The two companies will formally part ways in the first quarter of 2026, splitting control of three giga factories launched together in 2022. SK On will take full ownership of the 45-gigawatt-hour plant in Stanton, Tennessee, while Ford assumes the twin sites in Glendale, Kentucky, totaling 82 GWh.

The breakup, while abrupt, offers SK On a strategic reset. Freed from exclusive commitments to Ford, it can now supply a broader pool of customers — particularly utilities, hyperscale data-center operators, and ESS integrators repositioning for the grid-scale storage boom. The shift also reflects Ford's own retreat: its EV unit has lost more than $5 billion this year, prompting the automaker to delay mass production of its next-generation electric pickup to 2028.

Strategic Reset

The restructuring sharply improves SK On's balance sheet. Nearly 10 trillion won ($6.7 billion) in BlueOval SK liabilities currently sit on SK On's consolidated financials. The separation will transfer roughly half of that debt off its books, reducing annual interest expenses by about 250 billion won while giving SK On full access to U.S. Inflation Reduction Act (IRA) production tax credits.

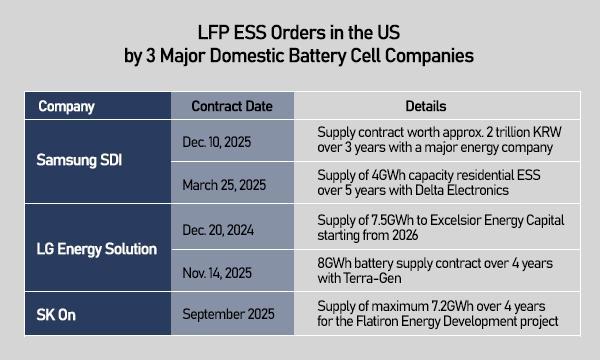

The company has already set an aggressive ESS roadmap, targeting up to 10 GWh in orders next year by converting EV battery lines at its Tennessee and Georgia plants. Mass production of LFP-based ESS cells is slated for the second half of 2026.

Korean battery makers LG Energy Solution, Samsung SDI, and SK On are all accelerating the conversion of underutilized EV battery lines into ESS production amid deteriorating visibility for global EV demand.

"EV batteries face strict weight and volume constraints that demand high energy density and output, but ESS units are stationary installations with relatively fewer space limitations," said Chung Won-suk, an analyst at iM Securities.

SK On is separately converting its Stellantis joint venture plant in Indiana into an ESS-dedicated facility targeting 30 GWh of annual capacity by end-2025. Utilization at the plant has dropped below 50 percent amid Stellantis' EV pullback following the phaseout of U.S. federal purchase subsidies in September.

ESS Momentum

Samsung SDI is in advanced talks to supply Tesla with about 3 trillion won in ESS batteries over three years — roughly 10 GWh annually — marking what could be the company's first large-scale alliance with the world's dominant ESS integrator.

LG Energy Solution, which already supplies Tesla with 20 GWh of LFP cells a year, is negotiating to raise that volume by 50 percent to 30 GWh. Combined, Korean suppliers would deliver 40 GWh annually to Tesla, substantially widening the EV maker's diversification away from Chinese giants CATL and BYD.

SNE Research projects the global ESS market to expand more than sixfold from 185 GWh in 2023 to 1,232 GWh by 2035. Unlike EVs — where demand is vulnerable to consumer sentiment, macro cycles, subsidies, and policy swings — ESS growth is driven by structural factors: renewable-energy penetration, grid stability requirements, and escalating data-center loads.

"ESS battery demand currently stands at about 20 to 25 percent of the EV market, but ESS offers relatively stable structural growth," said Chung. "That is why its sustainability is rated more highly than EVs."

Korean players, however, still lag global leaders: they hold roughly 24 percent of the global EV battery market but less than 10 percent of ESS as of mid-2025. Chinese manufacturers CATL, Hithium, and EVE Energy dominate the ESS landscape, largely thanks to low-cost LFP production.

U.S.–China tech rivalry is simultaneously creating an opening. The IRA grants significant tax credits for ESS made with U.S.-produced components, giving Korean manufacturers — already operating large-scale facilities across North America — an edge at a time when Chinese firms face steep trade barriers.

Korean automakers themselves are shifting more of their product portfolios toward LFP. Though LFP offers lower energy density than nickel-based NCM batteries, it is roughly 30 percent cheaper and more durable under extreme temperatures and long operating cycles — characteristics ideal for storage systems and affordable EVs alike.

Separately this week, LG Energy Solution announced a $1.4 billion EV battery contract with Mercedes-Benz, believed by analysts to involve LFP cells targeting mid-priced models — another sign of Europe's pivot away from high-cost chemistries.

Samsung SDI also unveiled a multiyear, 2-trillion-won ESS contract with a U.S. energy developer, representing roughly 15 percent of its annual revenue and marking its first substantial move into the LFP segment long dominated by Chinese rivals.

While LFP appears ascendant, Korean engineers are betting that NCM technology could reclaim market share once it further reduces costs and demonstrates superior safety and energy performance.

"Provided that NCM batteries can prove technical sovereignty over LFP and cut prices, we believe the market will eventually sway back to safer and durable nickel variants in the long run," said Kim Sung-soo, head of smart batteries at Pai Chai University.

Copyright ⓒ Aju Press All rights reserved.