SEOUL, Jan. 13 (AJP) - South Korea’s benchmark KOSPI has extended its rally for a third straight week, brushing past the 4,700 level on Wednesday and moving closer to the long-anticipated 5,000 mark, buoyed by a record pile-up of investor cash on the sidelines.

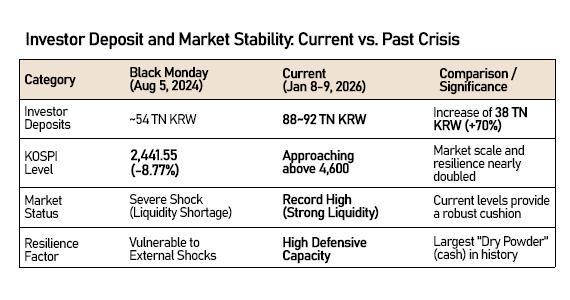

According to the Korea Financial Investment Association (KOFIA), investor deposits stood at 88.9 trillion won ($60.4 billion) as of Jan. 9, after briefly topping 92 trillion won a day earlier as retail investors rushed into the market.

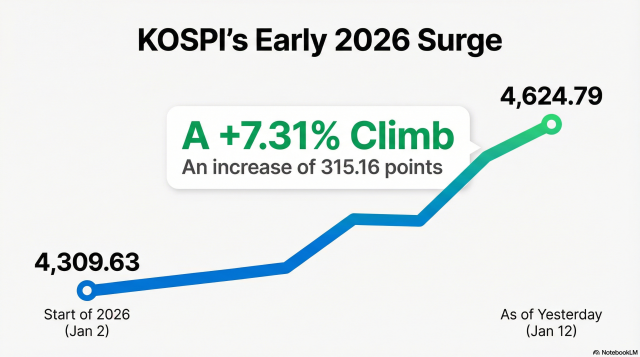

The KOSPI was the world’s best-performing major equity index in 2025, surging more than 75 percent, and the momentum has carried into the new year. The index gained 7.3 percent from the first trading session of 2026 through Jan. 12.

At first glance, the swelling pool of idle cash and the index’s steep ascent point to overheating. A closer look, however, suggests leverage remains largely contained.

Consignee unpaid accounts — funds used for credit-based stock purchases that have yet to be settled — totaled 1.1 trillion won as of Jan. 9, accounting for just 1.2 percent of investor deposits. Defaults within those credit positions stood at 11.8 billion won, or 1.1 percent, indicating that the rally has not yet morphed into unchecked speculative borrowing.

Liquidity conditions are also far stronger than during past market shocks. When the yen-carry trade unwound on Aug. 5, 2024, triggering a “Black Monday” sell-off, investor deposits hovered near 50 trillion won — roughly 30 to 40 trillion won below current levels. In theory, today’s larger cash buffer offers greater shock-absorbing capacity.

Still, market veterans warn against treating deposit figures as an ironclad safety net.

“Investor deposits are a lagging indicator, not a leading one, and they can flow out to other asset classes at any moment,” said Kim Hak-kyun, head of research at Shinyoung Securities. Unless idle cash is converted into actual transaction volume, he cautioned, headline liquidity numbers can offer a false sense of security.

History backs the caution. In the second half of 2021, deposits stayed above 70 trillion won, yet the KOSPI slid from around 3,300 in June to below 2,900 by November as fears of aggressive U.S. Federal Reserve tightening rattled markets.

Currency weakness adds another layer of risk. During the volatility following Russia’s invasion of Ukraine in 2022, the won-dollar exchange rate spiked to 1,300, triggering a flight of deposits into perceived safe-haven assets and accelerating equity losses. With the won weakening past 1,474 per dollar as of 3:30 p.m. Tuesday, some analysts argue domestic liquidity could again be overpowered by global macro forces.

“If an excessively weak won persists beyond a strong-dollar cycle, it could undermine confidence in the economy itself and erode the appeal of Korean equities,” said Oh Gun-young, head of Shinhan Bank’s wealth management division.

Structural factors amplify the concern.

“Because South Korea relies heavily on imported energy and raw materials, a weak won directly raises production costs and squeezes corporate margins,” said Lee Seung-hoon, a researcher at Meritz Securities, adding that currency depreciation ultimately undercuts industrial competitiveness regardless of how much cash is waiting on the sidelines.

Copyright ⓒ Aju Press All rights reserved.