SEOUL, Jan. 12 (AJP) -South Korea’s won has weakened for eight consecutive sessions to flirt with the 1,470 level, erasing year-end gains made from heavy central bank intervention and stoking concerns for entrenched fragility that can build up inflationary pressures across the economy.

The won closed at 1,468.4 against the dollar in Seoul on Monday, down 10.8 won from the previous session. After a volatile day that saw the currency start at 1,461.3 and briefly strengthen to 1,457.0, a late-afternoon surge pushed it to an intraday low of 1,470—the lowest level since late December and share reversal from 1,429.8 on December 29.

This latest depreciation is particularly painful for policymakers, as it follows a significant sacrifice of the nation’s foreign exchange reserves.

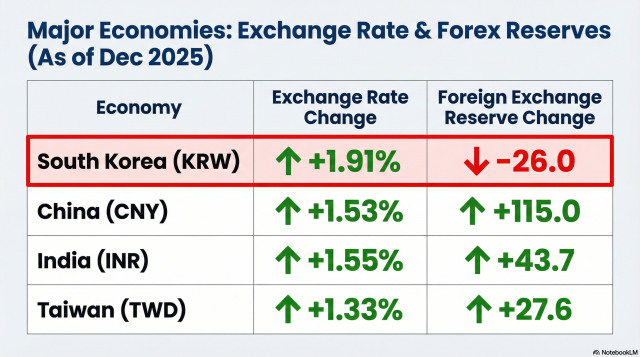

Reserves fell by $2.6 billion in late December, marking the only decline among the world’s top 10 reserve holders that month, according to the Bank of Korea. The drop represents the largest monthly contraction since the peak of the Asian Financial Crisis in December 1997 - $4 billion. The central bank has formally acknowledged that its active market interventions played a decisive role in the erosion of the nation’s foreign exchange buffers.

Despite this intervention, the won's performance has lagged behind its regional peers who chose to bolster their reserves during the same period.

Driving this latest leg of depreciation is a record-breaking exodus of domestic capital. Korea Securities Depository data shows that individual investors net purchased $1.94 billion in U.S. stocks during the first nine days of the year, the largest volume for that period since records began in 2011.

Many retail investors, sensing that the won-dollar rate had been artificially suppressed by government intervention, moved aggressively to convert cash into dollar-denominated assets. Meanwhile, offshore investors exacerbated the pressure by offloading 351 billion won in local equities on Monday.

"The sharp drop in the exchange rate late last year, triggered by government liquidity measures and the National Pension Service’s currency hedging strategy, prompted a wave of dip-buying from real-demand investors," Moon Da-woon, a researcher at Korea Investment & Securities, said, noting that this bottom-fishing trend is effectively capping any potential appreciation of the won.

External factors are equally punishing for Seoul. The dollar index (DXY) has risen for six straight sessions, hovering near the 99 level as geopolitical tensions drive a flight to safety. This dollar strength has been compounded by a weakening yen, which hit 158.2 per dollar — a yearly low — amid fears of fiscal instability ahead of a potential snap election in Japan.

Experts warn that a weak-won environment could become a permanent fixture, threatening to pass through to consumer prices via higher import costs and squeezing corporate margins on raw materials.

"Geopolitical risks centered on the U.S. are escalating early this year," Oh Jae-young, a researcher at KB Securities, said, pointing to looming legal rulings on Trump-era tariffs as a potential source of even greater market volatility.

The currency's weakness is also tying the hands of the Bank of Korea. With the won under pressure and housing prices remaining elevated in Seoul, the consensus among analysts is that the Monetary Policy Board will leave interest rates unchanged for a fifth consecutive time this week.

"While the fair value for the won is estimated around 1,300 based on the real effective exchange rate, structural supply-demand factors—including the expansion of overseas investment by 'Seohak Ants'—will likely keep the rate in the mid-1,400s for the time being," Yoon Yeo-sam, a researcher at Meritz Securities, said, predicting that high exchange rates will push consumer inflation to 2.3 percent this year, overshooting the central bank's 2.1 percent target.

Copyright ⓒ Aju Press All rights reserved.