SEOUL, December 16 (AJP) - There is a Korean saying that the younger is better than the elder. That adage hardly applies to the KOSDAQ, which has struggled to outperform its bigger sibling, the KOSPI, even with a steady stream of government stimulus measures.

The “younger brother” showed a brief revival in the final two months of the year as foreign investors returned. Overseas investors bought a net 128.7 billion won ($93 million) worth of KOSDAQ shares as of last week — a sharp reversal from the 1.4 trillion won in net selling recorded between January and November. Daily turnover averaged more than 1 trillion won, double the level seen in August.

Even so, gains remained modest. The KOSDAQ rose 1.8 percent over the period, compared with a 4.3 percent increase in the KOSPI. Last month, the pattern briefly reversed, with the KOSDAQ gaining 1.4 percent while the KOSPI fell 4 percent.

Longer-term charts tell a less flattering story. The KOSDAQ has been largely sidelined in Korea’s broader exit-strategy debate tied to the so-called “Korea discount.” As of Monday, the KOSDAQ was up 36.7 percent this year — respectable, but far behind the KOSPI’s 70.5 percent surge. The gap widens further over five years: the KOSDAQ has gained just 9 percent, versus a roughly 50 percent rise for the KOSPI.

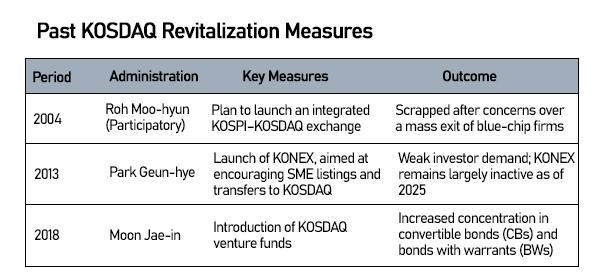

It is not that authorities have done little. In the latest policy push, the government is reportedly considering separating the KOSDAQ from the Korea Exchange (KRX) to establish it as an independent entity, modeled after the U.S. Nasdaq.

Yet despite aggressive support measures, companies continue to leave the market. The KOSDAQ’s deeper problem is its failure to persuade successful firms to stay once they scale up.

On Dec. 8, shareholders of Alteogen — the KOSDAQ’s largest biotech by market capitalization — approved a plan to move its listing to the KOSPI. Alteogen’s market value stands at around 25 trillion won, accounting for roughly 5 percent of the KOSDAQ’s total capitalization.

It is far from the first high-profile departure. Naver voluntarily delisted from the KOSDAQ to move to the KOSPI in 2008, followed by Kakao in 2017 and Celltrion in 2018.

Size matters

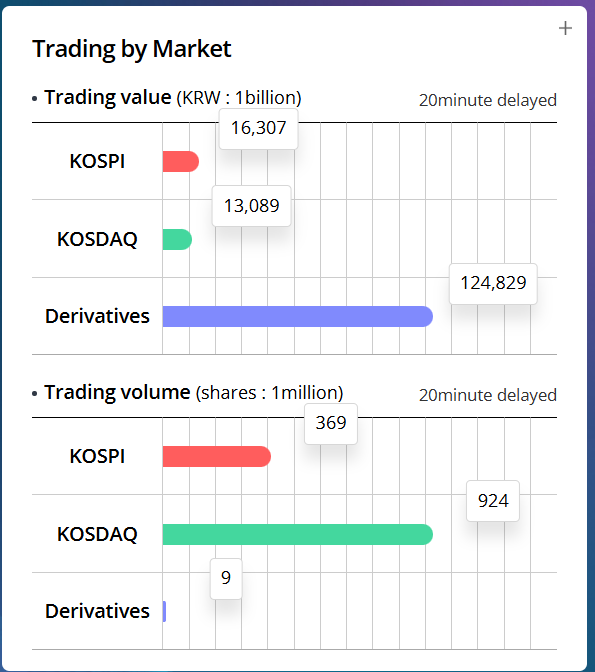

As of Tuesday, 1,822 companies were listed on the KOSDAQ, nearly double the 958 firms on the KOSPI. Trading volume on the KOSDAQ is roughly three times higher, yet trading value tells a different story: KOSPI transactions totaled 16.3 trillion won, surpassing the KOSDAQ’s 13 trillion won.

Park Soon-jae, chief executive of Alteogen, said the move is expected to “increase the stockholding ratio of institutional investors,” noting that both domestic and foreign institutions tend to favor KOSPI-listed firms.

Confidence problem

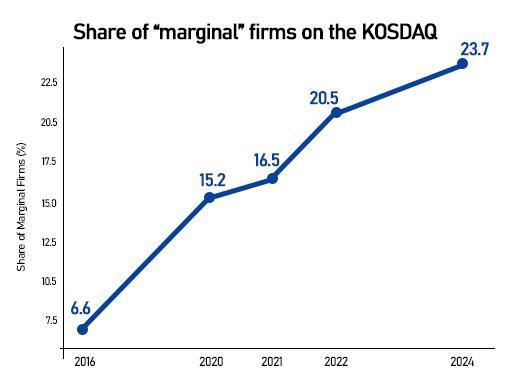

The Federation of Korean Industries (FKI) points to the high share of “marginal” or “zombie” companies — firms unable to cover even their interest expenses — as a core weakness. As of 2024, such companies accounted for 23.7 percent of KOSDAQ listings, more than double the roughly 10 percent share on the KOSPI.

Still, new listings continue to appear almost daily this month, highlighting the lack of financing alternatives for startups and early-stage companies. A survey released last Friday by the Korea Venture Business Association (KOVA) found that 85 percent of unlisted venture firms planning an IPO hoped to list on the KOSDAQ rather than the KOSPI.

Respondents agreed that fundamental structural reform is needed to revitalize the market. Many emphasized prioritizing the “technology special listing” system, under which technological capability and growth potential are the main criteria. While more than a third of KOSDAQ-listed firms already use the system, standards remain ambiguous, with marketability sometimes outweighing technological merit.

Market discipline was another recurring theme. About 84 percent of surveyed companies said the KOSDAQ could only be revitalized by expelling insolvent firms, including zombie companies, arguing that financial soundness is as critical as technological strength in restoring investor confidence.

“The KOSDAQ can only function as a proper securities market when its identity is clearly defined and its soundness is strengthened,” said Lee Jung-min, secretary-general of KOVA, adding that the government’s “KOSDAQ 1,000” goal would only be achievable with a clear, national-level roadmap.

Copyright ⓒ Aju Press All rights reserved.