SEOUL, January 19 (AJP) - Shares of robotics and automation companies surged Monday as investor funds rotated out of semiconductor stocks and into so-called “physical AI” plays, amid renewed uncertainty over U.S. semiconductor trade policy.

Hyundai Motor jumped 12.5 percent to 465,000 won ($315.3), while Doosan Robotics soared 20.13 percent to 108,600 won, sharply outperforming the broader market as sentiment toward chipmakers weakened on tariff concerns.

The shift followed a fresh warning shot from Washington. U.S. President Donald Trump signed a proclamation imposing a 25 percent tariff on certain AI semiconductor products manufactured by Taiwan Semiconductor Manufacturing Co. and imported into the United States before being re-exported to third countries. The White House also signaled the possibility of broader, second-phase tariffs on semiconductors and derivative products as part of its push to expand domestic manufacturing.

Against this backdrop, investors moved into sectors viewed as less directly exposed to trade frictions, including robotics, automation and next-generation mobility.

Hyundai Motor’s rally briefly lifted the automaker past LG Energy Solution to become the third-largest company by market capitalization on the Korea Exchange. As of 10:50 a.m., the stock had touched an intraday high of 466,000 won, marking a fresh 52-week high and pushing its market cap above 94 trillion won.

Robot-related shares posted broad gains. Doosan Robotics led the advance. On the KOSDQ, Hurim Robotics jumped 23.26 percent, Hyundai Movex rose 13.45 percent and Yuil Robotics gained 9.88 percent.

Market participants attributed the rally to growing expectations that robotics could emerge as the next market-leading theme, filling the vacuum left by semiconductors, which had driven the market’s recent advance before stalling on renewed trade uncertainty.

Although U.S. memory chipmaker Micron Technology hit a record high last week on news of insider buying, investor sentiment toward Korean chipmakers deteriorated after Washington renewed pressure on companies that do not expand manufacturing investment in the United States, including the possibility of punitive tariffs.

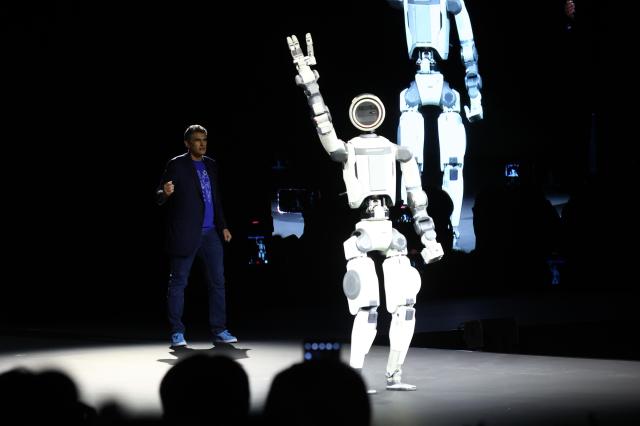

Hyundai Motor Group drew particular attention after Boston Dynamics’ humanoid robot Atlas, a core asset in the group’s robotics portfolio, received a major robotics award at CES earlier this month, raising confidence in robotics-led future mobility.

The company has outlined plans to deploy Atlas robots at its Metaplant America facility in Georgia from 2028 and scale production to 30,000 units annually by 2030.

“The focus of AI has shifted dramatically in just one year,” said Lee Seung-hoon, head of research at IBK Investment & Securities. “Comparing CES 2025 and CES 2026, AI has moved from generative technologies that answer questions to physical AI that sets goals, executes tasks and interacts with the real world. Hyundai Motor Group’s Atlas went beyond demonstrations, presenting a roadmap for mass production and real-world deployment in manufacturing, logistics and services.”

Doosan Robotics’ sharp rise came without company-specific disclosures, underscoring that gains were driven largely by theme-based rotation rather than near-term earnings factors. The company specializes in collaborative robots for industrial and commercial use and is seen as a direct beneficiary of rising automation demand in North America and Europe.

Market observers noted that the reshuffling of market-cap rankings reflects a broader transition in leadership themes. In 2021, NAVER occupied the No. 3 spot during the pandemic-driven digital boom. In 2022, LG Energy Solution surged on electric-vehicle battery demand, while SK hynix later reclaimed the No. 2 position on high-bandwidth memory optimism.

Copyright ⓒ Aju Press All rights reserved.