SEOUL, December 22 (AJP) - Samsung Electronics is poised to share next-generation high-bandwidth memory (HBM) orders for Nvidia’s upcoming Rubin artificial-intelligence accelerator with SK hynix, after earning strong evaluations in final sample testing by Nvidia, people familiar with the matter said.

Samsung is said to have received one of the most favorable assessments in early system-in-package (SiP) validation for its HBM4, marking a sharp turnaround from earlier hurdles in supplying HBM3 to Nvidia. The results position Samsung as a credible second supplier alongside SK hynix, the pioneer of AI-optimized HBM.

According to industry sources, Samsung’s HBM4 performance gains stem from its use of a next-generation base die built on the D1c process node, compared with the D1b nodes used by rivals, as well as its in-house 4-nanometer logic technology.

“There are speed requirements the product must meet, and ours is performing well,” a Samsung official said. “Using the D1c base die gives us stronger characteristics, and our 4-nanometer process further enhances performance when integrated.”

Samsung acknowledged that expanding HBM production inevitably competes with conventional DRAM wafer capacity, but said recent investments should help cushion the impact.

“HBM does take up a substantial amount of DRAM capacity,” the spokesperson said. “But we have expanded overall capacity significantly over the past two years — nearly doubling it — so the impact should be smaller than the market fears.”

HBM relies on three-dimensional stacking, with multiple memory dies placed vertically and connected through through-silicon vias (TSVs). The architecture allows memory to sit closer to CPUs and GPUs via interposers, sharply reducing latency while improving bandwidth and power efficiency. Conventional DDR memory, by contrast, uses a two-dimensional layout in which chips are arranged side-by-side.

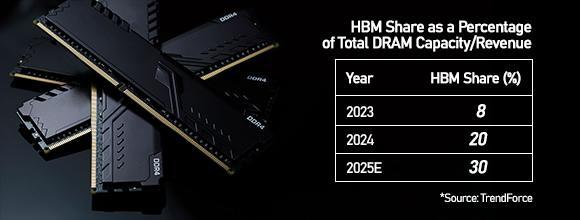

As hyperscale data-center investment accelerates, South Korea’s newest fabs are increasingly being dedicated to HBM production, heightening supply concerns across the broader memory market. Device makers — from automakers to PC manufacturers — have begun stockpiling mainstream DRAM amid fears of shortages.

“The effect is already visible,” said Yangpaeng Kim, a senior researcher at the Korea Institute for Industrial Economics and Trade. “DDR5 fixed-transaction prices have risen roughly fivefold from a year earlier, and this appears closely linked to capacity shifts toward HBM. Price volatility is likely to remain elevated.”

Spot prices for standard DRAM have climbed more than 60 percent over the past six months and are expected to reach $500 in the first quarter of 2026 — double the level of a year earlier — according to market researcher TrendForce.

Ahn Ki-hyeon, executive director at the Korea Semiconductor Industry Association, said HBM demand is likely to continue exerting upward pressure on mainstream memory. “Demand-side momentum remains strong, giving DRAM prices a high likelihood of moving higher,” he said.

While SK hynix retains a technological edge in stacking — including advanced 16-high TSV architectures — Samsung’s improving SiP-level stability, spanning thermal management, power behavior and GPU-package signal integrity, is seen as a meaningful step toward potential qualification for Nvidia’s Vera Rubin platform.

With memory prices expected to rise into early 2026, the balance between HBM expansion and conventional DRAM supply is emerging as a critical industry fault line. Whether Samsung can scale HBM4 production while preserving adequate capacity for DDR5 and LPDDR is likely to shape pricing, supply stability and competitiveness across the next cycle of AI infrastructure and consumer electronics.

Copyright ⓒ Aju Press All rights reserved.