SEOUL, January 20 (AJP) - High-bandwidth memory (HBM), a critical component powering artificial intelligence chips, is emerging as a national security concern in South Korea as technology leaks involving advanced semiconductors increasingly flow to China amid intensifying global competition in AI.

The National Police Agency said industrial espionage investigations last year led to the arrest of 378 suspects, including six detentions, in cases involving advanced technologies such as AI-related semiconductors.

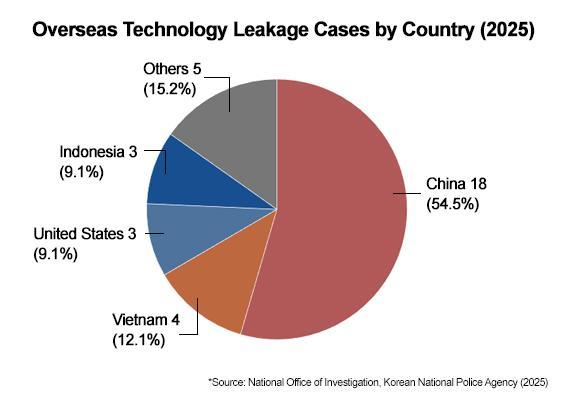

According to data released by the National Office of Investigation, authorities detected 179 technology-leakage cases in 2025, including 33 involving overseas transfers. More than half of those overseas cases — 18 incidents, or 54.5 percent — were linked to China, followed by Vietnam, Indonesia and the United States.

Among overseas leakage cases, semiconductors accounted for the largest share of strategically sensitive technologies, alongside displays and secondary batteries. Several incidents involved memory-related technologies designated as “national core technologies” under South Korean law.

HBM, which stacks multiple DRAM chips to sharply boost data-processing speed, has become indispensable for AI accelerators used in data centers operated by global technology firms such as Nvidia, Amazon, Microsoft and Google.

Unlike conventional memory used in smartphones and personal computers, HBM is tightly integrated with graphics processing units (GPUs) through advanced packaging processes, making it difficult to substitute and leaving production highly concentrated among a small group of suppliers.

South Korea is home to the world’s two dominant HBM producers — Samsung Electronics and SK hynix — positioning the country at the center of the global AI memory supply chain while also exposing it to heightened security risks.

“The scale and frequency of recent technology leaks have raised serious concerns within the industry,” said a Samsung Electronics industry official.

“HBM is no longer just a memory product but a core infrastructure technology that determines the performance of AI systems,” said Kim Ki-duk, a professor of semiconductor engineering at Sejong University.

Kim said China has made sustained efforts to narrow the technology gap by recruiting experienced engineers with long careers in memory development, adding that accumulated know-how is difficult to contain once engineers cross borders.

“Even without physically transferring documents, engineers inevitably carry knowledge acquired through years of work,” he said.

Industry officials said the strategic value of HBM has risen sharply as artificial intelligence becomes embedded not only in corporate systems but also in consumer-facing services, driving rapid growth in GPU-based computing.

As a result, memory chips are increasingly viewed not merely as electronic components but as infrastructure assets critical to national competitiveness and security.

Police data showed that small and mid-sized firms accounted for nearly 87 percent of technology-leakage victims, underscoring vulnerabilities in supply-chain security as advanced semiconductor ecosystems expand.

Kim cautioned that while stricter regulations and tougher penalties may slow technology leakage, they are unlikely to halt China’s catch-up efforts entirely.

“China’s progress can be delayed, but it will continue,” he said, adding that sustained investment in next-generation memory technologies would be essential for South Korea to maintain its lead.

The issue is adding pressure on policymakers and chipmakers as South Korea navigates tightening U.S. export controls, intensifying U.S.-China technology rivalry and growing demands to protect core technologies underpinning its AI-era growth.

“Rather than focusing solely on punitive measures, companies and policymakers need to address the root causes driving skilled engineers to leave, including incentives and research environments,” said Lee Soo-jun, a professor of business administration at Sejong University.

Copyright ⓒ Aju Press All rights reserved.