data centers and renewable energy infrastructure is emerging as a more durable growth engine.

Samsung SDI and LG Energy Solution are not expected to significantly ramp up domestic LFP capacity to match the latecomer.

Chang added that Samsung won most of its recent contracts using NCM batteries rather than LFP cells. "It was the broader battery ecosystem that secured contracts for Samsung and LG. They have far less incentive to expand LFP production in Korea," he said.

While challenges abroad persist, particularly in the United States, industry observers expect domestic rivalry to intensify. All three Korean battery makers increasingly view ESS as a critical earnings pillar as the global EV market remains mired in uncertainty.

Copyright ⓒ Aju Press All rights reserved.