SEOUL, December 24 (AJP) - South Koreans who shift funds from overseas stocks back into domestic equities over the next year will be exempted from capital-gains taxes, under a new government initiative aimed at correcting capital outflows that have contributed to the structurally weak won.

The tax incentive, unveiled Wednesday by the Ministry of Economy and Finance, offers a full exemption on capital gains from overseas stock sales if the proceeds are converted into won and reinvested in Korean equities for at least one year. The benefit will be phased down depending on when the funds return, with a 100 percent exemption for capital repatriated by March 2026, 80 percent by June and 50 percent in the second half of the year.

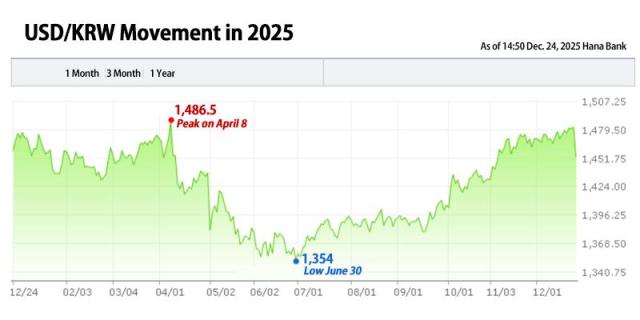

The measure is the latest in a series of government efforts to stabilize the currency, which has hovered near levels last seen during financial crisis periods amid persistent capital outflows and strong dollar demand.

Despite one of the strongest equity performances globally this year — with the KOSPI up 71.6 percent and the KOSDAQ gaining 35.6 percent — retail investors have continued to move money abroad. Overseas stock investment by Korean individuals reached $30.9 billion through November, while they were net sellers of 11.6 trillion won worth of domestic shares during the same period.

At the core of the package is the creation of a so-called Reshoring Investment Account (RIA) for individual investors.

Under the plan, investors who sell overseas stocks they held as of Dec. 23, 2025, convert the proceeds into won and invest in domestic equities for a minimum holding period — for example, one year — will qualify for a temporary exemption from capital-gains tax on overseas stock sales.

The exemption will apply for one year, subject to a per-person cap on eligible sale proceeds, tentatively set at 50 million won ($36,000). To encourage early participation, the tax benefit will be front-loaded, with the most generous exemptions offered to those who repatriate funds in early 2026.

In another measure, the government will support the launch of forward foreign-exchange contracts tailored for individual investors, addressing a long-standing lack of FX risk-management tools for retail participants.

Major brokerages will be encouraged to roll out “retail forward-selling” products, allowing investors to hedge against a stronger won without selling their overseas equity holdings.

To reinforce uptake, the government will introduce an additional tax deduction tied to currency hedging. For overseas stocks held as of Dec. 23, 2025, investors who hedge their FX exposure through forward contracts will be allowed to deduct five percent of the hedged amount — capped at 5 million won — when calculating capital-gains tax on overseas stock sales. The annual FX-hedging recognition limit will be set at 100 million won per individual.

Authorities expect the measure to have an immediate stabilizing effect on the foreign-exchange market by increasing dollar supply through hedging activity, while also protecting retail investors from currency losses if the won strengthens.

The third pillar of the package targets corporate capital flows. The government will raise the income-exclusion ratio on dividends received by Korean parent companies from overseas subsidiaries from 95 percent to 100 percent, effectively eliminating residual double taxation.

Officials said the move is intended to encourage multinational firms to bring profits back to Korea, supporting domestic investment and employment.

Taken together, the measures are aimed at easing pressure on the won by addressing what policymakers describe as a structural imbalance in foreign-exchange supply and demand.

As of the third quarter, Korean individuals held $161.1 billion in overseas equities, according to international investment position data. Even a partial shift of those holdings back into domestic assets or into currency-hedged positions could significantly expand foreign-currency supply, the ministry said.

The government plans to pursue swift legislation through amendments to the Special Tax Treatment Control Act. Tax benefits tied to RIAs and retail FX hedging will apply from early 2026, once the accounts and products are formally launched, while the expanded dividend tax exemption will take effect for dividends received from Jan. 1, 2026.

The announcement comes amid heightened FX market volatility. The U.S. dollar fell more than 1 percent, or 29.1 won, to 1,452.90 won as of 2:45 p.m. Wednesday, following heavy hedging activity after the greenback briefly breached the 1,480-won level — a threshold last seen in April during tariff-driven market turmoil and during the 2009 global financial crisis.

Copyright ⓒ Aju Press All rights reserved.